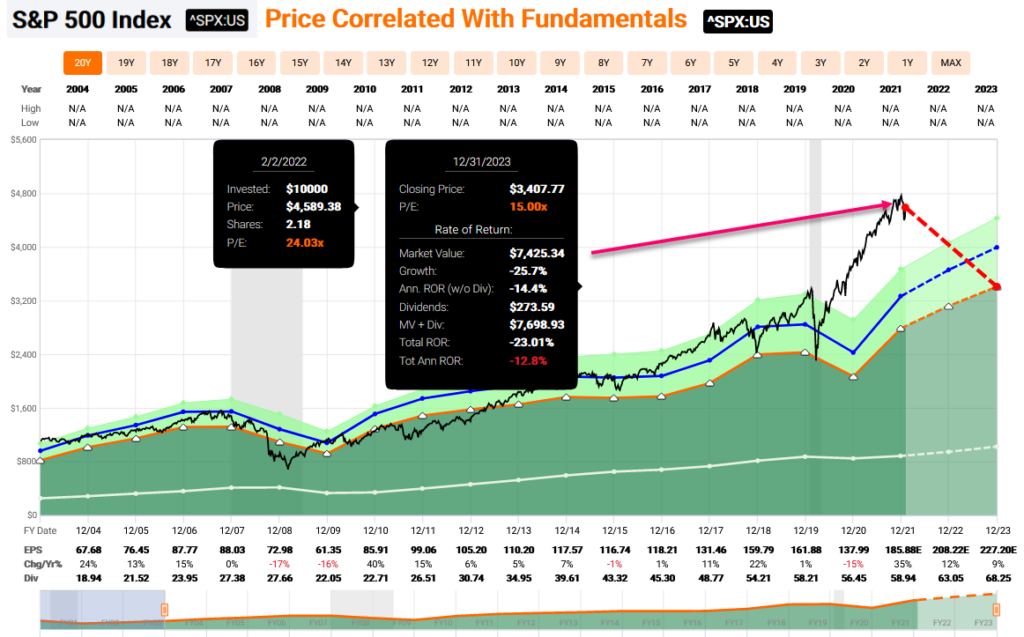

How Far Can The Stock Market Fall?

S&P 500

The stock market as measured by the S&P 500 has been correcting since the start of the new year. However, as I always contend, it is a market of stocks and not a stock market. True that statement is the reality that most of the damage has come from the significantly overvalued constituents. The fairly valued or undervalued S&P 500 stocks are actually performing pretty well. This is something that makes logical sense because some of the valuations on these overvalued stocks have been beyond excessive. In this video, I am going to take a high-level look at 20% of the S&P 500 constituents representing the majority of the overvalued companies and show how excessive valuation is beginning to take its toll. My goal is to give you a perspective that you might not have had before watching this video.

(Click on image to enlarge)

Stock Market

These are the 110 S&P 500 companies I've identified as overvalued: Agilent Technologies (A), Abiomed (ABMD), Accenture (ACN), Adobe (ADBE), Analog Devices (ADI), Automatic Data Processing (ADP), Autodesk (ADSK), AES Corp (AES), Albemarle (ALB), Align Technology (ALGN), Allegion (ALLE), Applied Materials (AMAT), Advanced Micro Devices (AMD), Arista Networks (ANET), Ansys (ANSS), Aon Plc (AON), Aptiv Plc (APTV), Atmos Energy (ATO), Activision Blizzard (ATVI), Avery Dennison (AVY), American Water Works (AWK), Boeing (BA), Brown Forman (BF-B), Bio Rad Laboratories (BIO), Blackrock (BLK), Ceridian (CDAY), Cadence Design Systems (CDNS), Clorox (CLX), Comcast (CMCSA), Chipotle (CMG), Cummins (CMI), Copart (CPRT), Charles River Lab (CRL), Catalent (CTLT), Citrix Systems (CTXS), Danaher Corp (DHR), Disney (DIS), Dominos Pizza (DPZ), Darden Restaurants (DRI), Dexcom (DXCM), Equifax (EFX), Estee Lauder (EL), Emerson Electric (EMR), Enphase Energy (ENPH), Epam Systems (EPAM), Etsy (ETSY), Fidelity National Information Services (FIS), Fiserv (FISV), Fleetcor Technologies (FLT), First Republic Bank (FRC), Fortinet (FTNT), Generac Holdings (GNRC), Global payments (GPN), Garmin (GRMN), Honeywell (HON), Humana (HUM), Idexx Laboratories (IDXX), Illumina (ILMN), IHS Markit (INFO), Intuit (INTU), IPG Photonics (IPGP), Intuitive Surgical (ISRG), Jacobs Engineering (J), Keysight Technologies (KEYS), Carmax (KMX), Leidos Holdings (LDOS), Leggett & Platt (LEG), Lam Research (LRCX), Microchip Technology (MCHP), Moodys Corp (MCO), Medtronic (MDT), Marketaxess Holdings (MKTX), Monolithic Power Systems (MPWR), MSCI (MSCI), Microsoft (MSFT), Motorola Solutions (MSI), Nasdaq (NDAQ), Nextera Energy (NEE), Netflix (NFLX), Nike (NKE), Nvidia (NVDA), Newell Brands (NWL), Old Dominion Freight (ODFL), Oracle (ORCL), Paycom Software (PAYC), Pentair (PNR), PayPal Holdings (PYPL), Resmed (RMD), Rockwell Automation (ROK), Rollins (ROL), Ross Stores (ROST), Starbucks (SBUX), Solaredge Technologies (SEDG), Sherwin Williams (SHW), SVB Financial Group (SIVB), Snap On (SNA), Synopsys (SNPS), S&P Global (SPGI), Sempra Energy (SRE), Stanley Black & Decker (SWK), Skyworks Solutions (SWKS), Bio Techne (TECH), TE Connectivity (TEL), Teradyne (TER), Teleflex (TFX), Target (TGT), Trimble (TRMB), T Rowe Price Group (TROW), Trane Technologies (TT), Take Two Interactive (TTWO).

Video length 00:21:49

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more