How To Invest In Stocks

There are two ways to invest in stocks - betting on winners that Main Street loves and on up and coming winners that it will love.

First: Bet on Main Street

Invest in a company alongside its peak. Stocks like Google, Apple, or Facebook are all holding on at their peaks, they have been for several years, and no one can tell when their reign will fade. As of today, Facebook, Apple, Amazon, Netflix, and Google — collectively know as FAANG — make up ~10% of the $23 trillion U.S. stock index the S&P 500. With a collective $2.3 trillion market cap, 10% is double what the FAANG stocks represented 5 years ago. Many of us knew these 5 brands were going to be a big part of our lives five, even 10 years ago. But few invested. So only few acquired that wealth. The idea is to simply observe how things are playing out in society and culture. Invest in what appears to have staying power with the mainstream.

Second: the Steph Curry Method

Find a company with potential that hasn’t hit their stride just yet, but that’s making bold moves to update their branding. The right marketing at the right time can make a worthwhile difference. Sparking the public’s attention can often lead to a boost in brand sales, which leads to a bump in company quarterly earnings, which leads to a bump in the stock price’s short term trajectory. Financial markets tend to react rapidly and dramatically to news that’s unexpected.

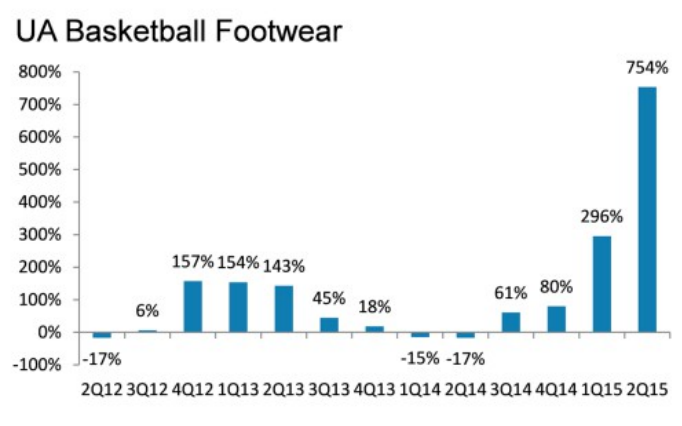

In this case, such news would prove a company is more valuable than was estimated by the majority of traders and analysts who watch the stock most closely. When this info is realized, the stock price jumps up to account for the gain in perceived company value. A great example of this is Under Armour’s stock, in 2013. The company decided it wanted to build a $1 billion brand around basketball player Steph Curry of the Golden State Warriors. They offered him a $4 million deal. Curry very publicly accepted and, for the past several years, Steph Curry’s shoe line has been Under Armour’s MVP of sales. As Curry’s popularity began skyrocketing, UA’s sales were skyrocketing, and UA’s stock price reached record highs.

Under Armour’s second quarter in 2015 boosted by Steph Curry

This second method is often used by billionaire investor Warren Buffet and is formally known in professional circles as value investing. But for sake of remembering it and in spirit of basketball season, I’ll call it the Steph Curry method.

These two ways of investing are best for people who spend time on Snap or Instagram, rather than reading the Wall St Journal. However, they can benefit anyone who wants to use them, as they are a direct way to share in the wealth, growth, and profits of the $100 trillion U.S. economy.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of ...

more

Good article, James