High Dividend 50: Walgreens Boots Alliance

Photo by Kanchanara on Unsplash

Walgreens Boots Alliance (WBA) has an exceptional dividend growth record, with 47 consecutive years of dividend growth. Thanks to its robust business model and its resilience to recessions, the stock is on track to become a Dividend King in three years.

Due to some business headwinds and the impact of inflation on the valuation of the stock, Walgreens is offering a nearly 10-year high dividend yield of 5.2% while it is also trading at a nearly 10-year low forward price-to-earnings ratio of 7.9.

It is one of the high-yield stocks in our database, all of which yield at least 5%.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

In this article, we will analyze the prospects of Walgreens.

Business Overview

Walgreens Boots Alliance is the largest retail pharmacy in both the U.S. and Europe. Through its flagship Walgreens business and other business ventures, the company is present in more than 9 countries, with more than 13,000 stores in the U.S., Europe, and Latin America.

Walgreens is currently facing a strong business headwind, namely the fading positive effect of the pandemic. In the first quarter of its fiscal 2023, the company executed only 8.4 million vaccinations, which was 29% lower than the 11.8 million vaccinations in the second quarter of 2022. As a result, the retailer saw its total revenues dip 1.5% and its earnings per share slump 31% over the prior year’s quarter.

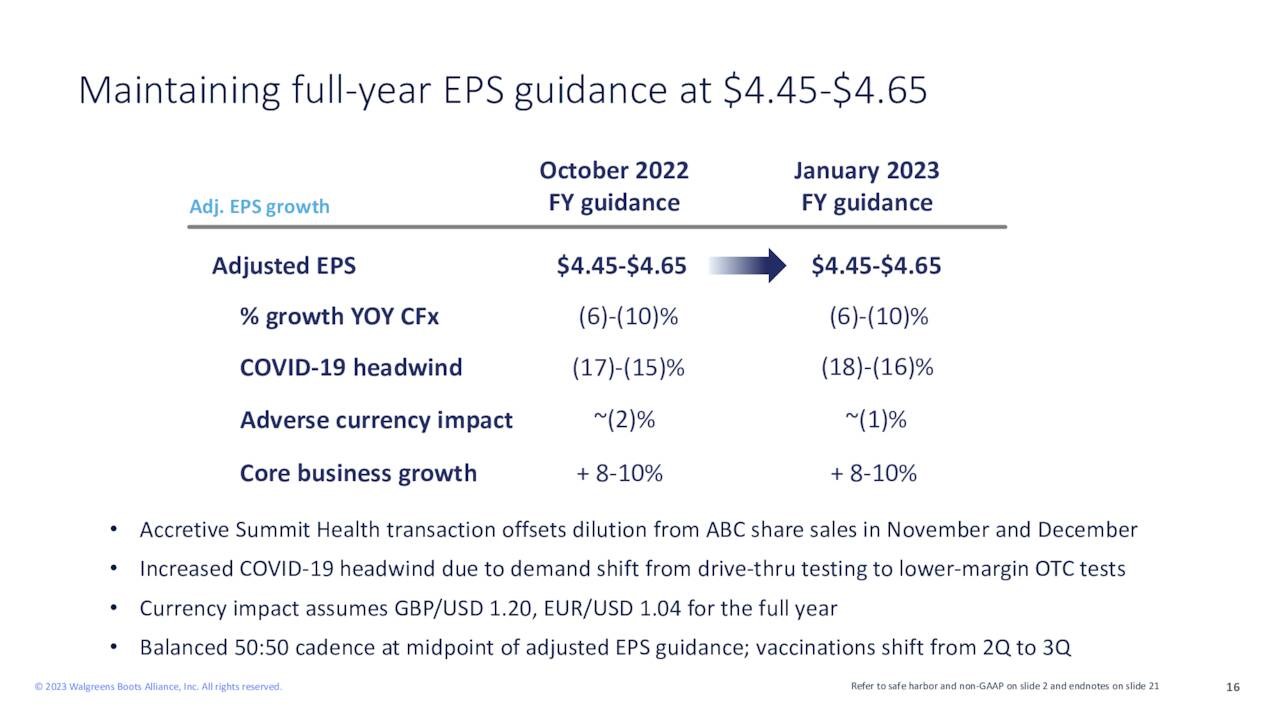

On the bright side, Walgreens has exceeded the earnings-per-share estimates of analysts for 10 consecutive quarters. It also recently reiterated its guidance for earnings per share of $4.45-$4.65 in 2023.

Source: Investor Presentation

At the mid-point, this guidance implies a 10% decrease over the prior year. Such a decrease is reasonable, given the fading tailwind from COVID vaccinations.

