High Dividend 50: Viatris

Viatris (VTRS) stock has plunged 30% in just five weeks, primarily due to the disappointing guidance of the company and the divestment of its biosimilar assets. As a result, the stock is offering a 4.4% dividend yield and hence it now belongs to the group of high-yield stocks.

Investors should perform their due diligence before purchasing a high-yield stock in order to avoid a dividend cut and material capital losses. In this article, we will analyze whether income investors should purchase Viatris for its enticing yield.

Business Overview

Viatris is a global healthcare company that was formed in late 2020 with the merger between Mylan and Pfizer’s UpJohn Business unit. The company offers a wide range of treatments and operates in three business segments: Brands, Complex Gx & Biosimilars, and Generics.

The first segment includes well-known products, such as Viagra and Dymista. In addition, Viatris makes generic versions of branded drugs after the expiration of patents. These medications share the same formula, but cost less than “brand” medicine. Finally, Viatris offers a portfolio of diverse global biosimilars, with approximately 150 marketing authorizations in over 85 countries focused on oncology, immunology, endocrinology, ophthalmology, and dermatology.

Due to its recent formation, Viatris has a very short history and hence it is challenging to make accurate forecasts for the company. In addition, the company has inherited an excessive debt pile from its predecessors. The leveraged balance sheet is an additional risk factor for the stock.

In late February, Viatris reported its results for the fourth quarter of 2021. Its total net sales grew 21% over the prior year, mostly thanks to strong growth in the brand division, and its adjusted earnings grew 49%.

However, management provided disappointing guidance for this year. It expects revenue of $17.0-$17.5 billion, which implies a 3% decrease at the midpoint. It also stated that it expects adjusted EBITDA around $6.0 billion, thus signaling a 7% decrease over the prior year.

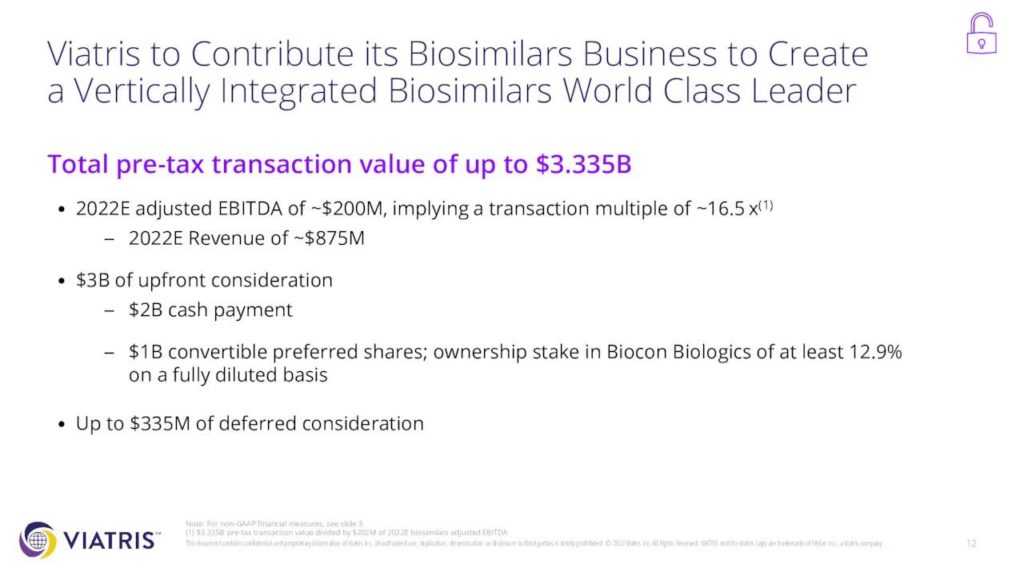

Moreover, Viatris announced the sale of its biosimilars business to Biocon Biologics for $3.3 billion, with $2.0 billion paid in cash, $1.0 billion in convertible preferred equity, which will give the company a 12.9% stake in Biocon Biologics, and up to $335 million in cash in 2024. Viatris stated that it decided to sell its biosimilars segment mostly for the rich valuation of the deal, which was closed at 16.5 times the EBITDA of the segment.

