Top Picks For 2025: Advanced Micro Devices

Image Source: Pixabay

ChatGPT exploded onto the scene in 2023, and with it came a rush into semiconductor stocks. The AI trade was hot that year, but we saw a bit of bifurcation in 2024, as the “haves” and the “have-nots” were separated. Unfortunately for Advanced Micro Devices Inc. (AMD), it found itself on the latter list. But it may be worth a closer look for investors here, suggests Bret Kenwell, US investment analyst at eToro.

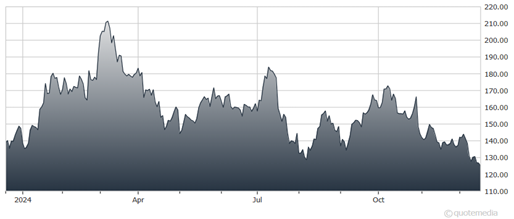

Advanced Micro Devices shares languished through 2024 despite an otherwise strong year for equities. A lot of investors are seemingly waiting for Advanced Micro Devices to make the turn and show some signs of life, but that has yet to happen. Will that change in 2025?

Despite the stock’s poor performance in 2024 — down 13.8% through Dec. 15 — the company’s fundamental situation has continued to improve. According to Bloomberg estimates, earnings and revenue are forecast to jump 25.2% and 13.1% in 2024, respectively, while free cash flow is expected to jump from $1.1 billion to $2.8 billion.

Advanced Micro Devices Inc. (AMD) Chart

In 2025, analysts expect all three metrics to accelerate significantly, with adjusted earnings forecast to climb more than 50%. Further, free cash flow is expected to climb to a range of $6 billion to $7 billion (depending on which consensus estimate you look at).

Lastly, a bump in margins — with estimates calling for operating margins to increase from roughly 11.8% in 2024 to more than 20% in 2025, according to Bloomberg — would only act as a sweetener for bulls.

The expectations are clear: Advanced Micro Devices should see meaningful growth in its top- and bottom-lines, allowing more cash to trickle down through its financials. So, why isn’t the market front-running the company's expected successes?

There is a clear appetite for AI-related hardware from big tech. We’ve seen this with Nvidia Corp. (NVDA), and most recently with Broadcom Inc. (AVGO). While that may be true, it’s also hard — maybe impossible — to argue that demand for Nvidia’s chips isn't sapping some of the energy away from Advanced Micro Devices.

In many ways, that’s an ongoing risk. That said, there is a place for Advanced Micro Devices' products, too, and the shift brought on by AI isn’t a multi-quarter transition -- it’s a multi-year play with robust demand.

Advanced Micro Devices stock was a lot less tempting north of $200 a share. However, it was recently trading near $125, down about 45% from its 52-week high. It may be worth a closer look, particularly with shares trading at 24 to 25 times consensus 2025 earnings expectations — a valuation that has generally been supportive in the past.

About the Author

Bret Kenwell is the US Investment Analyst at eToro, the trading and investing platform empowering you to invest, learn, and share. He has spent his career focused on market research and analysis. Mr. Kenwell’s work has been featured on CNBC, Bloomberg, Yahoo! Finance, TheStreet, Nasdaq, among many other publications.

Prior to joining eToro, he worked as a financial journalist at TheStreet covering a variety of beats including the auto sector, technology space, and most recently the technical setups for the U.S. indices and individual stocks.

More By This Author:

Top Picks For 2025: IperionXTop Picks For 2025: Lloyds Banking Group

Top Picks For 2025: Etsy

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more