High Dividend 50: AGNC Investment Corporation

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly more than the market average dividends. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is AGNC Investment Corporation (AGNC).

Business Overview

AGNC was founded in 2008 and is an internally managed REIT. Unlike most REITs, which own physical properties that are leased to tenants, AGNC has a different business model. It operates in a niche of the REIT market: mortgage securities.

AGNC invests in agency mortgage-backed securities. It generates income by collecting interest on its invested assets, minus borrowing costs. It also records gains or losses from its investments and hedging practices.

Agency securities have principal and interest payments guaranteed by either a government-sponsored entity or the government itself. They theoretically carry less risk than private mortgages.

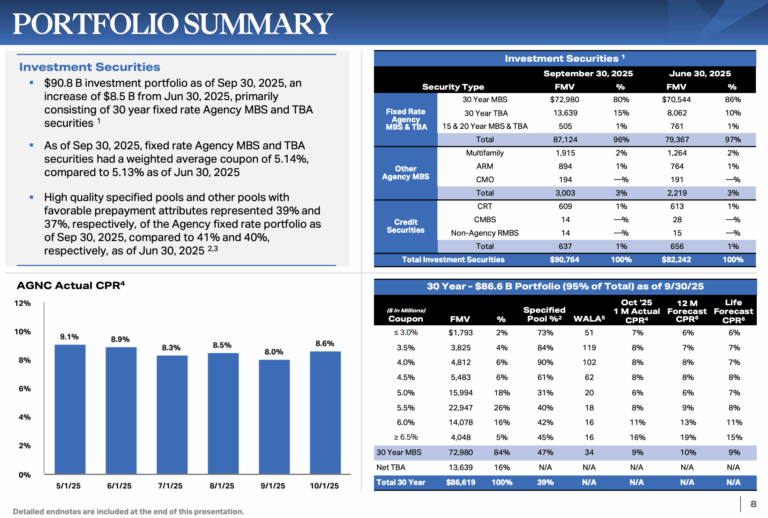

(Click on image to enlarge)

Source: Investor Relations

The trust employs significant amounts of leverage to invest in these securities, boosting its ability to generate interest income. AGNC borrows primarily on a collateralized basis through securities structured as repurchase agreements.

The trust’s goal is to build value via monthly dividends and net asset value accretion. AGNC has done well with its dividends over time, but net asset value creation has sometimes proven elusive.

The company reported a strong third quarter for 2025, with comprehensive income of $0.78 per common share, including $0.72 in net income and $0.06 in other comprehensive income. Net spread and dollar roll income came in at $0.35 per share, excluding a small catch-up premium amortization cost. Tangible net book value rose to $8.28 per share, up 6% from the prior quarter, while dividends of $0.36 per share were declared, contributing to an economic return on tangible common equity of 10.6%.

The company’s investment portfolio totaled $90.8 billion, primarily consisting of Agency mortgage-backed securities ($76.3 billion) and net TBA positions ($13.8 billion), with credit risk transfer and non-Agency investments making up the remainder. AGNC maintained disciplined leverage at 7.6x “at risk” tangible net book value, while unencumbered cash and Agency MBS reached $7.2 billion, providing liquidity equal to 66% of tangible equity. The average projected CPR of 8.6% and an annualized net interest spread of 1.78% reflected stable portfolio performance in the quarter.

Management highlighted a favorable investment environment driven by easing Fed policy and strong Agency MBS demand. Capital markets activity included $309 million in net proceeds from common stock ATM offerings and a $345 million Series H preferred stock issuance. Hedging strategies remained robust, with interest rate swaps covering a significant portion of funding liabilities, and AGNC’s net short U.S. Treasury exposure was $16.7 billion. Overall, the company is positioned to deliver attractive risk-adjusted returns while maintaining strong liquidity and disciplined leverage.

