HIVE Digital Technologies: Trading At A Discount To Peers Despite Superior Capital Deployment

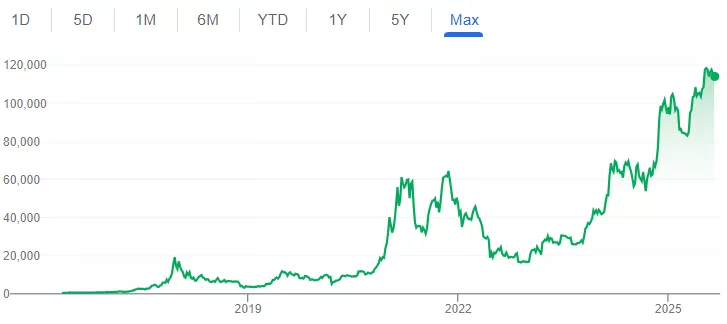

Bitcoin Price - Source: Google

A few years ago (2020-2022), when Bitcoin prices were skyrocketing, Bitcoin mining companies with strategies to mine and accumulate Bitcoin on their balance sheets as if they were Michael Saylor’s Strategy (NYSE: MSTR), mined as much Bitcoin as they could at any cost, given Bitcoin’s gains were so robust.

Fast forward a few years, and reality had set in. Companies like MARA Holdings (Nasdaq: MARA) and Riot Platforms (Nasdaq: RIOT) share prices came down to earth as it became more clear that bitcoin could be mined at a loss, and thus the allure of a mining company accumulating Bitcoin at any cost could be less lucrative than simply buying Bitcoin. Like any production asset, ROIC, production efficiency, and cash flows determine the quality of the underlying operation and its ability to generate long-term returns. Bitcoin mining has become highly competitive due to the development of increasingly advanced ASICs (application-specific integrated circuits—essentially electronics specifically designed to do certain tasks very well). Thus, mining Bitcoin on your personal computer, or even a small fleet of ASICs, cannot compete with the large-scale operations of Bitcoin miners focused on maximizing operational efficiencies through ASIC miner fleets powered by more lucrative, direct power purchase agreements with power producers, cooled by efficient cooling systems, and even profiting from economies of scale, reducing per-hash overhead.

In this article, I will explain why HIVE Digital Technologies (Nasdaq: HIVE) has a better, more profitable Bitcoin mining operational strategy, driven by its careful capital deployment and focus on operational efficiencies. As opposed to many of its peers, the company generates profit from mining and does not need to rely on strong Bitcoin appreciation to bolster its balance sheet as an intangible asset (using fair value accounting under GAAP). And as it can generate cash flows, it can be more easily valued. The company appears undervalued.

The Business of Bitcoin Mining

Bitcoin mining is essentially the business of being rewarded to record transactions on the blockchain (a shared public ledger) for the network to verify and confirm. To simplify, it’s basically a decentralized transaction network where the work of verifying these transactions on the ledger is done via software and lots of work, as opposed to through a third party like a bank. Thus, Bitcoin miners are “getting paid for their work as auditors.” A good summary of the Bitcoin mining fundamentals can be found here.

The capital allocation and revenue generation of Bitcoin mining is somewhat like real estate merged with a natural gas production asset, where:

- Asset acquisition (new mining facilities/ASICs) is fairly frequent and expensive (like drilling new wells),

- Near-passive income is generated with newly operational mining facilities,

- Capital appreciation is generated via the option of holding some of the mined Bitcoin,

- Operational costs are fairly steady,

- Revenue drops off significantly over time (like a natural gas decline curve) due to Bitcoin halvings, hardware lifespan, and obsolescence,

- Criticality of location and resources (real estate property location versus location for low-cost electricity),

- Intense competition causes only those with favorable cost structures to continue operating with profits, like physical commodity producers.

Graphic showing calculated revenue from mining (calculation from rewards, transaction fees, and periodic mining difficulty adjusments). The red circle shows the hash price index falling strongly with the Bitcoin reward halving event. Source

Because of these factors, the highest quality Bitcoin mining companies will be run with executives with a deep understanding of the market dynamics, including revenue potential, capital allocation, and operational efficiencies.

