High Dividend 50: Northwest Bancshares

Northwest Bancshares (NWBI) has been a high dividend yield stock since early 2020 when the COVID-19 pandemic impacted the US economy. The bank has struggled with volatile revenue and earnings. However, the bank continues to pay and increase its dividends. The dividend yield is now over 5.5%.

Business Overview

Northwest Bancshares is a 100+ years old bank founded in Pennsylvania and headquartered in Columbus, Ohio. Today, the bank has about 162 branches and eight drive-through locations in Ohio, Pennsylvania, Western New York, and Indiana. The bank’s focus is personal and business banking and wealth management.

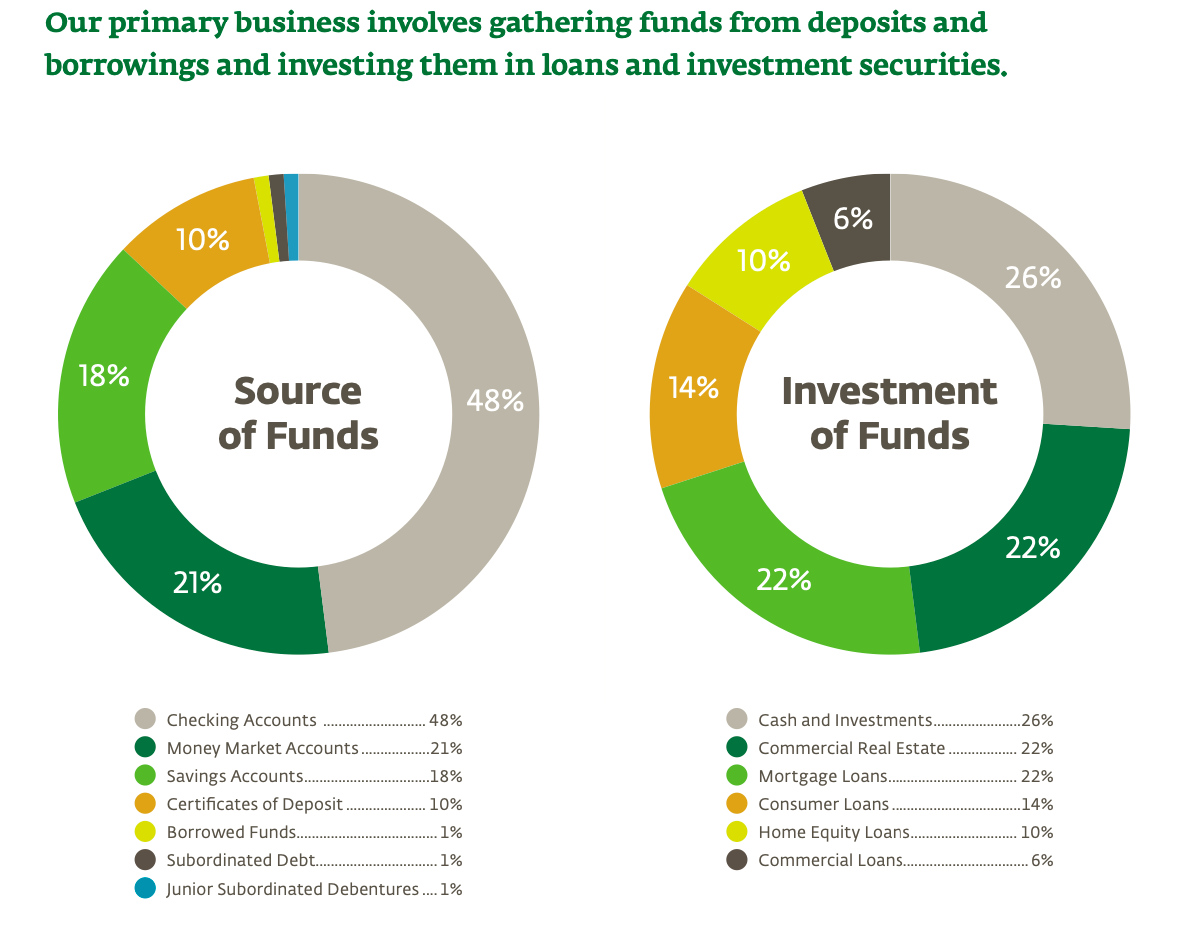

Northwest takes in deposits and loans out money to consumers and small-to-medium-sized businesses like most community banks. Besides loans, the bank invests deposits in cash and cash equivalents.

Hence, the bank offers consumers checking and savings accounts, mortgages, auto loans, personal loans, and credit cards. For small businesses, the bank offers business checking and savings, credit cards, loans, payables and receivables, retirement plans, etc. In addition, Northwest provides wealth management, offering mutual funds, insurance, and annuities.

Total revenue (net interest income and non-interest income) was approximately $546 million in 2021 and the past 12 months.

Source: Investor Relations

Growth Prospects

A community bank like Northwest generates revenue in three ways: interest on loans, fees on services, and wealth management fees.

Community banks earn revenue from the net interest margin (NIM), which is the spread between the interest rate they give on deposits and the interest rate they charge on loans. This income is the net interest income. For instance, banks collect deposits offering the lowest interest rate possible. They offer checking and savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs) to collect deposits. Then, banks loan this money out at a higher rate on mortgages, auto loans, commercial loans, home equity loans, etc.

