Historic Expiration, Good Data, Russell To New Highs & Trade Gone Bad

Image Source: Unsplash

Today is the single largest options expiration in history. While that sounds important, the truth of the matter is that March, June, September and December are always huge expirations with December usually even larger because it is year-end. And as markets grow, so does the use of derivatives, like options. So, the numbers are historic, but not something I am going to worry about since all of these options go bye bye today.

Over the last few days, the government released lots of data. We learned that inflation fell and came in cooler than expected. We also saw that jobless claims fell and were better than expected. Although I never question the integrity of the data, I also think the government shutdown may have added some noise. Finally, the budget deficit is projected to be $600 billion lower year over year. Tariffs income certainly played a part in that.

I cannot get over how many people have been chirping about the Santa Claus rally (SCR) failing or not showing up. These folks epitomize the ignorance in the markets and why the masses usually get it wrong. The SCR only has one definition. It is the last five trading of the year plus the first two in January. In other words, it doesn’t start until the close on December 23rd.

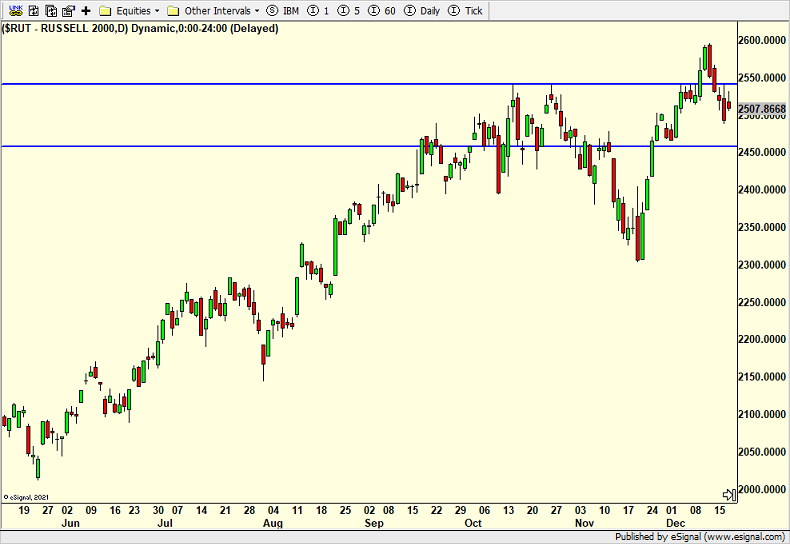

FYI, while I am discussing seasonal trends, a very strong one in small caps began on December 15th that last the rest of 2025. As you know I have been positively disposed to small caps since April and have increased exposure during the fall pullback. I expect the index below to reach new highs in the coming weeks.

(Click on image to enlarge)

Next I want to share a recent trade that had a good risk/reward set up and ended poorly. Below is an ETF that invests in semiconductors, a sector that was setting up nicely for a rally into year-end. For a variety of reasons we bought the SMH on the last day on the chart below which was Wednesday. I was expecting a run to new highs with the risk being a close below that day’s low.

(Click on image to enlarge)

One day later, SMH fell hard and closed below the low where we sold for a loss. And of course, it bounced hard on Thursday and looks higher this morning. Good set up. Good risk/reward. Solid plan. Lost money. Move on and to something else.

(Click on image to enlarge)

Holiday season is in full swing. Having been out 10 of the last 11 nights with games, meetings and social events, I was planning on heading north tonight for what has been an epic early season in Vermont. Mother Nature had other ideas with a quick warm up, rain, wind and then flash freeze. So, the boys and I will likely watch the Oklahoma/Alabama football game and then try to head up tomorrow at some point. That Mark Twain was certainly right about New England weather.

More By This Author:

Fed Delivers – Markets Too – Rally BroadensSpecial Fed Day Update – Rate Cut & Dow 50K Coming

New Highs Up Next With Higher Risk Leading Into Fed Meeting

Disclosure: Please see HC's full disclosure here.