High Dividend 50: Golub Capital BDC, Inc.

Image Source: Pexels

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Golub Capital BDC, Inc. (GBDC) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

Next on our list of high-dividend stocks to review is Golub Capital BDC, Inc. (GBDC).

Business Overview

Golub Capital BDC, Inc. is an externally managed, closed-end investment company regulated as a Business Development Company (BDC). Founded in 2009 and based in Chicago, the firm focuses on generating income and capital appreciation by investing in one-stop and other senior secured loans to U.S. middle-market companies with annual EBITDA under $100 million.

Managed by GC Advisors LLC, Golub emphasizes strong credit quality, scalable business models, and consistent cash flows. With a diversified portfolio across multiple industries, the company has built a reputation as one of the largest and most reliable middle-market lenders in the U.S., generating over $600 million in annual net investment income, maintaining a steady record of dividend payments, and adhering to disciplined risk management.

Source: Investor Relations

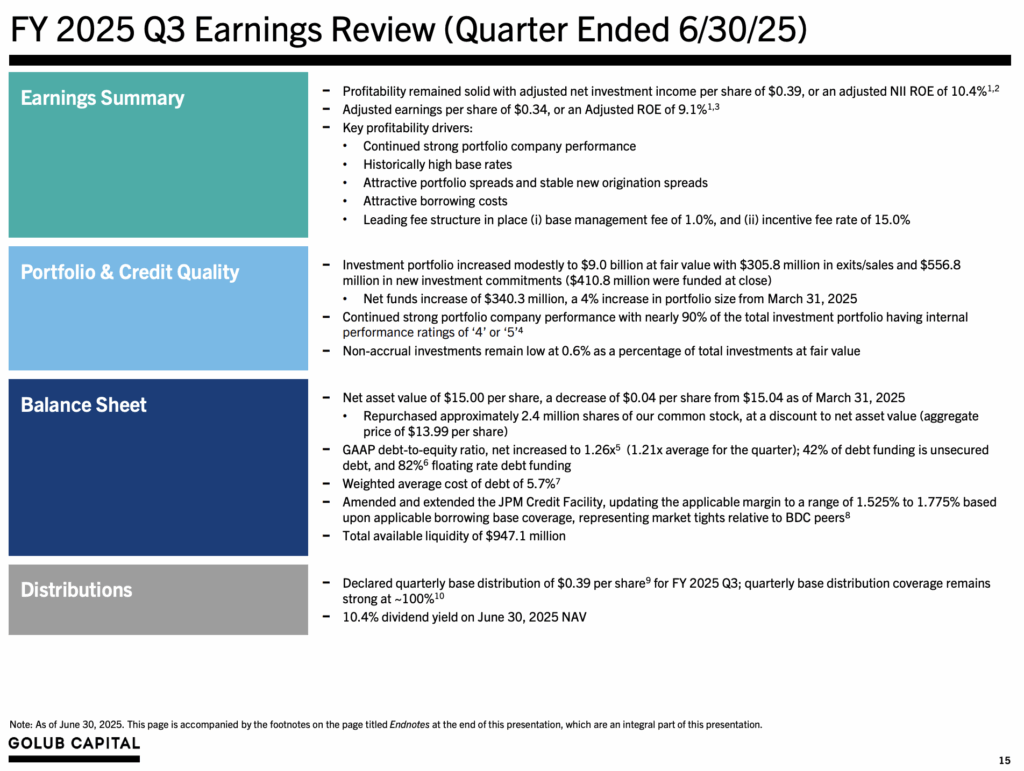

Golub Capital BDC, Inc. reported its fiscal third-quarter 2025 results, ending June 30, with net investment income of $0.38 per share, up from $0.37 in the prior quarter, and adjusted NII steady at $0.39 per share. Revenue rose 27.5% year-over-year to $218.3 million, slightly exceeding expectations. Net earnings were $0.34 per share, while net asset value (NAV) per share declined slightly to $15.00 from $15.04. The company declared a quarterly dividend of $0.39 per share, payable on September 29, 2025.