HIVE’s Operations: Bitcoin Mining and High Performance Computing (HPC)

HIVE mines Bitcoin in several countries (Canada, Sweden, and Paraguay) and operates high-performance computing for Canadian sovereign AI to generate revenue. The company is focused on return on invested capital (ROIC) as a key metric to determine where to invest its capital. This is a strategy in contrast with other crypto mining companies such as MARA and Riot which have historically HODLed their Bitcoin and funded operations through many financings.

HIVE’s Bitcoin Mining Strategy

In Bitcoin mining, where mining difficulty increases every four years, hardware obsolesces, and power prices swing, the businesses generating real returns aren’t only accumulating Bitcoin (HODLing). While accumulating Bitcoin may be part of that strategy, the spent capital, revenues, share price, and even Bitcoin (intangibles) are measured in dollars.

Source: HIVE Investor Presentation

HIVE focuses on ROIC when determining capital expenditures. It sounds obvious to do so, but not all crypto mining companies put the work in to ensure that their capital expenditures will have a near-guaranteed payback. In its most recent capital deployment, HIVE is quadrupling from 6 EH/s (exahash per second) to 25 EH/s with its green-powered mining operation being built out in Paraguay. This includes 300MW of operations across two locations (Yguazú and Valenzuela). Including its existing mining operations in Canada and Sweden, HIVE’s power consumption in Bitcoin mining will total 440MW by the end of CY2025 if all goes well with the project.

The total cost for the project, including Yguazú (200 MW site - $56 million), $19 million in power purchase agreement (PPA) deposits to Paraguay's national utility (ANDE), construction completion (~$80 million), and ASICs will likely total about $270 million. This project will add 19EH, which at normal operational margins will generate around $240mm in net income. Assuming that this net income is maintained until the next Bitcoin halving (perhaps 3 years from now), that is a total of $720 million in returns from a $270 million investment, in just three years.

The main consideration is that although HIVE had hundreds of millions in Bitcoin on its balance sheet, the $270 million invested over about a year to complete this project is somewhat more than they could organically finance. They used a lot of their Bitcoin to secure their equipment buildout:

To date, using our Bitcoin “pledge strategy,” HIVE has pledged over $200 million worth of Bitcoin to our equipment supplier to secure our expansion to 25 EH/s. This has enabled the Company to scale the business, increase revenue and mining margin* significantly, without having to otherwise issue equity or take on debt for this required amount of investment. We believe this is highly accretive to our shareholders, as growth in ASIC hashpower has occurred without the dilution that would otherwise come from equity financing. Furthermore, the Company has the option to buy back this Bitcoin at the original pledge price. The market value of the Bitcoin today exceeds the value of the Bitcoin at the time of pledge.

Presumably, as an alternative or supplementary financing, the company has an ATM facility in place where it can sell over $100 million in shares into the market at its discretion. Needless to say, there could be a little bit of pressure on the shares from ATM drawdowns, but most of this project was financed by HIVE and even allows it to purchase back its Bitcoin at the pledge price (US$87,000 per Bitcoin), for no loss. Unless I’m missing something, this project appears to have extremely favorable economics, and was a very good set of moves by management.

Comparing HIVE’s Buzz to HPC/AI Competition

In contrast to some other Bitcoin miners that have repurposed their infrastructure (power) or divested Bitcoin mining operations to chase higher revenues in HPC/AI, HIVE has so far kept its mining operations while additionally launching and growing its AI/HPC cloud operations in Canada and Sweden, branded “BUZZ HPC.”

HPC and former Bitcoin mining companies such as TeraWulf (Nasdaq: WULF), which sold its stake in its Bitcoin mining facility to partner Talen Energy (NASDAQ: TLN), and CoreWeave (NASDAQ: CRWV), which acquired Core Scientific, a Bitcoin miner now focusing on HPC/AI, have inked high-value deals with major AI companies.

TeraWulf recently announced a $6.7 billion deal with Fluidstack, a “premier cloud AI platform,” with Google (NASDAQ: GOOG) backing TeraWulf with a total of $3.2 billion, including a 14% equity stake. Similarly, CoreWeave announced an “up to $11.9 billion” deal with OpenAI for access to its AI infrastructure, along with OpenAI investing in CoreWeave.

