Bear Of The Day: Clearway Energy

The long-term prospects of alternative energy player Clearway Energy (CWEN) may still be perplexing but unfortunately, there may be more short-term risk ahead landing its stock a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

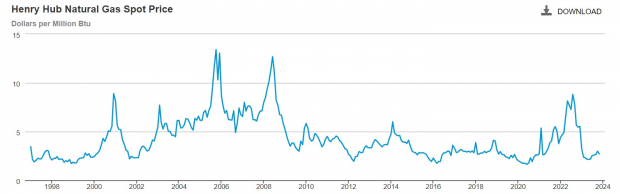

After widely missing earnings expectations for two consecutive quarters investors may want to curb their enthusiasm for Clearway’s luring 6.34% annual dividend yield amid weak renewable resource conditions and lower natural gas prices.

(Click on image to enlarge)

Image Source: U.S. Energy Information Administration

Weak Q3 Results

Notably, the Zacks Alternative Energy-Other Industry is in the bottom 39% of over 250 Zacks industries and Clearway’s Q3 results in November alluded to a tougher operating environment.

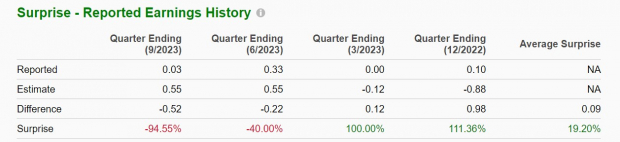

While Q3 sales of $371 million topped estimates by 8% earnings of $0.03 a share fell a very concerning -94% below expectations of $0.55 a share. This comes after Q2 earnings of $0.33 a share missed the Zacks Consensus of $0.55 a share by -40% in August.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Weaker Outlook: Largely attributing to Clearway’s strong sell rating, annual earnings estimates for fiscal 2023 are down -10% over the last 60 days while FY24 EPS estimates have fallen -11%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

On top of this, Clearway’s stock is already down -21% this year to vastly underperform the broader indexes and trail its Zacks Subindustry’s -14%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

While it’s far too soon to call Clearway Energy’s stock a value trap, investors may want to think twice before investing in the company at the moment considering its lucrative dividend yield but poor performance of late.

More By This Author:

Bull Of The Day: Zoom Video Comms3 Technology Mutual Funds For Solid Returns

Highly Ranked Stocks Poised To Move Higher In December

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more