Solana Long-Term Elliott Wave View Looking For $383 – 561 Area

Image Source: Pixabay

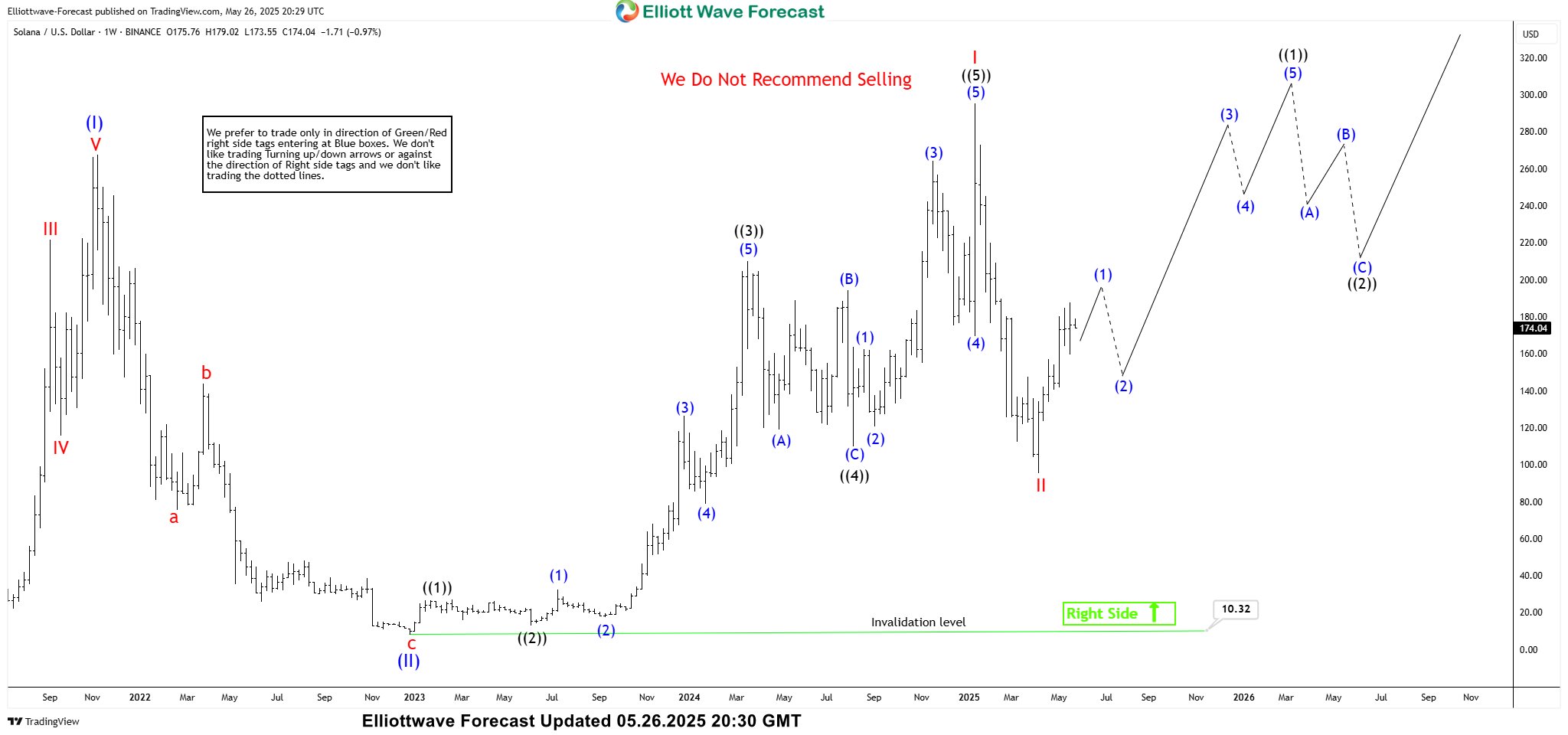

Cryptocurrencies have been rallying since forming a low back on April 7, 2025. Today, we look at the long-term Elliott wave view and the next targets for Solana.

Solana (SOL) Weekly Elliott Wave View

Solana weekly chart below suggests cycle from all time low ended at 267.52 on 8 November 2021. This was followed by a 3 waves pull back which ended in December 2022 around $10 mark. Rally then resumed again and SOL crypto went on to make a new high above November 2021 peak to create an incomplete bullish sequence. Rally from December 2022 low was impulsive with an extended wave (( 3 )) and ended in January 2025 at $295.31.

We then saw a sharp correction to $95.31 which ended on April 7, 2025. Cryptocurrency has been rallying since April 7, 2025 low and is currently trading at $175.04. As far as January 2025 high remains intact, there is possibility of a double three correction lower before the rally resumes. However, we can see 5 waves up from April 7, 2025 low which supports the idea that low should hold for at least 1 more leg higher.

January 2025 high needs to break to confirm that next leg in the form of wave III of ( III) is in progress. Ideal targets for wave III of ( III) would be $383 – $561 area which is 100 – 161.8 Fibonacci extension area of wave I related to wave II.

Solana (SOL) Daily Elliott Wave View

Solana daily chart below shows rally from April 7, 2025 ($96.58) is already showing 5 waves up. However, while below wave 4 low, we can see further extension in wave 5. As dips hold above $96.58, expect the rally to continue for a new high above January 2025 peak or one more leg higher at least.

More By This Author:

The Power Of Elliott Wave Blue Boxes: GBPUSD’s Perfect BounceTMUS Bullish Sequence Finding Blue Box Support, Targeting $400

Elliott Wave Analysis: Ethereum Likely Extending In Wave 5

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more