BUZZ HPC is somewhat different from these competitors; it has partnered with Bell Canada (TSE: BCE) to deliver advanced sovereign AI infrastructure for Canada. HIVE didn’t repurpose Bitcoin sites for HPC; rather, they repurposed 5,000 Nvidia (Nasdaq: NVDA) GPUs that were being used for Ethereum mining after Ethereum transitioned from proof of work to proof of stake, and it was no longer lucrative to mine. Due to the smaller scale of this business (despite rapidly growing to $20mm ARR) and its focus on sovereign operations, this is a slightly different value proposition compared with the global scale of BUZZ HPC’s aforementioned competitors. However, the scale of BUZZ HPC’s partners is fairly large, so this initial 5MW project has the potential to grow into something much greater. The company has applied for federal grants and has purchased a 7.2MW datacenter in Toronto, which will enable the company to potentially ramp BUZZ HPC’s revenue to $100mm next year.

HIVE’s Operational Efficiency

HIVE is constantly analyzing the market for ASICs and GPUs to continue to look for attractive near-term ROIs, which is a good strategy since longer-term ROIs both 1) decrease due to reward halvings and 2) can also be volatile due to changes in difficulty (which is adjusted every 2 weeks so that blocks are added to the chain at approximately the same rate over time, specifically to adjust for the number of miners).

The company’s management has a deep understanding of the mathematics and economics of Bitcoin mining, allowing them to manage downside risk from Bitcoin hashprices, energy prices, and other factors. This is done by changing the firmware on their ASICs to opportunistically downclock the units to optimize the hashrate-to-energy consumption ratio (+/-10-20%). With shrewd ASIC purchases and periodic ASIC fleet optimization, the company is able to minimize its $/TH.

The best recent example of HIVE’s wise equipment purchases is the company’s recent deal with Bitmain to acquire S21+ Hydro units for deployment at an acquired site in Paraguay, formerly owned by Bitfarms (NASDAQ: BITF). The company’s payback period on the S21+ Hydro miner ASICs is forecast to be 10 months net of operating costs, which reduces the company’s risk of not generating significant cash flows post another halving event.

In addition to its operational efficiency, HIVE compares itself to its peers and claims to have the lowest SG&A (SG&A expense/revenue) among the group, a testament to its focus on minimizing costs.

Source: HIVE Q1 F2026 Earnings Presentation

Management and Insider Ownership

HIVE clearly has capable management, which has proven itself through profitably mining Bitcoin (gross margin) through several bear markets, executing on large projects, and strategically shifting its business when opportune. However, one negative with the company is that it has very low insider ownership. While executive pay with RSUs, options, and performance-based bonuses align management with generating shareholder value, the KPIs are not entirely aligned with returns. For instance, strong performance in revenue growth, hash rate increases, and strategic diversification as KPIs are not KPIs that account for the cost of such growth.

In my opinion, the company’s incentives for the leadership team are acceptable, but pure share ownership (purchased or earned) is a better shareholder-friendly incentive. Certainly, one will always wonder why the executive team has not seemed compelled to purchase shares if the company’s future were so bright. Overall, ideally for shareholders, the company would have higher insider ownership, but this should not detract from management’s winning moves, quadrupling the company’s EH/s in Paraguay, all while minimizing dilution through a Bitcoin pledge.

Valuation

HIVE currently trades at about 21x Enterprise Value/Exahash Rate for its end of CY2025 target of 25 EH/s. At an average peer multiple (that management publishes in its investor presentation), HIVE should trade at roughly 3x its current value, or about $8.50/share.

The company provides several compelling comparisons, including to that of the recently acquired Core Scientific, acquired by CoreWeave for $9 billion (valuation at the time of the all-stock deal). While Core Scientific had a similar amount of Bitcoin mining power as HIVE (500MW vs 440MW in Nov ‘25), Core Scientific had 840MW allocated to HPC/AI. Additionally, there was “Immediate elimination of over $10 billion of cumulative future lease overhead to be paid for existing contractual sites over the next 12 years” according to CoreWeave, undoubtedly a deal that significantly bolstered the acquisition price given Core Scientific’s Q2 results of $78 million in revenue and only $21.5 million in EBITDA and $5 million in gross margin. In contrast, HIVE’s most recent quarter’s gross operating margin was $15.8 million, with an adjusted EBITDA of $44.6 million, on $45.6 million in revenue.

HIVE also carries 435 Bitcoin in its treasury as of June 30th, 2025. This is down from 2,201 Bitcoin from a prior reporting period. According to HIVE, “the decrease in digital currencies was mainly due to 1,565 Bitcoin used towards equipment purchases. The Company entered into equipment purchase agreements whereby the Company was able to make the purchase in Bitcoin and also receive an option to repurchase the bitcoin in the future for a fixed price.”

