Honeywell International: What Its Breakup Announcement Says About Conglomerates

Image Source: Unsplash

Is the era of conglomerates over? When I was making my way through college, business conglomerates were the big thing and continued to be well-regarded for a long time. But some high-profile changes have cast doubt on conglomerates. Honeywell International Inc. (HON) is an example, remarks Rob Carlson, editor of Retirement Watch.

A conglomerate is a company composed of several different businesses that operate more or less independently. One stated advantage of a conglomerate is that a stronger or more established business can help fund an entity that is trying to expand or increase its growth rate.

Another advantage is that the businesses might have different business cycles. They’ll have downturns at different times. That can make the conglomerate’s earnings more stable over time.

But in recent years, high-profile conglomerates have been on the way out, and that seems to have been more profitable for investors than having all the businesses under one umbrella. GE Aerospace (GE) is the most striking example.

As a conglomerate built over many decades, GE Aerospace grew rapidly and was a stock market leader. In the 1990s and early 2000s, it was one of the largest components of the S&P 500. Its longtime CEO, Jack Welch, largely was considered the manager to emulate.

But the company hit hard times after the financial crisis and Welch’s retirement. GE Aerospace struggled for more than a decade, changing CEOs several times. It sold or spun off several businesses. Finally, it decided to split the remaining businesses into three separate companies.

The stock prices of each of the companies have done very well. The combined stock market values of the three companies recently were four times GE Aerospace’s 2022 value.

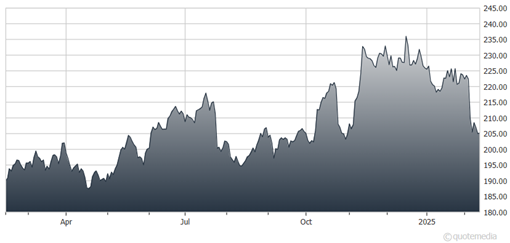

Honeywell International Inc. (HON) Chart

Honeywell recently announced that it will try to emulate GE Aerospace. After a new CEO took over in 2023, the company made some relatively small spin-offs, acquisitions, and sales. But the stock price has lagged.

Most recently, it decided to split into three separate companies. The CEO also said the aerospace operation has been doing extremely well, much better than the other two businesses.

The expectation is that the market will reward the aerospace spin-off with a significantly higher stock price while the stocks of the other two businesses won’t do as well.

About the Author

Robert Carlson is editor of the monthly newsletter and website, Retirement Watch. He is chairman of the board of trustees of the Fairfax County Employees' Retirement System, which has over $3 billion in assets, and was a member of the board of trustees of the Virginia Retirement System, which oversaw $42 billion in assets, from 2001-2005.

He co-authored Personal Finance After 50 for Dummies (with Eric Tyson). Previous books include Invest Like a Fox...Not Like a Hedgehog and The New Rules of Retirement.

More By This Author:

Federal Agricultural Mortgage: A Dividend Play In The Agricultural Finance Sector

SPY: How A "Give Growth A Chance" Mantra Could Keep Markets Rising

Gold: Hitting Record Highs Amid “Insurance” Buying And More

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more