High Dividend 50: KeyCorp

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly more than market average dividends.

There are many ways to define high yield, but we see it as stocks with significantly higher yields than the S&P 500’s current yield of ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is KeyCorp (KEY).

The bank has a 12-year dividend increase streak, having boosted its payout each year since the Great Recession.

KeyCorp has grown its dividend by more than 12% annually for the past decade, and has a very strong yield, making it an attractive income stock.

Business Overview

KeyCorp is a bank holding company for KeyBank National Association, which operates retail and commercial banking businesses in the US.

It offers the traditional mix of checking and deposit products, as well as a variety of loans to both consumers and businesses. It also has brokerage, insurance, wealth management, and related products in addition to traditional banking products.

KeyCorp was founded in 1849, generates about $6.4 billion in annual revenue, and trades with a market cap of nearly $13 billion.

The bank posted first-quarter earnings on April 18th, 2024, and the results were largely in line with estimates.

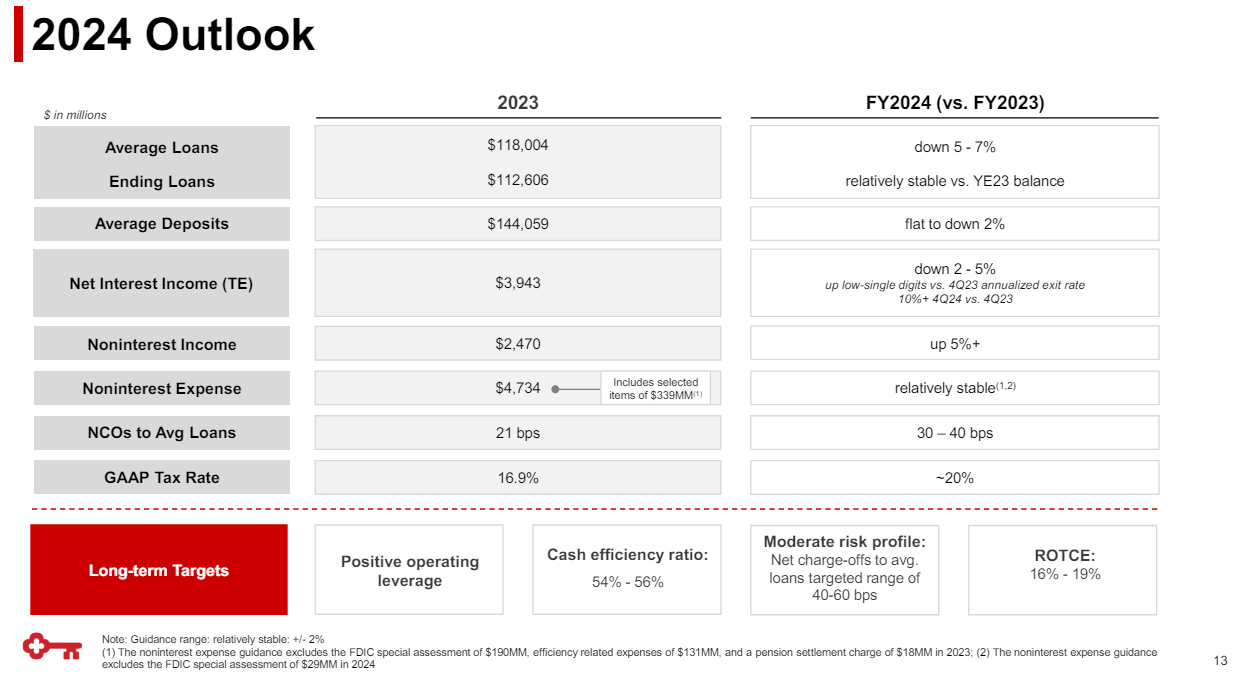

Source: Investor presentation

Earnings-per-share came to 22 cents on an adjusted basis, which excludes the two-cent impact from the FDIC special assessment, which was ~$29 million.

Net interest income was down 4.5% sequentially, which reflected lower loan balances and higher funding costs. Noninterest income was up 6% quarter-over-quarter, which was due to a record performance from its investment banking business.

Expenses were down, reflecting a significant impact from certain non-repeated items from prior periods. Excluding those items, expenses were flat year-over-year.

After Q1 results, we see $1.15 in adjusted earnings-per-share for this year.

Growth Prospects

Growth for KeyCorp has been tough to come by in recent years, and indeed, estimated earnings for this year are only fractionally higher than what they were in 2014.

While KeyCorp was able to remain quite profitable for all of these years, it simply hasn’t managed to move the needle on earnings despite a booming US economy, and in recent years, much higher interest rates.

However, looking forward we see 10% annual growth as the base of earnings for 2024 is low by historical standards. Therefore, our estimate of growth is due to a reversion to the mean, so to speak.

Source: Investor presentation

Management provided guidance for this year, and sees loan balances declining this year, resulting in falling net interest income. We also see higher net charge-offs, which negatively impact earnings.

Overall, while we see strong growth from here, it’s not due to inherent business strength, but rather a rebound from extremely low levels.

Competitive Advantages & Recession Performance

As with other banks, competitive advantages are very difficult to come by for KeyCorp. Given banks all offer essentially the same products and services, there is little to no differentiation between them.

Scale is really the main margin enhancer for a bank, and KeyCorp is fairly large, but certainly still a regional bank.

We also note that – as evidenced by the dividend cut during the Great Recession – that KeyCorp is highly sensitive to economic weakness.

The company lost large sums of money during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: -$2.22

- 2009 earnings-per-share: -$2.01

- 2010 earnings-per-share: $0.48

While KeyCorp was able to rebound to a small profit in 2010, there were several very weak quarters posted by the bank.

As mentioned, this saw the dividend slashed, and given the relatively weak performance of KeyCorp in recent quarters, we believe it may be at significant risk of earnings declines.

Therefore, we caution investors to closely monitor the company’s earnings reports for signs of weakness in credit quality, which accelerate during times of economic weakness.

Dividend Analysis

The bank’s current dividend is $0.82 per share annually. Based on the current share price of ~$14, that equates to a yield of 6.0%, or more than four times the average S&P 500 yield.

This puts KeyCorp stock firmly in the high-yield category.

We see $1.15 in adjusted earnings-per-share for this year, meaning the payout ratio is fairly elevated at 71%. As mentioned above, any weakness in earnings has the ability to cause a dividend cut, particularly alongside a broader recession.

Barring protracted economic weakness, we think the dividend is sustainable at the current EPS trajectory. That makes KeyCorp an attractive income stock given its high yield, so long as the company can see its earnings rebound.

Final Thoughts

KeyCorp has a 12-year streak of annual dividend increases and a high current yield of 6.0%.

At the same time, when the next economic downturn strikes, the dividend is likely at risk of being cut. The payout ratio is over 70% for 2024, during a period of strong economic growth for the US.

We like the yield, which is several times that of the S&P 500, but given the inherent risk of the payout’s safety over time, we caution investors jumping in strictly for the yield.

More By This Author:

High Dividend 50: Organon & Co.

3 Master Limited Partnerships Yielding More Than 6%

High Dividend 50: Ethan Allen Interiors, Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more