The company also expects to ramp HPC revenue with a target of $100mm ARR in 2026. It is not yet clear what margins are to be expected as the business ramps, but competitors report very high gross profit and EBITDA margins, over 75% and 50%, respectively. Thus, while HPC is a fledgling business for HIVE at the moment, it has the potential to add significant long-term recurring revenue and quite a bit of upside. For instance, a 10x EBITDA multiplier on $50mm recurring EBITDA from HPC would result in $500mm in valuation. Taking May’s $20mm HPC ARR and assuming a 50% margin with a 15x EBITDA ratio (high growth, early stage), this translates to another $150mm in value now and potentially more later.

HIVE has 204.3 million issued shares according to its most recent 1Q2026 SEDAR filing. Assuming about 10 million RSUs are issued, and a few million in warrants, options, as well as a few million in future ATM sales inflate the share count, we will assume a future share count of 230 million shares outstanding.

Adding up the $720 million in the next three years’ net income ($240m/yr*3yrs), along with an estimated $240 million in terminal value (⅓ the peak performance period value after the next halving event/competing with next-gen ASICs, then obsolescence), and a $150 million HPC business, HIVE is currently worth an estimated $1.11 billion, or $4.80/share, approximately 70% above the current share price.

There is arguably additional upside to this estimate as HIVE looks to deploy generated capital into additional high ROIC projects and as its BUZZ HPC business grows. Shares are attractively valued, and HIVE shares currently appear to be more attractive than other Bitcoin mining companies’ shares based on Enterprise Value per Terahash (EV/TH).

The average price target shown on TipRanks as of my writing this article (August 2025) is $7.29/share, which is based on several recent analyst price targets and roughly aligns with my very simplified valuation based on near-term earnings.

Risks

Many companies are entering the HPC market, and it is not yet clear whether this competition will drive HPC pricing power down or up. Consumer and enterprise AI demand is surging, which will drive prices up. Additionally, AI RAM is currently undersupplied (example: Micron Technology (Nasdaq: MU) is sold out of its high-bandwidth memory through 2025 (and has strong demand already for 2026), which will limit total available HPC supply from growing too fast. In contrast, HPC competition is surging, which could drive prices down.

Bitcoin mining, on the other hand, has noisy hashrate prices, and as energy demand is projected to explode due to AI workloads, this could drive energy prices up over the long term. However, if HIVE continues to focus on deals with short payback periods and high ROIC, it can continue to mitigate these inherent risks.

Additionally, there are mild funding risks associated with finishing the Paraguay buildout (all the way to 25 EH/s), though I don’t think the concern is very significant. There may be a little bit of ATM pressure on shares if they need the cash to fund the last portion of the project.

Conclusion

Bitcoin mining is a highly competitive industry, and there appear to be two main strategies: HODLing Bitcoin while issuing massive amounts of shares to finance mining, and strategic capital deployment based on near-term returns. In contrast to high-profile peers, HIVE fits in the latter category, focusing not on Bitcoin speculation but on business fundamentals. Astute management with wise capital deployment drives returns in this business. It is likely that HIVE has not been re-rated and will not until investors see a full quarter of their Paraguay project’s impact on earnings, but that could be well within a year from now.

HPC, on the other hand, has commanded premium valuations for several companies if they can land high-value customers. While BUZZ HPC is in its early stages of growth, it could contribute to a greater portion of the company’s valuation in the future.

HIVE’s management has proven to be shrewd with equipment purchases and keen on maintaining high operational efficiencies. With minimized SG&A/revenues but also a low EV/TH multiple, it appears to be both the most cost-effective Bitcoin miner and the most attractive in terms of valuation, though several Bitcoin mining companies investing in HPC make direct comparisons less clear.

HIVE shares appear moderately undervalued, and investors can expect management to continue to make smart moves to further increase per-share value in the future.

More By This Author:

Apollo Silver: Two World-Class Silver Assets In One Stock

Galectin Therapeutics Is Undervalued And With Short Squeeze Underway

Intelligent Bio Solutions’ Fingerprint Drug Screening Technology Poised For Massive Growth

Disclosure: I am long HIVE, WULF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more