High Dividend 50: Chimera Investment Corporation

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing retirement income. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Chimera Investment Corporation (CIM) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

Business Overview

Chimera Investment Corporation is a real estate investment trust (REIT) specializing in mortgage finance. The company primarily invests, through its subsidiaries, in a diversified portfolio of mortgage-related assets, including residential mortgage loans, non-agency RMBS, agency CMBS, and other real estate securities. Chimera generates income mainly from the spread between returns on its assets and its financing and hedging costs.

To fund these investments, the company utilizes a combination of asset securitization, repurchase agreements, warehouse lines of credit, and equity capital. Currently, Chimera has a market capitalization of approximately $1.0 billion and is positioned as a prominent player in the specialty finance sector of the mortgage market.

Source: Investor Relations

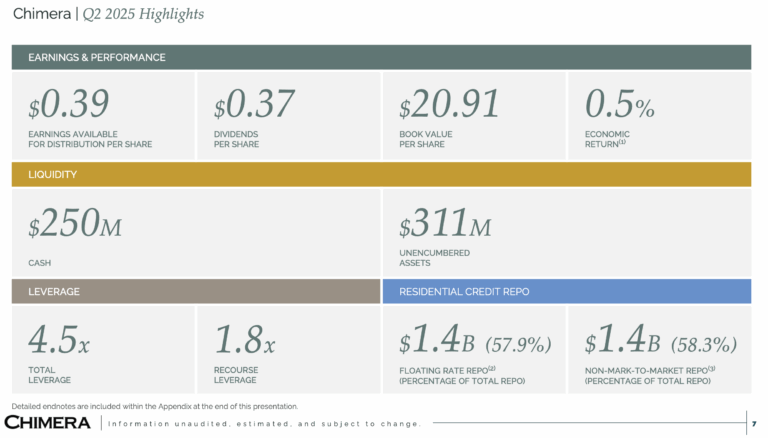

Chimera Investment Corporation reported Q2 2025 GAAP net income of $0.17 per diluted share and earnings available for distribution of $0.39 per adjusted share. GAAP book value was $20.91 per share, with an economic return of 0.5% for the quarter and 9.8% year-to-date. The company also announced a definitive agreement to acquire HomeXpress Mortgage, expanding its role from mortgage asset manager to originator.

The company’s diversified portfolio includes residential mortgage loans, Non-Agency and Agency RMBS, Agency CMBS, and MSRs. Net interest income totaled $66.0 million, with other income of $1.4 million, while expenses—including compensation and transaction costs—were $27.1 million. Non-GAAP measures, such as earnings available for distribution, exclude non-recurring items to better reflect distributable income.

As of June 30, 2025, Chimera held $14.86 billion in assets, funded through secured financing, securitized debt, and equity. GAAP leverage was 4.5:1, with a balanced mix of fixed- and adjustable-rate assets. These results underscore Chimera’s strategy of portfolio diversification, disciplined financing, and continued growth in the residential mortgage market.

Source: Investor Relations

Growth Prospects

Chimera Investment Corporation has exhibited volatile performance over the past decade, characterized by stagnant earnings and a 10-year low in EPS in 2023. High debt and rising interest rates have exposed the company’s vulnerabilities, and its complex business model adds uncertainty. We project modest EPS growth of about 9% annually over the next five years from this low base.

The REIT has historically offered high dividends, ranging from 9.2% in 2021 to 17.5% in 2009 and 2011, but earnings volatility and leverage make the payout uncertain. While Chimera continues to diversify and pursue strategic acquisitions, investors should view its high yield as attractive but also consider it as a risk.

Source: Investor Relations

Competitive Advantages & Recession Performance

Chimera’s competitive edge stems from its expertise in mortgage credit and a diversified portfolio that spans residential loans, Non-Agency and Agency RMBS, CMBS, and MSRs. Strategic acquisitions, such as HomeXpress and Palisades, enhance its ability to originate, manage, and finance mortgage assets.

Despite this, the REIT’s high leverage and interest rate sensitivity have caused uneven performance during downturns, including a 10-year low EPS in 2023. While diversification mitigates some risk, earnings remain vulnerable in recessionary environments.

The company performed poorly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $7.28

- 2009 earnings-per-share: $4.99

- 2010 earnings-per-share: $5.87

Dividend Analysis

Chimera’s annual dividend is $1.48 per share. At its recent share price, the stock has a high yield of 11.6%.

Given the company’s earnings outlook for 2025, EPS is expected to be $1.55 per share. As a result, the company is expected to pay out roughly 95% of its EPS to shareholders in dividends.

Final Thoughts

Chimera has been significantly impacted by rising interest rates, which have pushed it to near 23-year highs, resulting in a 48% decline over the past five years. If inflation eases, the stock could generate a 12.8% average annual return over the next five years, supported by a 11.6% dividend and 9% earnings growth, partially offset by a 3.4% valuation headwind.

The company may rebound if the Fed cuts rates more, but its volatile performance, opaque business model, and vulnerability to prolonged downturns pose substantial risks. Combined with the historical underperformance of stocks undergoing reverse splits, Chimera is best considered a hold for investors who understand and accept its high risk.

More By This Author:

High Dividend 50: Ellington Financial Inc.High Dividend 50: Prospect Capital Corporation

High Dividend 50: Blue Owl Capital Corporation

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more