Hidden Gems: 2 Top Ranked Stocks Flying Under The Radar

Image Source: Unsplash

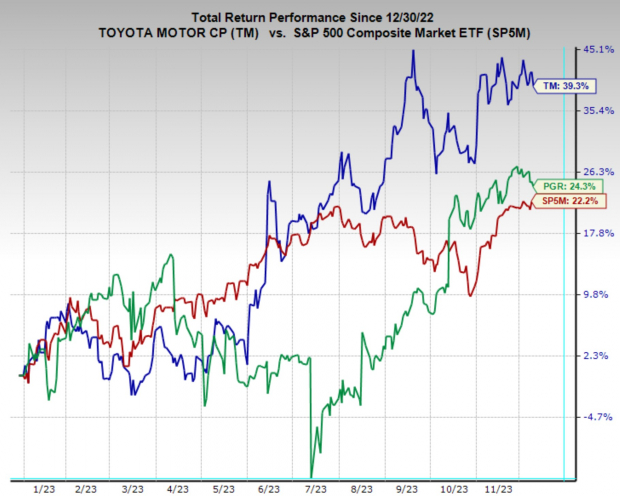

During a year like 2023, when many stocks are acting well, it can be easy to miss some top performers. However, for discerning investors, this can be an advantage because fishing where others aren’t make for rich waters.

While many investors are focused on big tech stocks, and the magnificent seven, less exciting companies still offer compelling returns. In this article I will discuss two such stocks that enjoy top Zacks Ranks.

Image Source: Zacks Investment Research

Toyota Motor

While a legacy auto manufacturer like Toyota Motor (TM) may not be as exciting as the newest EV startup, TM stock offers a compelling investment opportunity. In addition to being one the world’s largest car producers, enjoying a cheap valuation and top Zacks rank, it is also leading the way in electric vehicle battery technology.

Although there are skeptics of Toyota Motor’s battery innovation its liquid electrolyte approach could offer an industry leading breakthrough. If successful, these batteries will dramatically extend driving ranges, reduce costs, and speed up charging times, all of which are major concerns for current EV manufacturers.

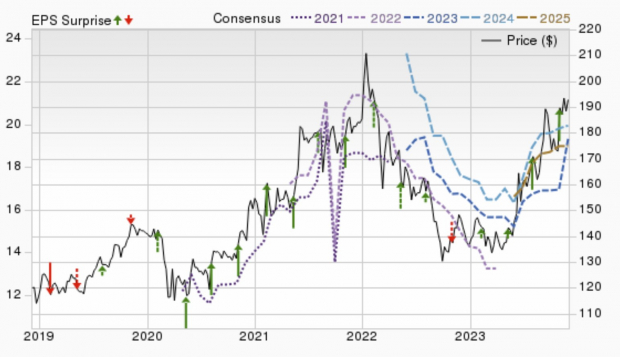

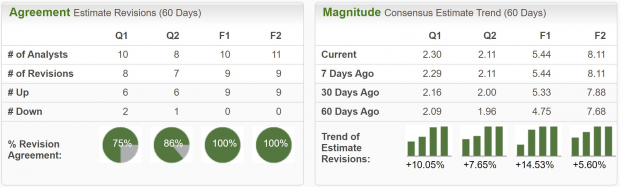

Earnings estimates have followed TM’s stock price higher since the start of the year and have been raised considerably over the last two months, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have increased 8.6% in the last two months. FY24 earnings estimates have been raised by 15.2% and are projected to grow 45.4% YoY to $19.31 per share.

Also worth noting is that the Automotive – Foreign industry is currently in the Top 13% (32 out of 251) of the Zacks Industry Rank.

Image Source: Zacks Investment Research

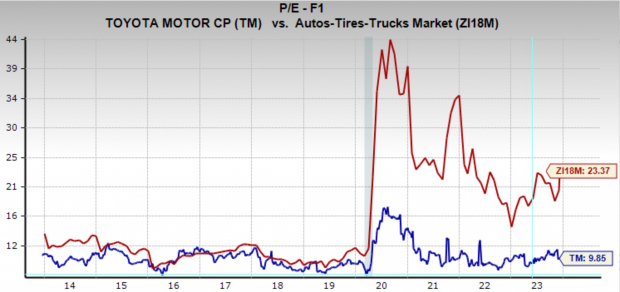

Toyota Motors is trading at a one year forward earnings multiple of 9.9x, which is in line with its 10-year median and well below the industry average. However, with EPS growth forecasts of 24.5% annually over the next 3-5 years, it enjoys a PEG Ratio of just 0.40x, an extremely compelling reading.

Image Source: Zacks Investment Research

The Progressive

Another industry that may be quickly overlooked for its less exciting nature is insurance. But investors looking for steady and impressive long-term performance would be wise to research top names in the sector. The Progressive (PGR), one of the major auto insurers in the US has incredible long-term and recent stock performance.

The Progressive stock is up 24.3% YTD and has had an annualized return of 20.6% over the last 15 years, 16xing investor's money over that period. PGR has been pushing steadily higher all year and made new all-time highs last week.

Additionally, the Insurance – Property and Casualty Industry sits in the top 9% (23 out of 251) of the Zacks Industry Rank.

Image Source: TradingView

Progressive also enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. Current quarter earnings estimates have been boosted 10% over the last two months and are forecast to grow 53% YoY to $2.30 per share. FY23 earnings estimates have been revised higher by 14.5% and are expected to climb 34% YoY to $5.44 for share.

Analysts expect The Progressive company to grow EPS 25.8% annually over the next 3-5 years.

Image Source: Zacks Investment Research

Bottom Line

There are thousands of publicly traded equities for investors to scan through, but Zacks can make that process significantly easier. By utilizing the Zacks Rank investors can simplify their research, as it identifies stocks with dramatically improved odds of strong near-term performance.

More By This Author:

Alphabet's Google Unveils Gemini, Boosts Gen AI Efforts

Bull Of The Day: Griffon

Bear Of The Day: Clearway Energy

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more