High Dividend 50: Dynex Capital Inc.

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Dynex Capital Inc. (DX).

Business Overview

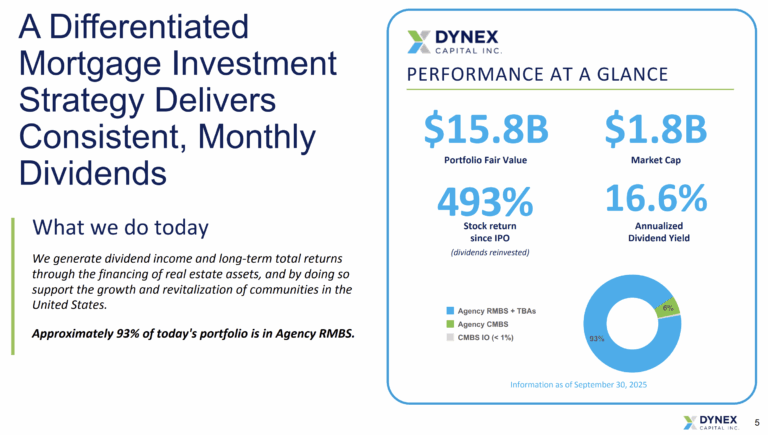

Dynex Capital, Inc. is an internally managed real estate investment trust (REIT) based in Glen Allen, Virginia. The company invests primarily in mortgage-backed securities (MBS), including agency residential and commercial MBS guaranteed by U.S. government-sponsored entities like Fannie Mae and Freddie Mac.

Dynex uses leverage through repurchase agreements to enhance returns, aiming to generate steady income from interest payments and potential capital gains. Its portfolio strategy focuses on balancing yield opportunities with interest-rate and credit-spread risk.

Strategically, Dynex emphasizes disciplined risk management and a long-term approach to capital allocation. The company positions itself as a stable income generator for shareholders while supporting the broader U.S. housing market.

However, as a mortgage REIT, its performance is highly sensitive to interest-rate fluctuations, prepayment speeds, and changes in financing conditions. Despite these challenges, Dynex’s conservative investment philosophy and focus on high-quality agency assets have helped it maintain consistent dividends and preserve book value.

Source: Investor Relations

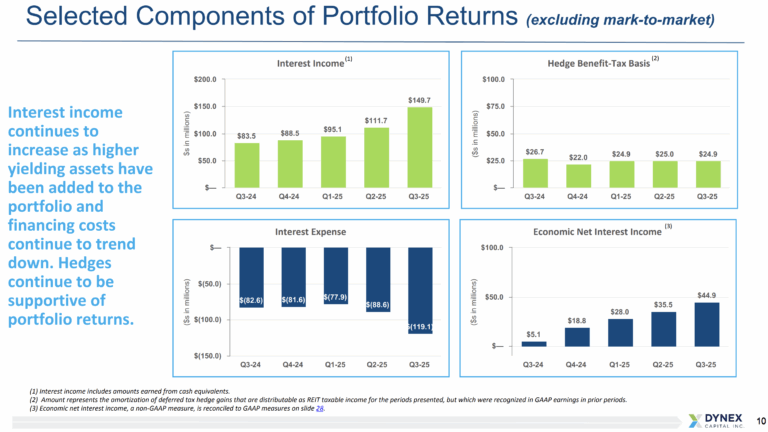

The company reported strong third-quarter 2025 results, delivering a total economic return of $1.23 per common share, or 10.3% of beginning book value. Book value rose $0.72 to $12.67 per share, and the company declared $0.51 in dividends. Comprehensive income reached $1.20 per share, driven by tighter mortgage spreads and declining Treasury yields. Dynex raised $254 million through at-the-market stock offerings, invested $2.8 billion in agency MBS and CMBS, and maintained over $1 billion in liquidity with a 7.5x leverage ratio.

Co-CEO Smriti Laxman Popenoe credited the quarter’s success to disciplined capital deployment, higher-yielding assets, and steady financing costs. With improving net interest spreads and lower funding rates expected in the coming quarter, Dynex remains well-positioned to generate stable income and sustain its dividend growth strategy.

Source: Investor Relations

Growth Prospects

Dynex’s growth potential is anchored in its ability to raise equity capital, expand its mortgage-backed securities (MBS) portfolio, and capture favorable spreads in agency-backed assets. The company recently raised over $250 million in at-the-market offerings and deployed significant funds into agency RMBS and CMBS.

Its reported portfolio expansion and rising book value suggest that management is executing on scaling the business. Additionally, the company has benefited from falling Treasury yields and tightening mortgage spreads, which have boosted asset valuations and reduced funding cost pressures.

However, several factors temper the growth outlook. The company operates with high leverage, making it highly sensitive to interest-rate shifts, prepayment speeds, and changes in the funding market. While some estimates project strong revenue growth (e.g., ~40% annually) and improving earnings potential, others remain cautious, forecasting modest return on equity (~10–13%).

Analyst consensus price targets indicate limited upside from the current share price, suggesting tempered expectations. In short, while Dynex has clear growth levers, it remains exposed to macro risks that could limit its ability to consistently deliver.

Source: Investor Relations

Competitive Advantages & Recession Performance

Dynex Capital’s competitive advantages stem from its focus on high-quality, agency-backed mortgage-backed securities (MBS) and disciplined risk management. By focusing on liquid, transparent agency RMBS and CMBS, the company minimizes credit risk while maintaining access to efficient funding through repurchase agreements.

Its experienced management team and proven ability to raise capital opportunistically enable Dynex to scale its portfolio and capitalize on market dislocations, providing a consistent income stream for shareholders even in volatile markets.

In terms of recession performance, Dynex has historically shown resilience due to its portfolio of government-backed securities, which are less sensitive to defaults than private-label MBS.

While its leverage exposes the company to interest-rate and liquidity risk, its conservative capital structure, strong liquidity, and focus on high-quality assets help maintain book value and dividend stability during economic downturns. This combination of asset quality and prudent risk management positions Dynex to weather recessions better than many non-agency mortgage REITs.

Dividend Analysis

The company’s annual dividend is $2.04 per share. At its recent share price, the stock has a high yield of 15%.

Given the company’s 2025 earnings outlook, EPS is expected to be $0.94 per share. As a result, the company is expected to pay out roughly 217% of its EPS to shareholders in dividends.

Final Thoughts

Looking forward over the next five years, Dynex is expected to deliver total annualized returns of 8.9%. However, considering the current challenges in the sector, these returns appear less compelling on a risk-adjusted basis. As a result, we maintain a Hold rating on the stock despite its appealing dividend yield.

More By This Author:

High Dividend 50: Gladstone Capital3 Top Dividend Aristocrats For Long-Term Returns

High Dividend 50: Diversified Royalty Corp.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more