Hideout In The Financial Sector As We Round Out 2025?

Image Source: Pexels

Entering the last trading week of the year, investors are certainly pondering where to put their money to work in 2026, and the financial sector may be at the forefront with the stock market near all-time highs.

To that point, the surge in finance stocks has been validated as the market environment in 2025 was shaped by policy uncertainty, tariffs, and inflation pressures, conditions that tend to keep rates higher for longer despite the Fed’s easing cycle.

Of course, higher interest rates have led to increased profitability for banks, and a resilient economy has still supported lending and credit quality, with many financial firms also benefiting from technology and AI-driven adoption.

Big Banks Lead the Financial Sectors' Strong Performance

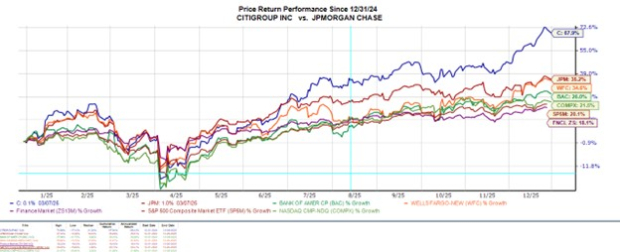

Outside of several fintech stocks that have etched out exponential gains, the stellar performances of the big banks have led the financial sector, with Citigroup’s (C - Free Report) year-to-date return of +68% leading the way, followed by JPMorgan’s (JPM - Free Report) +35%.

As we round out 2025, all four of the largest U.S. Bank stocks have outperformed the broader indexes, with the Zacks Finance Market slightly trailing the S&P 500 and Nasdaq at +18%. Following their exhilarating YTD rallies, the big bank stocks all land a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Enticing Dividends & Attractive Valuations

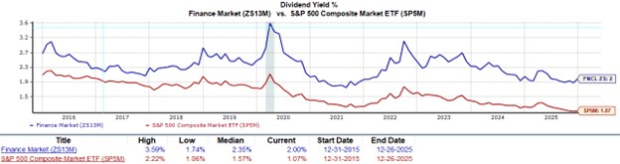

With many finance stocks starting to offer the pleasant returns that investors look for, the dividends in the sector are also among the most appealing to consider. The Zacks Finance Market currently has an average annual dividend yield of 2% compared to the benchmark S&P 500’s 1% while the majority of the growth-centered companies in the Nasdaq don’t offer a payout.

Image Source: Zacks Investment Research

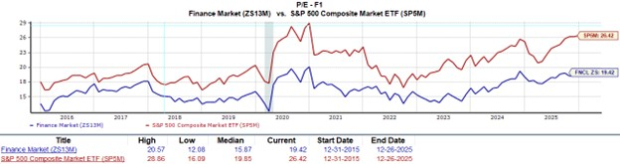

Even better is the value that can be found, with the finance market’s forward P/E multiple of 19X being well below the often-inflated price to earnings valuations that investors pay for tech stocks in the Nasdaq and nicely beneath the benchmark's 26X.

The Top-Rated Securities & Exchanges Industry

Ironically, but correlating with the stock market being near all-time highs, the top-rated industry in the Zacks Finance Market is the Securities and Exchanges Industry, which is currently in the top 10% of over 240 Zacks industries.

The Zacks Securities and Exchanges Industry has several stocks that are benefiting from a trend of positive EPS revisions, including the exchange operators for the broader indexes, with Nasdaq (NDAQ - Free Report) and S&P Global (SPGI - Free Report) stock sporting a Zacks Rank #2 (Buy).

Bottom Line

At the moment, the Zacks Finance Market is the second-rated sector out of 16 Zacks sectors. The Zacks Computer and Technology Market is the only sector with a culmination of higher-rated sub-industries, but for many investors, valuation concerns and less appetizing dividends in the space could make the financial sector their first choice and a place to hide out with the stock market near its peaks.

More By This Author:

Buy Stock In The Mag 7 Hyperscalers Or Are They Spending Too Much?

3 Leading AI Stocks Investors Can Buy For 2026 (Nvidia, Broadcom, Vertiv)

D-Wave Quantum Or IonQ: Which Quantum Computing Stock Will Lead In 2026?