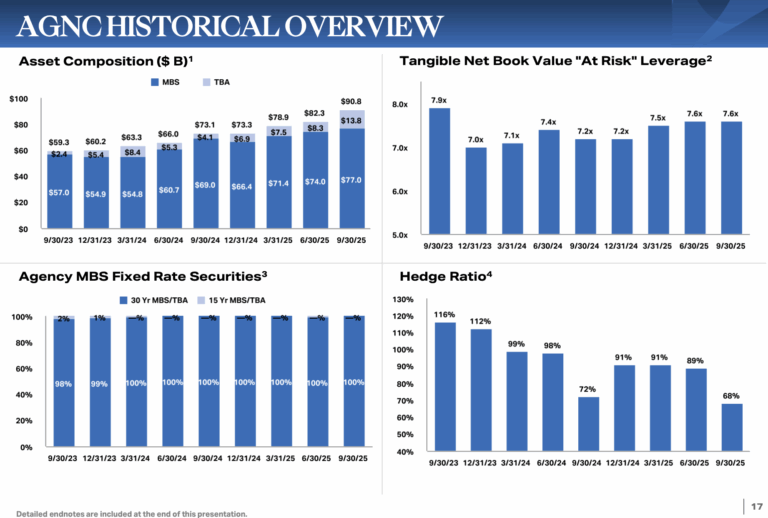

(Click on image to enlarge)

Source: Investor Relations

Growth Prospects

The main challenge for mortgage REITs like AGNC is that rising interest rates can pressure their business model. AGNC earns by borrowing at short-term rates, lending at long-term rates, and capturing the spread. These REITs are also highly leveraged—AGNC currently carries a 7.5x leverage ratio—because spreads on mortgage securities are generally tight.

When interest rates rise, the value of mortgage REIT investments often falls. Fixed payments on their assets can lag behind variable borrowing costs, compressing interest margins. Last year, global central banks aggressively raised rates to curb inflation, pushing U.S. rates to 23-year highs and causing AGNC’s book value to decline in recent quarters. Consequently, the REIT’s high payout ratio and volatile model may limit earnings-per-share growth, and dividend increases are likely to remain modest in the near term.

On the upside, inflation has eased in many developed economies, including the U.S. The Fed has begun lowering rates, with guidance suggesting a drop from 4.75%-5.0% to 2.75%-3.0% by 2026. If this unfolds as expected, AGNC could benefit from lower borrowing costs and wider interest margins, providing a favorable boost to its business.

Competitive Advantages & Recession Performance

AGNC went public in 2008 during the financial crisis, making it difficult to predict its performance in the current recession. Mortgage-backed securities are highly sensitive to leverage and interest rates, and they tend to underperform when the housing market weakens and foreclosures rise. Consequently, AGNC should not be considered a safe, defensive stock.

That said, the company has delivered strong results, with industry-leading total economic return (NAV-based) and total stock return (share-price based). This outperformance stems from its efficient cost structure and competitive advantage as one of the largest residential mortgage REITs, benefiting from economies of scale.

AGNC also emphasizes risk management to protect against downside and enhance shareholder returns. Its approach includes careful asset selection, disciplined hedging, and diversified funding strategies.

Dividend Analysis

AGNC has declared monthly dividends of $0.12 per share since April 2020. This means that AGNC has an annualized payout of $1.44 per share, which equals an extremely high current yield of 14.4% based on the current share price.

(Click on image to enlarge)

Source: Investor Presentation

High yields often signal elevated risk, and AGNC’s dividend is no exception. The company has reduced its payout several times over the past decade.

A near-term dividend cut appears unlikely, as the recent adjustment accounted for unfavorable interest rate changes, and AGNC’s net asset value has stabilized. Management has acted to protect interest income, and anticipated Fed rate cuts over the next few years should provide additional support. The payout ratio is expected to remain below 90% of earnings in 2025, reducing the immediate need for another cut.

That said, mortgage REITs inherently carry payout risk. Investors should remain aware of this, particularly given the volatility in interest rates in recent years.

Final Thoughts

High-yield, monthly dividend stocks can be very appealing to income investors, especially in a low-interest-rate environment where alternative income sources offer much lower returns.

AGNC currently offers a substantial 14.4% yield, which is exceptionally high. While we believe this yield is sustainable in the near term, the company’s business model and sensitivity to interest rates make it far from a low-risk investment.

Although AGNC’s dividend yield remains well above the S&P 500 average, it is not well-suited for conservative, risk-averse income investors.

More By This Author:

High Dividend 50: Capital Southwest Corporation

High Dividend 50: Chimera Investment Corporation

High Dividend 50: Ellington Financial Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more