Housing Looks Good Despite Low July Builder Sentiment: 7 Picks

Image: Bigstock

The U.S. housing industry has been witnessing solid demand trends for homes for the past several months. Despite supply-side challenges including rise in material costs, government regulation, labor constraints and higher prices, Americans seem to be interested in buying new homes. This is evident from the latest builder confidence reading for July.

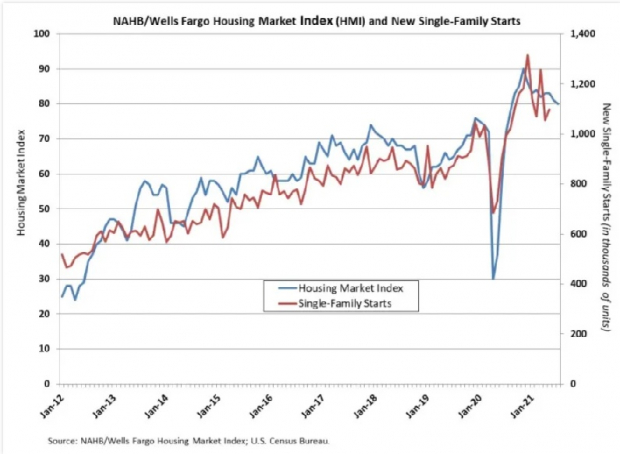

The NAHB/Wells Fargo Housing Market Index (HMI) reading unveils that sentiment among U.S. homebuilders for newly-built single-family homes inched one point down to 80 this month from the June reading of 81. Nevertheless, the metric is eight points above the June 2020 reading of 72.

Despite the sequential one-point drop in homebuilders’ sentiment for July, the reading of 80 and above still signals strong demand in the housing market.

Image Source: NAHB

Inside the Headlines

Since the beginning of 2021, the economy has been grappling with strikingly high lumber prices, labor shortage and supply chain disruptions along with the second wave of COVID-19. Builders have been forced to announce price hikes, which are ultimately sidelining prospective buyers. This is evident from the three HMI components.

The indicator that gauges present sales conditions dropped one point to 86 from the last month. Prospective buyer traffic also declined six points to 65. Nonetheless, sales predictions for the next six months, which gives an idea of future industry movement, increased two points to 81.

Builders are still optimistic about the future growth potential of the industry. This is evident from the recent sales and starts numbers, which fell sequentially yet increased on a yearly basis. In May, the three significant indices — single-family housing starts, new single-family home sale and single-family existing home sales — were up 49.8%, 9.2% and 39.2% year over year, respectively. Also, the NAHB/Royal Building Products Remodeling Market Index was up 14 points year over year for second-quarter 2021, signaling residential remodelers’ high confidence in the markets served.

Encouragingly, the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ended Jul 9 improved 16 points from the prior week, as the 30-year fixed-rate mortgage rate hit 3.09%. This indicates that home buyers are taking advantage of lower rates despite higher prices. In addition to these positives, private residential construction spending rose 0.2% in May from April to a seasonally adjusted annual rate of $751.7 billion. Also, the metric was 28.7% higher than a year ago. Specifically, single-family construction spending was up 0.8% in May from April and 46.1% on a year-over-year basis.

Hurdles to Overcome

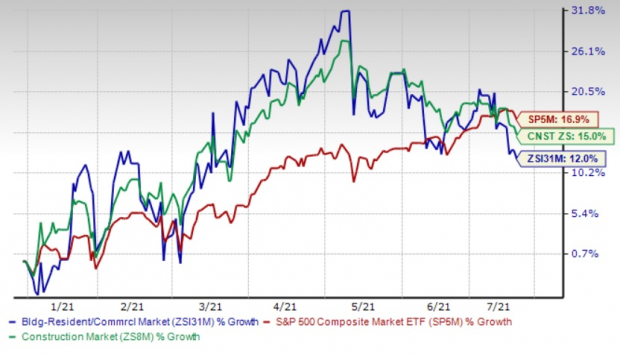

Higher costs and lower availability of softwood lumber as well as other building materials are concerning almost every homebuilder. So far this year, the Zacks Building Products - Home Builders industry has gained 12% versus the Zacks Construction sector and S&P 500 composite’s 15% and 16.9% rally, respectively. The homebuilding industry has slightly underperformed the sector and S&P 500 due to supply-chain and accelerating material prices woes.

Image Source: Zacks Investment Research

Framing lumber prices have quadrupled since April 2020. Oriented strand board has also surged a whopping 510% since January 2020. Although the recent lumber prices have registered a downturn of about 52%, per the recent NAHB survey, 94% of home builders have seen a shortage of lumber.

Inflation also hit a 13-year high in June. The Bureau of Labor Statistics (BLS) reported on Jul 13 that the Consumer Price Index rose 0.9% in June on a seasonally adjusted basis, following an increase of 0.6% in May. This marks the largest increase since June 2008.

The labor shortage is also concerning homebuilders, as published by the BLS. June employment rate for construction declined by 7,000, reflecting 238,000 job loss since February 2020. This apart, deliveries continue to be delayed by lingering supply-chain issues surrounding the pandemic.

Our Take

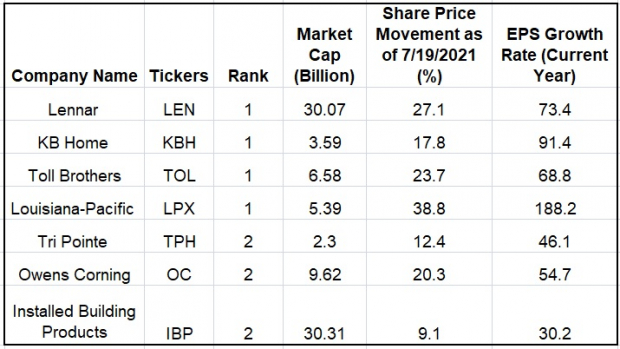

Although there are certain headwinds prevailing in the industry, solid demand for homes and six-month sales predictions are worth considering. Therefore, we have listed seven top-ranked stocks from the Zacks Construction sector that investors must add to their portfolio given the companies’ solid prospects. These stocks have been picked with the help of the Zacks Stock Screener.

Seven stocks with encouraging performance and prospects are Lennar Corporation (LEN - Free Report), KB Home (KBH - Free Report), Toll Brothers, Inc. (TOL - Free Report), Louisiana-Pacific Corporation (LPX - Free Report), Tri Pointe Homes, Inc. (TPH - Free Report), Owens Corning (OC - Free Report) and Installed Building Products, Inc. (IBP - Free Report).

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more