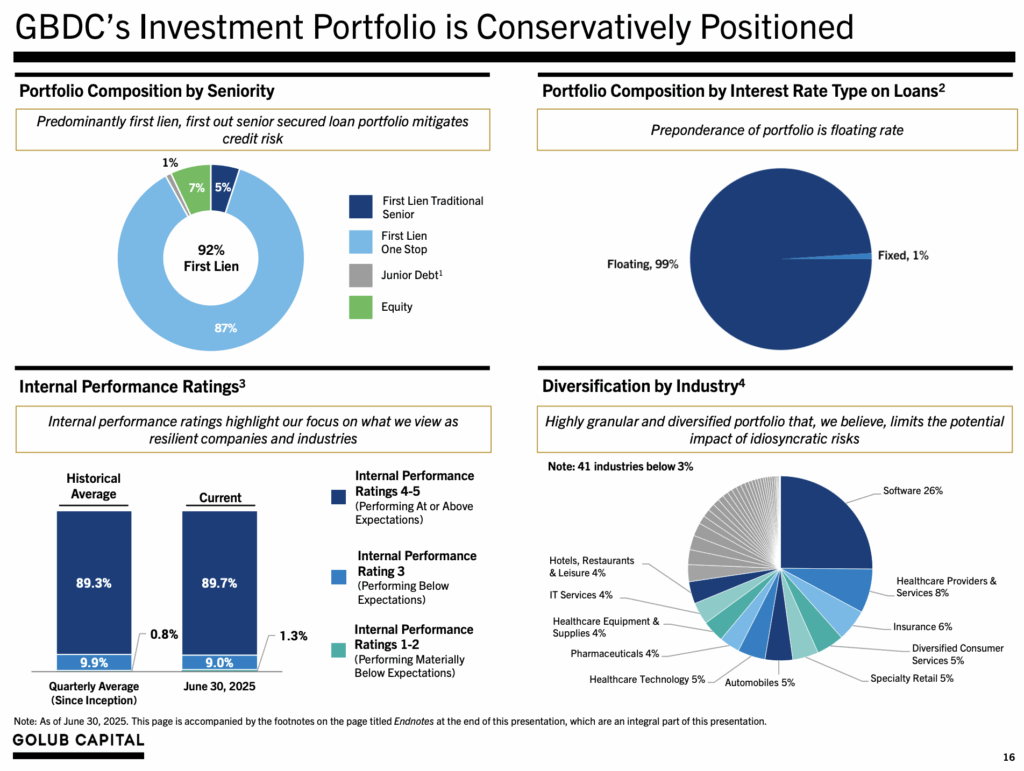

As of June 30, 2025, Golub’s investment portfolio totaled $8.96 billion across 401 portfolio companies, up from $8.62 billion and 393 companies in the prior quarter. The portfolio was primarily composed of one-stop loans (86.9%), with smaller allocations to equity (7%) and senior secured loans (5.4%). The company made $556.8 million in new investment commitments and repurchased 2.4 million shares of its stock for $34.3 million at an average price of $13.99 per share.

Golub maintained a strong financial position with $9.24 billion in total assets and $5.15 billion in debt, resulting in a 1.26x debt-to-equity ratio. Liquidity remained healthy, supported by $99.8 million in cash and $547 million in credit facility availability. The company also improved borrowing flexibility by amending its JPMorgan and GC Advisors credit agreements. Despite minor unrealized losses from certain portfolio holdings, Golub demonstrated solid income generation, disciplined capital management, and consistent shareholder value through dividends and buybacks.

Source: Investor Relations

Growth Prospects

Golub Capital BDC, Inc. has maintained stable net investment income over the years, currently paying an annualized base dividend of $1.56 per share. Its equity investments have occasionally generated additional gains used for special dividends, though these are irregular—$0.04 in FY2023 and $0.35 in FY2024, with none in FY2021 or FY2022.

The company’s growth prospects are influenced by interest rates and portfolio performance. Investment income yield, which fell to 7.3% in mid-2022, has risen to 12.0% with higher rates, though the net investment spread has narrowed to 5.9% from 7.0% last year due to rising debt costs. Despite this, Golub’s diversified, senior-secured loan portfolio supports stable income and potential capital appreciation.

Golub’s strategy of combining reliable loan income with opportunistic equity gains, along with disciplined balance sheet management and consistent dividend payments, positions the company to continue generating shareholder value. While future EPS and special dividends are uncertain due to market volatility, the company’s track record suggests it can sustain stable income and selectively reward shareholders.

Source: Investor Relations

Competitive Advantages & Recession Performance

Golub Capital BDC, Inc. has strong competitive advantages in middle-market lending, including a focus on one-stop and senior secured loans, rigorous underwriting, and relationships with private equity sponsors that provide access to high-quality opportunities. Its diversified portfolio and disciplined credit monitoring help manage risk across industries.

The company has proven resilient in economic downturns, maintaining net investment income and dividend payments even during market stress. By combining conservative lending, active portfolio management, and strategic sponsor partnerships, Golub sustains a stable, recession-resistant business model.

Dividend Analysis

Golub Capital BDC’s annual dividend is $1.65 per share. At its recent share price, the stock has a high yield of 11.6%.

Given the company’s 2025 earnings outlook, NII is expected to be $1.60 per share. As a result, the company is expected to pay out over 100% of its NII to shareholders in dividends.

The dividend appears to be on track to be cut this year or next.

Final Thoughts

Golub Capital BDC, Inc. is a well-diversified investment company that offers a net investment spread of approximately 5%. We project annualized returns of around 8.5%, primarily driven by its dividend, though actual returns could be higher if its private equity investments perform well.

Insider ownership exceeds 10% of the $3.94 billion company, indicating strong alignment with shareholder interests. At current prices, the shares merit a hold rating.

More By This Author:

10 Of The Right Retirement Stocks For Income Investors

3 Top Retirement Stocks For Income

High Dividend 50: AGNC Investment Corporation

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more