How Gamestop's Stock Price Was Squeezed

Photo by Michael Förtsch on Unsplash

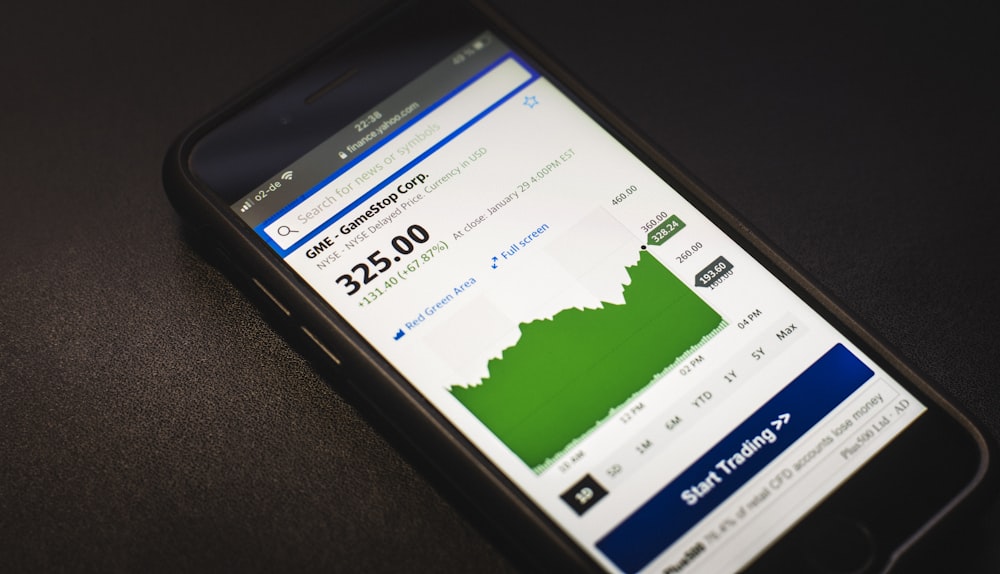

The story of how Gamestop (GME) went from a value of $11.01 per share on 13 November 2020 to reach $325.00 per share on 29 January 2021 has become a stock market legend.

It has also become the subject of a fascinating academic study, where a new paper by Lorenzo Lucchini, Luca Maria Aiello, Laura Alessandretti, Gianmarco De Francisci Morales, Michele Starnini and Andrea Baronchelli investigated how social media contributed to the short squeeze that made GME into *the* prototype meme stock.

If you're not familiar with the story, here's the paper's summary of how the GME short squeeze was made, in which Reddit's r/wallstreetbets (WSB) plays a prominent role (we've added the bullet list formatting to make it easier to follow):

GameStop (GME) is a US video game retailer which was at the centre of the short squeeze in January 2021. The timeline of the events around the squeeze is summarized in table 1, and it unfolded as follows.

- In 2019, Reddit user u/DeepFuckingValue entered a long position on GME, i.e. he bought shares of the GME stock, and started sharing regular updates in WSB.

- On 27 October 2020, Reddit user u/Stonksflyingup shared a video explaining how a short position held by Melvin Capital, a hedge fund, could be used to trigger a short squeeze.

- On 11 January 2021, GME announced a renewed Board of Directors, which included experts in e-commerce. This move was widely regarded as positive for the company, and sparked some initial chatter on WSB.

- On 19 January, Citron Research (an investment website focused on shorting stocks) released a prediction that GME’s stock price would decrease rapidly.

- On 22 January, users of WSB initiated the short squeeze.

- By 26 January, the stock price increased more than 600%, and its trading was halted several times due to its high volatility. On that same date, business magnate Elon Musk tweeted ‘Gamestonk!!’ along with a link to WSB.

- On 28 January, GME reached its all-time intra-day highest price, and more than 1 million of its shares were deemed failed-to-deliver, which sealed the success of the squeeze. A failure to deliver is the inability of a party to deliver a tradable asset, or meet a contractual obligation; a typical example is the failure to deliver shares as part of a short transaction.

- On 28 January, the financial service company Robinhood, whose trading application was popular among WSB users, halted all the purchases of GME stocks.

- On 1 and 2 February, the stock price declined substantially.

By the end of January 2021, Melvin Capital, which had heavily shorted GameStop, declared to have covered its short position (i.e. closed it by buying the underlying stock). As a result, it lost 30% of its value since the start of 2021, and suffered a loss of 53% of its investments, i.e. more than 4 billion USD.

While the paper's summary indicates a substantial decline in value, we'll point out that since it peaked at $325 per share, GME bottomed at $40.69 per share on 18 February 2022 before climbing back up to $300 per share on 8 June 2021, before dropping back toward the middle of that range. The following chart shows its stock price history:

(Click on image to enlarge)

That's all the "what happened", but it's the "why it happened" we find fascinating. The authors identify one key element in the postings of the WSB redditors that established their credibility, separating their postings from the ordinary run of the mill comments that dominate discussions on many other stock investing discussion sites, which they describe in the paper's introduction:

In this paper, we analyse discussions on WSB from 27 November 2020 to 3 February 2021 (table 1) and investigate how they translated into collective action before and during the squeeze that was initiated on 22 January and lasted until 2 February. Motivated by recent theoretical [10,11] and experimental [12] evidence that minorities of committed individuals may mobilize large fractions of a population [10,13–15] even when they are extremely small [16], we investigate whether committed users on WSB had a role in triggering the collective action. To this aim, we operationalize the commitment of a user as an exhibited proof that the user has financial stakes in the asset.

We won't keep you in suspense. Here's the summary of what they found:

We show that a sustained commitment activity systematically pre-dates the increase of GameStop share returns, while simple measures of public attention towards the phenomenon cannot predict the share increase. Additionally, we also show that the success of the squeeze operation determines a growth of the social identity of WSB participants, despite the continuous flow of new users into the group. Finally, we find that users who committed early occupy a central position in the discussion network, as reconstructed by WSB posts and comments, during the weeks preceding the stock price surge, while more peripheral users show commitment only in the last phases of the saga.

The last part is to say that the early influencers who effectively established their credibility continued to be influential within the network. We think that continued influence is attibutable to their success, which had the short squeeze of GME's stock not occurred, would have led other WSB participants to discount the information value of their postings. People with opinions about a company's investment worthiness are a dime a dozen on a stock discussion board, but people who back up their talk with hard evidence of their bets that go on to pay off were granted credibility.

Much of the authors' study focuses on the dynamics between this "core" group of GME redditors and others who were on the periphery of the investing activity, which they describe as a "behavioural cascade" event. The core group attained a critical point of credibility, sweeping up peripheral redditors who transitioned from observers to participants in what became a cascading short squeeze event.

Disclosure: None.