It is also remarkable that Walgreens attempted to sell its Boots business in order to unlock shareholder value. However, the company did not receive any attractive offers and thus it decided to retain its Boots business.

Nevertheless, Walgreens kept up its efforts in enhancing shareholder value. In early November, VillageMD, which is majority owned by Walgreens, announced its agreement to acquire Summit Health in a deal valued at about $8.9 billion. Thanks to this acquisition, Walgreens recently raised its fiscal 2025 sales guidance from $11.0-$12.0 billion to $14.5-$16.0 billion. It also expects the deal to add $0.07-$0.11 (~2%) to its annual earnings per share in 2024 and become even more accretive after 2024. We currently estimate $4.55 in earnings per share for this year.

Growth Prospects

During the last decade, Walgreens has grown its earnings per share at a 7.6% average annual rate. It has achieved such a performance thanks to solid revenue growth, a steady net profit margin, and modest share repurchases.

The retailer is currently facing some business headwinds. Apart from the aforementioned fading boost from the pandemic, the company is facing somewhat intense competition and thus it does not have as strong pricing power as it used to have.

Moreover, the profit margins in the pharmaceutical industry have come under scrutiny in recent years. As a result, it is prudent not to expect meaningful margin expansion going forward.

On the other hand, Walgreens has some long-term growth drivers, which are intact. An aging population should remain a material growth driver. In addition, the focus of the retailer on becoming an even more diversified health destination is likely to bear fruit in the upcoming years. Overall, we expect Walgreens to grow its earnings per share by about 4% per year on average over the next five years off this year’s somewhat low comparison base.

Competitive Advantages

The immense scale of the network of Walgreens renders the company highly efficient and thus constitutes a major competitive advantage. The retailer also enjoys great synergies across its vast healthcare portfolio.

Source: Investor Presentation

Another key feature of Walgreens is its resilience to recessions, as the demand for drugs does not decrease even during the fiercest economic periods. The resilience of a company to recessions is paramount for investors, as recessions are inevitable and hence it is critical for companies to remain firm during such periods.

It is also important to note that the global economy has remarkably slowed down in recent quarters, primarily due to the aggressive interest hikes implemented by central banks in an effort to restore inflation to its normal range. As the risk of an upcoming recession has increased, the resilience of Walgreens to downturns is especially important.

Dividend Analysis

Walgreens has raised its dividend for 47 consecutive years. It has grown its dividend by 6.7% per year on average over the last decade and by 4.3% per year on average over the last five years.

Notably, the stock is currently offering a nearly 10-year high dividend yield of 5.2%. The high yield has resulted, not only from the annual dividend hikes of the company but also from the 32% decline in the stock price due to the aforementioned headwinds.

Due to a combination of dividend growth and stagnant earnings per share in the last five years, the dividend payout ratio of the stock has risen from 27% in 2018 to 42% right now. However, the payout ratio of Walgreens remains healthy.

In addition, the company has a decent balance sheet, with an interest coverage ratio of 4.8. Its net debt of $59.0 billion is elevated, at 15 times the annual earnings. Nevertheless, given its healthy payout ratio, its resilience to recessions, and its decent growth prospects, Walgreens is likely to continue growing its dividend, albeit at a modest pace, for many more years.

Overall, investors are given the opportunity to lock in a nearly 10-year high dividend yield of 5.2% and rest assured that the dividend will remain safe for the next several years.

Final Thoughts

Walgreens is offering a nearly 10-year high dividend yield of 5.2% and is trading at a nearly 10-year low forward price-to-earnings ratio of 7.9. The primary reasons behind the exceptionally cheap valuation of the stock are the fading tailwind from the pandemic and the impact of inflation on the valuation, as inflation reduces the present value of future earnings.

Moreover, Walgreens has failed to grow its earnings over the last five years, partly due to increasing competition and public discontent over the profit margins in the pharmaceutical industry. In the last five years, the stock of Walgreens has plunged 52%, whereas the S&P 500 has rallied 43%.

Given a healthy payout ratio of 42% and a decent balance sheet, the dividend of Walgreens can be considered safe for the foreseeable future. In addition, Walgreens is likely to recover from the current downturn and grow its earnings at a decent pace in the upcoming years.

Overall, the stock is offering a high dividend yield and the potential for significant capital gains thanks to a double tailwind; higher earnings, and a higher price-to-earnings ratio. Given this, we have a by-rating on the stock.

More By This Author:

High Dividend 50: Canadian Imperial Bank Of Commerce

High Dividend 50: Hanesbrands Inc.

High Dividend 50: Big Lots Inc.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more