Homebuilder Earnings On Deck

While homebuilder sentiment experienced a historic plunge in the latest reading, homebuilder stocks have actually been on the move higher in today’s session. That brings the total rally off of the June low above 20%, although that is only a dent in the larger decline since late last year. The S&P 1500 Homebuilders group is currently down 31.4% since the December 10th high. Without a coincident drop alongside sentiment, homebuilders continue to hold above their 50-DMA.

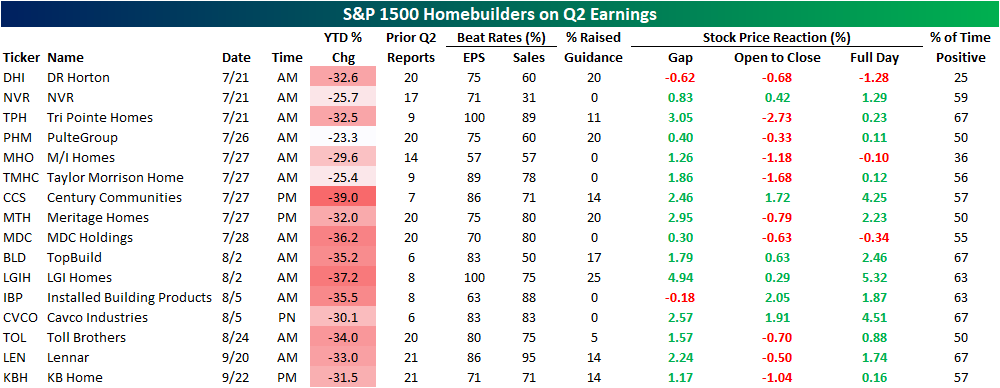

Homebuilders are at a bit of a crossroads at the moment as a further move higher would definitively break the past several month downtrend whereas a break back below its 50-DMA would mark a failed breakout similar to what happened earlier this spring. If today is any indication, macro data hasn’t been a particularly strong catalyst for the industry, however, there is a huge slate of earnings in the month ahead. Later this week on Thursday, DR Horton (DHI), NVR (NVR), and Tri Pointe Homes (TPH) are all scheduled to release quarterly results. Of these, DHI has actually averaged some of the worst performance on Q2 earnings of any homebuilder. The stock has averaged a 1.28% decline on its historical Q2 earnings reaction days and positive returns only a quarter of the time. As for other notables, Q2 has tended to be the best quarter of the year for stock price performance of Century Communities (CCS), Installed Building Products (IBP), LGI Homes (LGIH), and NVR (NVR).

(Click on image to enlarge)

More By This Author:

Pumped For Some Relief

Crisis of Confidence 43 Years Later

Seasonal High is Here for Claims

Click here to learn more about Bespoke’s premium stock market research service.