SPY: How A "Give Growth A Chance" Mantra Could Keep Markets Rising

Image Source: Unsplash

Meanwhile, over half of all public companies’ stock prices are now above their own 200-day moving averages. This is up dramatically from only 25% last year. Money has already begun to shift out of the handful of favorites. This is positive for the markets, just not for the indexes.

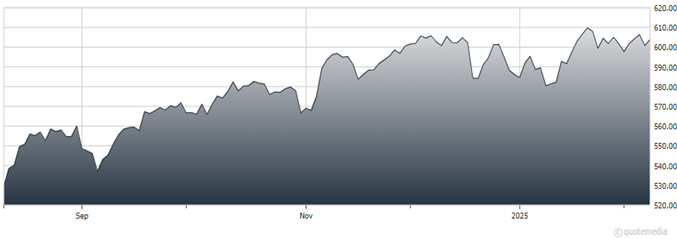

SPDR S&P 500 Trust (SPY)

That said, the new 52-week low list expanded again. The advance/decline lines have once again deteriorated and look too weak for comfort. This is a dangerous market. Do not chase anything here. Be patient. Even great stocks pull back.

As for the economy, inflation is 3%, while bonds yield 4.5%. Move on. There is not much more to think about here. This is a time to own rather than lend. You just need to own the right things.

The pro-growth and America-first policies of the new administration are the real key. They have kick-started small business, consumer, and stock market optimism. Despite obstacles and potholes, the environment is now set for winners to win. Just do not count on a straight line up.

More By This Author:

Gold: Hitting Record Highs Amid “Insurance” Buying And More

Top Picks For 2025: Advanced Micro Devices

Top Picks For 2025: IperionX

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more