High Dividend 50: Midland States Bancorp

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Midland States Bancorp (MSBI).

Business Overview

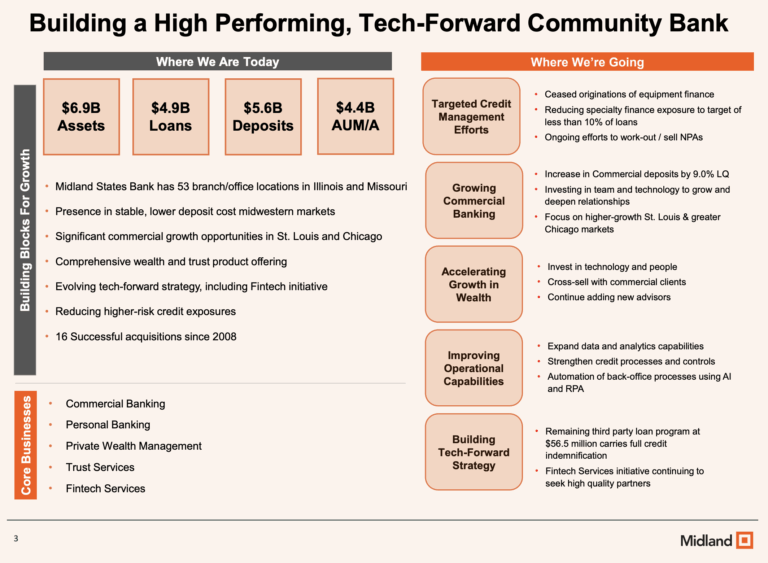

Midland States Bancorp, Inc. is a community-based financial holding company headquartered in Effingham, Illinois. Through its subsidiary, Midland States Bank, the company provides a full range of commercial and consumer banking services, including business lending, mortgage origination, equipment financing, and deposit products.

Midland also offers wealth management, trust and estate services, investment management, insurance, and financial planning solutions. As of September 30, 2025, the company held approximately $6.9 billion in total assets and $4.36 billion in wealth management assets under administration.

Midland operates primarily in Illinois and the Midwest, focusing on building long-term client relationships and maintaining strong community ties. The company’s strategy emphasizes steady loan growth, disciplined credit management, and diversification across commercial and consumer segments. Recent initiatives include tightening underwriting standards, exiting higher-risk lending areas such as equipment finance, and improving overall asset quality.

With a solid capital position and a growing wealth management platform, Midland continues to position itself for sustainable, lower-risk profitability.

(Click on image to enlarge)

Source: Investor Relations

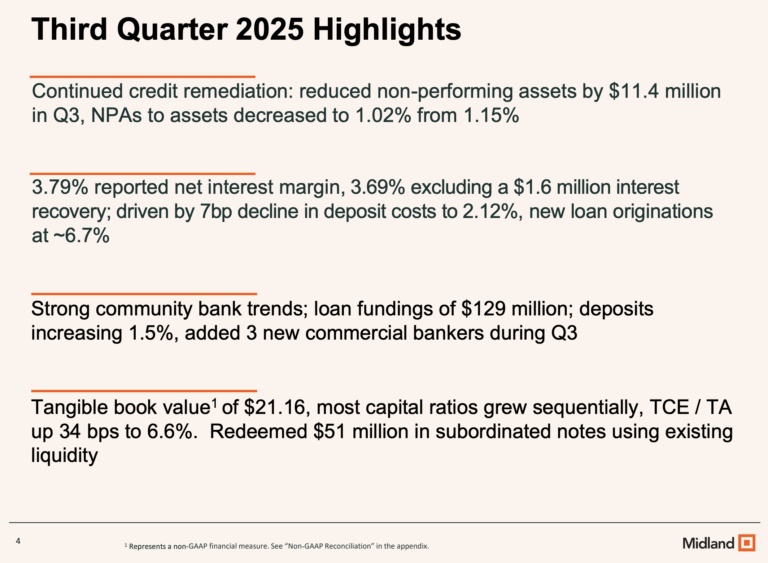

The company reported third-quarter 2025 net income of $5.3 million, or $0.24 per share, down from $9.8 million in the prior quarter and $18.2 million a year earlier. Results were impacted by a $15 million provision for credit losses in the company’s equipment finance portfolio. However, the net interest margin improved to 3.79% from 3.56%, and nonperforming assets declined to 1.02% of total assets.

CEO Jeffrey G. Ludwig said the company is focusing on reducing problem loans and strengthening its balance sheet. Midland stopped originating new equipment finance loans to limit risk and redeemed $50.75 million in subordinated notes. The common equity tier 1 ratio rose to 9.4%, showing improved capital strength.

Community banking and wealth management remained solid, with record wealth management revenue of $8 million and commercial deposit growth of $70 million. Total loans declined to $4.87 billion as Midland reduced exposure to higher-risk assets. The company expects lower funding costs and stronger margins moving forward.

(Click on image to enlarge)

Source: Investor Relations

Growth Prospects

Midland States Bancorp has demonstrated steady long-term growth driven by strategic acquisitions and disciplined expansion. Since 2009, the company has acquired seven smaller banks, helping it grow its asset base by an average of 12% annually over the past nine years.

Between 2015 and 2023, earnings per share increased by nearly 7% per year, supported by diversified revenue streams and a growing wealth management platform. Although Midland reported a loss in 2024 due to large loan charge-offs and elevated deposit costs, the company has since strengthened its credit quality and capital position, positioning itself for a return to consistent profitability.

Looking ahead, Midland is expected to benefit from a more favorable interest rate environment, which should expand its net interest margin and support stronger earnings. Management’s decision to tighten underwriting standards and reduce exposure to higher-risk loans enhances long-term stability. While the company’s past earnings have been volatile, improved asset quality and lower funding costs provide a foundation for gradual recovery.

Analysts expect earnings per share to reach around $2.25 in 2025 and grow modestly—about 2% annually—through 2030, reflecting disciplined management and measured, sustainable growth.

Competitive Advantages & Recession Performance

Midland States Bancorp’s competitive edge comes from its strong Midwest community presence, diversified services, and focus on personalized banking. Its offerings—including commercial lending, wealth management, trust, and insurance—create multiple revenue streams and allow it to compete with larger banks while maintaining flexibility.

The bank’s performance during the recession has been mixed. While strong capital and tightened credit standards help mitigate risk, the 2024 loss highlighted vulnerabilities in loan quality and interest rate swings. Recent measures to reduce higher-risk loans and improve asset quality should make Midland more resilient in future downturns.

Dividend Analysis

The company’s annual dividend is $1.28 per share. At its recent share price, the stock has a high yield of 7.9%.

Given the company’s 2025 earnings outlook, EPS is expected to be $2.25 per share. As a result, the company is expected to pay out roughly 57% of its EPS to shareholders in dividends.

Final Thoughts

Midland States Bancorp has declined 30% this year following weaker-than-expected business results. Over the next five years, it could deliver an average annual return of 15.0%, supported by 2.0% earnings-per-share growth, a 7.9% dividend yield, and a 7.2% potential valuation tailwind.

However, concerns about the quality of its loan portfolio make the stock risky, so we rate it a hold for investors with a higher risk tolerance. The stock is best suited for patient investors who can withstand volatile performance and price swings.

More By This Author:

High Dividend 50: Freehold Royalties Ltd.

High Dividend 50: Gladstone Commercial Corporation

High Dividend 50: Dynex Capital Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more