(Click on image to enlarge)

Source: Investor Presentation

Thanks to this deal, Viatris will reduce its debt load and enhance its margin profile. Moreover, the segment of biosimilars currently generates only 7% of the total sales of Viatris and hence the deal value, which is 18% of the market capitalization of the stock before the announcement, seems attractive.

However, the market punished the stock with a 24% plunge on the announcement of the deal. A small part of the collapse of the stock can be attributed to the disappointing guidance for 2022, but most of the collapse resulted from the announcement of the divestment. The market punished the company because it will divest one of its three segments but the proceeds from the sale will be too low to strengthen its balance sheet.

Viatris has net debt of $29.3 billion, which is more than twice as much as the market capitalization of $13.0 billion of the stock. In addition, while the company has posted adjusted earnings in the last two years, it has posted material GAAP losses, -$0.7 billion in 2020 and -$1.3 billion in 2021. Therefore, it is reasonable to be concerned over the burden of the debt pile on Viatris and the vulnerability of the company in the event of an unforeseen downturn. The $3.3 billion value of the aforementioned deal is obviously insufficient to render the balance sheet of Viatris strong.

Growth Prospects

Due to its recent formation, Viatris has a very short performance record. Given also its somewhat complicated business model, which includes numerous medicines and treatments, and the recently announced divestment of its biosimilars segment, it is essentially impossible to make accurate forecasts for the future results of this company. As a result, Viatris is a highly speculative stock right now.

On the bright side, management recently stated that it will pursue to divest many assets until the end of next year in order to unlock value for the shareholders and strengthen the balance sheet. In such a case, the company will reduce its interest expense and thus it will improve its profitability.

Overall, Viatris has become speculative but most of the damage seems to have already been priced in the stock. If the company announces a divestment of some assets for an attractive amount compared to its depressed market capitalization, it is likely to offer a strong relief rally to the stock.

Competitive Advantages

The primary competitive advantage of Viatris is its vast portfolio of branded and generic drugs. Mylan has a wide range of medicines and treatments, such as those for epilepsy and heart conditions. The Upjohn business has iconic brands as well, such as Lipitor and Viagra, as well as proven commercialization capabilities, including management positions in China and other emerging markets.

On the other hand, the healthcare market is highly competitive, with complex regulations. The divestment of the biosimilar business seems to have dampened growth prospects in the near future and thus Viatris will need to replenish its pipeline of medicines to prevent a decline in its earnings. Such an endeavor will be challenging due to the weak balance sheet of Viatris, which poses limits on the investment amounts of the company.

Dividend Analysis

Viatris is currently offering an above-average dividend yield of 4.4%. The company has posted GAAP losses in each of the last two years but its payout ratio is only 13% using adjusted EPS. The 4.4% dividend yield with a payout ratio of 13% looks certainly enticing on the surface.

However, the excessive debt pile, which Viatris has inherited from its predecessors, raises a big red flag for income-oriented investors. As net debt is more than twice as much as the current market capitalization of the stock, it is undoubtedly high. Even if the company performs well in its business, it will be greatly burdened by its debt for years.

The weak balance sheet also renders Viatris vulnerable to unforeseen headwinds. To cut a long story short, the underlying risk of Viatris cannot justify an investment in the stock for its generous dividend.

Final Thoughts

Due to its disappointing guidance and the negative reaction of the market to the divestment of the biosimilars business, the stock of Viatris has collapsed. It seems that the market has punished the stock to the extreme and hence Viatris has much more upside potential than downside right now.

A potential catalyst will be the announcement of an asset sale at an attractive value relative to the depressed market capitalization of the stock. Nevertheless, the stock is highly speculative and hence unsuitable for income-oriented investors.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more