Banks organically grow their net interest income by adding customers and expanding into new territory by adding branches. Banks can grow net interest income rapidly in high population growth areas, such as Florida or Texas. However, Northwest operates in an area with low or even declining population growth limiting organic growth. Hence, Northwest has been active in the M&A front. In 2019, the bank merged with Donegal expanding in Pennsylvania. More recently, in 2020, Northwest merged with MutualFirst Financial attaining $12.3 billion in assets and expanding into Indiana. The bank will likely continue to merge with smaller banks in its territory. This strategy has been implemented by the current CEO, who took over in 2017.

Northwest can also grow by adding consumers and businesses who utilize more fee-based services, like ATMs. In addition, the bank can grow by adding customers for wealth management. The bank receives commissions or fees for insurance products, trusts, brokerage accounts, and the sale of mortgages on the secondary market.

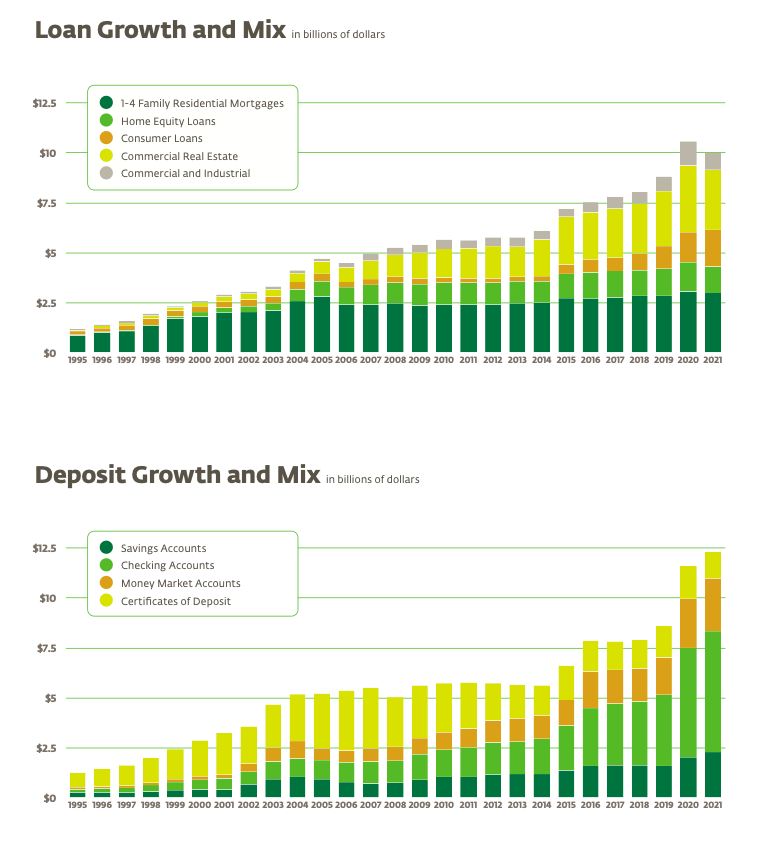

Since 1995, Northwest has successfully grown its deposit base and loans. Moreover, the recent acquisitions have resulted in a jump in both metrics.

Source: Investor Relations

In addition, the rising interest rate environment in 2022 should drive higher net interest income. This occurs because banks usually increase the interest rates on loans faster than the interest rate on deposits in a rising interest rate environment. Consequently, the NIM increases, leading to revenue growth.

Competitive Advantages

Northwest Bancshares’ competitive advantage is its focus on community banking. Many consumers and small-to-medium-sized businesses prefer banking at local banks since it keeps money in the community and results in a beneficial economic impact.

Next, many larger regional and national banks are moving more functions online and reducing branch count. Northwest is also following this trend, but a community bank can still build a solid face-to-face relationship through better service.

Dividend Analysis

Northwest pays an excellent dividend yield of approximately 5.6%. The forward dividend rate is $0.80 per share. The forward dividend yield is greater than the 5-year average of 5.00%. It is also more than three times the average dividend yield of the S&P 500 Index.

The bank has delivered an increasing dividend for 13 years, making the stock a Dividend Contender. Northwest’s dividend growth rate has been about 6.27% in the past decade and approximately 5.66% in the trailing 5-years. However, the most recent increase was 5.3%, near the long-term average but suggests the growth rate is slowing.

The company’s dividend is safe from the perspective of earnings and free cash flow (FCF), but this safety metric value is concerning. The payout ratio is about 73% based on the forward dividend rate and estimated 2022 earnings per share of $0.87. In addition, Northwest generated an FCF of approximately $188 million in 2021, and the dividend required only $100.3 million. Therefore, the dividend-to-FCF ratio is relatively conservative at ~53%.

Northwest had $14,501.6 million in total assets, $9,914.1 million in total loans, and $12,301.2 in total deposits at the end of 2021. The bank is well capitalized based on US federal regulations and Basel III regulatory capital levels. The common equity Tier 1 (CET 1) is 14.889%, more than the requisite 7.000%. The Tier 1 risk-based capital ratio is 10.296%, more than the regulatory requirement of 8.500%. The total risk-based capital ratio is 15.738%, more than the necessary 10.5%. Furthermore, the current credit rating is BBB+, a lower medium investment-grade credit rating by S&P Global.

Final Thoughts

Banks often pay higher dividends, especially when they are well-capitalized. Many banks faced net interest margin compression during COVID as the US Federal Reserve lowered interest rates. But in March 2022, the Fed raised interest rates and signaled further increases reversing the trend.

Northwest is a community bank that should benefit from rising interest rates as it takes deposits at low-interest rates and loans or invests the money at higher interest rates. In addition, the high yield is excellent, but investors should be aware of the high payout ratio.

Northwest is an acceptable stock for investors seeking a high dividend yield and income.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more