High Dividend 50: Big Lots Inc.

Discount retailer Big Lots, Inc. (BIG) has a relatively short history of paying a dividend having initiated it in 2014. The company hasn’t provided a dividend increase since 2018, but that hasn’t stopped the stock from reaching a very high yield after falling more than 57% over the last year.

In fact, the stock’s yield of 6.4% is nearly four times the average yield of the S&P 500, which is good enough to land Big Lots on our list of high-yield stocks.

In this article, we’ll take a deep look at Big Lots’ prospects as an investment today.

Business Overview

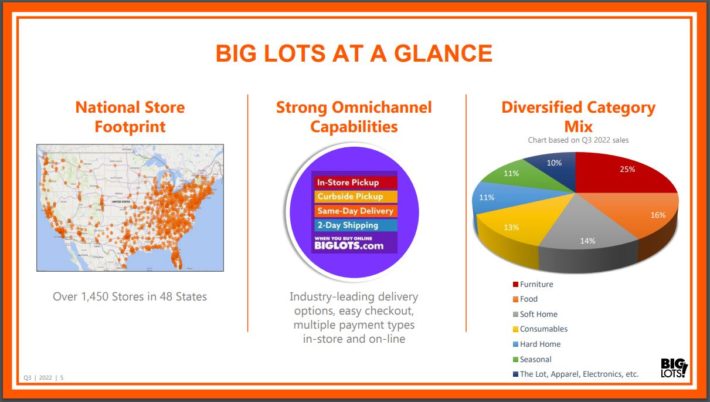

Big Lots is a home discount retailer with a focus on closeouts and offering customers low prices. The company’s merchandise categories include food, consumables, home, furniture, apparel, electronics, and seasonal. The company generates nearly $6 billion in annual sales and has a market capitalization of just $489 million.

Big Lots reported third quarter earnings results on December 1st, 2022.

Source: Investor Presentation

Revenue fell almost 10% to $1.20 billion for the period, which was $4.2 million less than expected by the analyst community. The company reported an adjusted earnings-per-share loss of $2.99, which was a nickel worse than anticipated. The loss on the bottom-line compared unfavorably to a loss of just $0.14 in the prior year and a loss of $2.28 in the second quarter of 2022.

Comparable sales fell 11.7%, worse than the market had expected, but in-line with company guidance. Declines were felt in almost every product category, but none was worse than the 26% decline in furniture. Other areas, such as soft and hard home, were down double-digits as well.

The only area of the store that performed well was seasonal, which improved 7% from the prior year.

Much of the decline in same-store sales is due to aggressive discounting of products. Big Lots, like many other retailers, has been holding too much inventory following a stock up during the Covid-19 pandemic. Inflationary pressures have also caused the cost of inventory acquisition to rise, which has meant more expensive prices for customers. Promotional activity is being used to trim inventory, but this has not been a quick transformation.

At the end of the quarter, Big Lots had $1.345 billion of inventory, which is up 5.3% from the same period of 2021. The good news is that this year-over-year growth in inventory is down from 48.5.% in the first quarter and 22.8% in the second quarter. Sequentially, at least, Big Lots is seeing inventory growth come down significantly. The company expects inventory to be flat or down in the fourth quarter.

The discounting of products took a toll on gross margin, which contracted 510 basis points to 34.5%.

Following third quarter results, Big Lots is not providing earnings-per-share guidance for the year. The company does expect that comparable sales will be down low double-digits in the fourth quarter as Big Lots works to right size its inventory levels. Gross margin is projected to remain in the mid-30% range, but improve on a sequential basis.

Despite the weakness and uncertainty regarding the company, we maintain our $5.00 per share estimate for 2022.

Growth Prospects

Big Lots has experienced a very uneven growth history. The middle of the last decade saw earnings-per-share grow, but this was due mostly entirely to a lower share count. Revenue was largely unchanged from 2012 to 2019, while earnings and net income both fell over the period.

The company did see substantial growth in 2020 as earnings-per-share almost tripled. Big Lots used its e-commerce business to capitalize on the Covid-19 pandemic as consumers turned to online shopping to meet their needs. As a discount retailer, the company offers consumers good value on the products they need, something that turned out to be a point in Big Lots’ favor during this period of time.

E-commerce continues to be a strength for the company even as the worst of the Covid-19 pandemic appears to be over. Despite weakness in the overall business, e-commerce grew 15% in the third quarter. Big Lots also offers a variety of fulfillment options as well, including in-store and curbside pickup, same-day delivery, and 2-day shipping for customers buying products on line.

That said, we don’t expect earnings growth over the next five years as Big Lots is already starting from a high base.

Competitive Advantages

With its business centering on closeouts and low-price points, Big Lots has an advantage during difficult economic periods. As consumers tighten their wallets, they look for value, something that Big Lots offers throughout its stores. This is why the company has done well during downturns, with the 2020 performance being a prime example of this.

Big Lots also benefits from an extensive footprint.

Source: Investor Presentation

The company has more than 1,450 stores throughout the continental U.S., with the majority of these located in more density populated states east of the Mississippi River. This gives the company access to a larger customer pool, though not as extensive as other discount retailers. For example, Dollar General Corporation (DG) has almost 19,000 stores.

Big Lots has leveraged its e-commerce business to great lengths already. As a smaller player in the discount retail space, this will be a highly important way for the company to take more market share.

Dividend Analysis

Big Lots has paid a dividend since 2014, with the next several years seeing extensive growth. The quarterly dividend went from $0.17 in 2014 to $0.30 by the beginning of 2018. That is where the dividend growth ended as the payment has remained constant for 20 consecutive quarters.

The current yield of 6.4% is well-ahead of the stock’s five-year average yield of 2.9%, suggesting that shares could be undervalued.

The dividend hasn’t been cut even during periods of uncertainty, which is a positive sign. Another point in the company’s favor is that the payout ratio has normally been low, typically in the mid-to-high 20% range. That said, we feel that further weakness in the business or multiple down years could eventually lead to a dividend cut.

Final Thoughts

Big Lots does have some positives regarding the company. It’s business model tends to work well during economic downturns and the e-commerce business has allowed the company access to more potential customers.

On the other hand, the company is small and is easily dwarfed by other discount retailers. Inventory levels remains elevated even as the year-over-year growth has become less. The dividend yield, while generous, may not be safe in a prolonged downturn in the business.

More By This Author:

2 Closed-End Funds For Income Investors

High Dividend 50: LyondellBasell Industries

High Dividend 50: Kronos Worldwide

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more