D-Wave Quantum Or IonQ: Which Quantum Computing Stock Will Lead In 2026?

Image: Bigstock

Key Takeaways

- D-Wave Quantum posted 227.6% year-to-date gains in 2025, driven by Advantage2 deployments and QCaaS growth.

- IonQ expanded globally with Tempo systems, strategic partnerships and $3.5 billion cash reserves.

- Analysts project 2026 revenue growth of 61.1% for D-Wave vs. 83.3% for IonQ.

As 2026 approaches, D-Wave Quantum Inc. (QBTS - Free Report) and IonQ (IONQ - Free Report) present distinct investment narratives in the burgeoning quantum computing sector.

In 2025, D-Wave’s official disclosures show strong commercial momentum, including robust third-quarter results with revenue and gross profit more than doubling year-over-year and cash balances hitting record highs, alongside product and business expansions such as hybrid quantum technology showcases and new U.S. government-focused business units.

IonQ, on the other hand, reported gains through strategic partnerships and deployments, such as finalizing delivery of its 100-qubit Tempo system to South Korea’s KISTI and expanding long-term collaborations in Europe, reinforcing global market penetration.

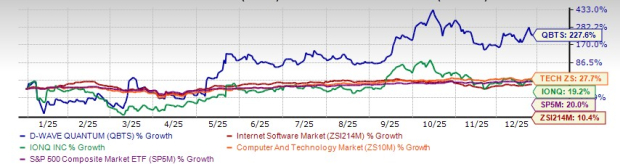

D-Wave stock has surged 227.6% year-to-date, far outpacing IonQ’s 19.2% gain, the broader Internet-Software industry’s 10.4% rise, the Computer and Technology sector’s 27.7% rally, and the S&P 500’s 20% increase, reflecting divergent investor sentiment ahead of 2026 due to differences in near-term commercial execution.

Let’s find out how things are shaping up for 2026.

D-Wave Quantum, IonQ: Year-to-Date Stock Performances

Image Source: Zacks Investment Research

The Case for D-Wave Quantum

Commercial Scaling of Advantage2 and Hybrid Quantum Apps: D-Wave enters 2026 with commercially deployed, production-grade systems. The Advantage2 system is already operational for enterprise and government users, including Davidson Technologies (U.S. defense), Julich Supercomputing Center, and a EUR10 million European installation scheduled to contribute revenue starting in 2026.

Real-world proofs-of-concept with BASF, Japan Tobacco, North Wales Police, airlines, banks, and semiconductor foundries demonstrate measurable performance gains over classical computing, supporting customer expansion, system sales, and recurring QCaaS revenues. Management emphasized a strong pipeline with larger average deal sizes and over $100 million in annual QCaaS revenue capacity, positioning 2026 as a monetization year rather than pure R&D.

Financial Strength and Path Toward Profitability: D-Wave closed the third quarter of 2025 with over $836 million in cash, minimal near-term financing risk, and improving gross margins, driven by high-margin system sales and upgrades.

Unlike peers reliant on government R&D funding, D-Wave’s three-pillar revenue model (QCaaS, professional services, & system sales) supports operating leverage as utilization rises. Management explicitly stated a focus on becoming the first independent public quantum company to achieve sustained profitability.

Stumbling Block for D-Wave Quantum

Despite its momentum, D-Wave faces constraints that could temper growth in 2026. Revenue gains in 2025 were highly concentrated, driven largely by the Julich system sale and upgrades, creating execution risk if follow-on system deals are delayed. Management also noted that larger enterprise transactions take longer to close, which may result in uneven bookings and revenue timing.

While gross margins improved meaningfully, adjusted EBITDA losses widened due to higher operating expenses, suggesting profitability is not yet secured despite a strong cash position. Additionally, QCaaS revenues remain early-stage, with many customers still in proof-of-concept phases rather than full production deployments.

The Case for IonQ

Next-Generation Systems, Quantum Advantage: IonQ enters 2026 with clear momentum from Tempo, its fifth-generation system, which achieved AQ 64, 99.99% two-qubit gate fidelity and is scheduled to ship in 2026.

IonQ has already demonstrated measurable quantum advantage in areas such as computational engineering (Ansys) and drug discovery with NVIDIA (NVDA - Free Report), Amazon (AMZN - Free Report), and AstraZeneca (AZN - Free Report), where quantum workloads compressed weeks of classical computation into hours. These milestones support higher-value customer contracts and strengthen IonQ’s ability to translate technical advancement into revenue growth.

Platform Expansion, Government Engagement, Financial Capacity: IonQ’s performance in 2026 is also likely to be driven by its transformation into a full quantum platform company, spanning quantum computing, networking, sensing, and cybersecurity. Acquisitions of Oxford Ionics and Vector Atomic expand IonQ’s addressable market and enable participation in large, multi-year government and infrastructure programs, including defense and secure communications initiatives.

The launch of IonQ Federal, growing international exposure and over $3.5 billion in cash with no debt provide substantial capacity to invest aggressively in R&D, talent, and scaling, supporting sustained growth even as operating losses persist.

Factors That May Temper Growth in 2026 for IonQ

Despite its momentum, IonQ faces risks that could moderate growth in 2026. Although revenues surged in 2025, the company continues to report large operating and EBITDA losses as it prioritizes heavy investment in R&D, talent, and platform expansion, with management indicating that profitability is not imminent.

Key growth catalysts, including Tempo system shipments, major government programs, and integration of Oxford Ionics and Vector Atomic, are still in scaling phases, adding execution risk. Moreover, significant equity raises, while strengthening the balance sheet, have led to shareholder dilution, which may limit per-share growth even if top-line momentum continues into 2026.

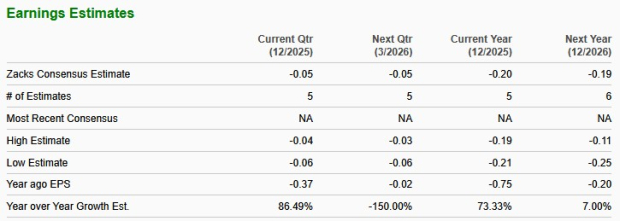

2026 Estimates

D-Wave: The company is expected to record earnings growth of 7% in 2026 on revenue growth of 61.1%. Based on short-term price targets offered by 14 analysts, D-Wave’s average price target represents an increase of 32.9% from the recent closing price of $29.1.

Image Source: Zacks Investment Research

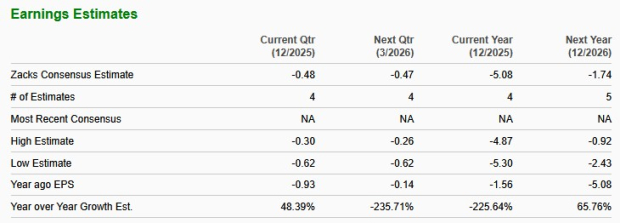

IonQ: The company is expected to record earnings growth of 65.8% in 2026 on revenue growth of 83.3%. Based on short-term price targets offered by 12 analysts, IonQ’s average price target represents an increase of 46.9% from the recent closing price of $51.4.

Image Source: Zacks Investment Research

Which Stock Offers Higher Upside Potential for 2026?

While both D-Wave and IonQ currently carry a Zacks Rank #3 (Hold) rating, the latter appears positioned for stronger long-term upside. Its 2025 results showcased 222% revenue growth, the successful development of its Tempo system with AQ 64 and 99.99% two-qubit gate fidelity, and a fortified $3.5 billion cash position, providing ample firepower for continued R&D, talent acquisition, and scaling.

Meanwhile, D-Wave has shown solid revenue growth and improving efficiency, but its near-term upside is more dependent on system sales execution. Overall, for investors looking at longer-horizon technology leadership, IonQ’s platform breadth and technical dominance make it a more compelling growth story in 2026.

More By This Author:

3 Top-Ranked Healthcare Mutual Funds Poised For Strong GainsPharma's $370 Billion Bet On America: The ETF Plays For 2026

China, Emerging Markets Stabilizing? 3 Global Luxury Stocks For 2026

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more