Here’s When The Coronavirus Sell-Off Will End

The global spread of the Coronavirus has plunged the S&P 500 into bear market territory, down 28% from its all-time high (at time of writing), and ending the record-long bull market. While for majority of investors this black swan event was a complete shock, I had actually warned of a black swan catastrophe in an article back in November 2019, and the same analysis technique that helped me predict its onset could prove to be a useful guide to when this pandemic will recede.

Valuation

Before the Coronavirus panic even hit financial markets, equity valuations were already very stretched, trading at around 19x forward earnings. The recent sell-off has brought the Forward PE down to 13.9x, which is below the 10-year average of 15x, bringing it down to more reasonable level for buyers.

However, keep in mind that this valuation ratio is based on particular assumptions for future earnings. Those earnings projections could prove unreliable given the uncertainty of the magnitude to which this pandemic will hurt economic conditions.

Only backward-looking economic data over the coming months will statistically reveal the extent of economic contraction we are witnessing now, though many experts claim that we are currently already in a recession. It is expected to be a sharp, but short-lived recession, highly dependent on how long this pandemic lasts, and whether companies are able to survive this period of financial stress. As the virus abates and we get more clarity on the economic impact, investors can project corporate earnings and invest in equities more confidently.

Technical Factors

Although my perspectives are usually mainly based on fundamental analysis, it is important to take into consideration technical factors given the lack of reliability of fundamental factors amid this crisis.

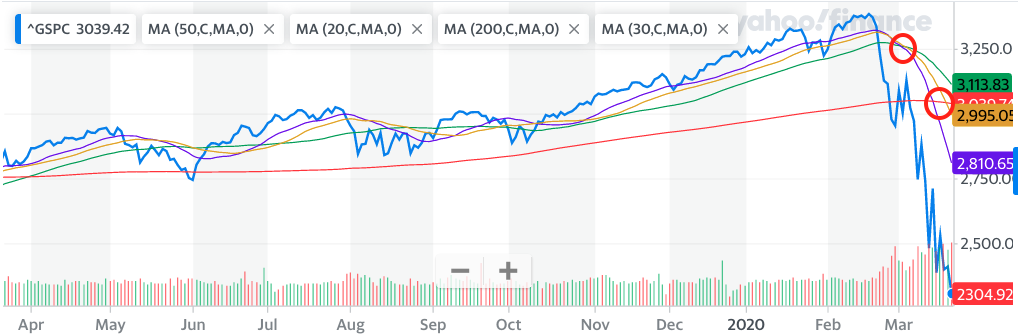

(Click on image to enlarge)

The chart above indicates how the crossing of the 20-day (purple line) and 30-day (yellow line) moving averages below the 50-day (green line) and 200-day (red line) moving averages have been followed by increased selling pressure. Though what is more worrisome is the fact that the 50-day moving average is approaching the 200-day moving average, the crossing of which is known as a death cross, an extremely bearish pattern formation. If this formation becomes a reality, then investors can expect more downside ahead before we find a bottom. There is a good chance the sell-off could get worse before it gets better.

Astrological Patterns

In November 2019, I had warned of a black swan event in early 2020 that would shake both the global economy and financial markets, through astrological

analysis. Needless to say, this black swan event has indeed transpired in the form of the coronavirus inducing a global economic shock. While some are skeptical of the use of astrological analysis to predict global economic developments, it has in fact proven useful in predicting the latest black swan event.

Furthermore, the astrological patterns that induced this black swan event will deviate around April/May 2020. Hence, we can expect this pandemic fear to start easing from next month, perhaps through a vaccine discovery or the virus just naturally disappearing. Hence, while leaders are currently unsure over how long this pandemic will last, with President Trump suggesting it could even last till August, investors should not get too nervous, because by April/May this pandemic fear will have receded.

As soon as financial markets witness signs of improvement next month, in terms of a decline in the number of new cases/deaths, asset prices will bounce higher, regardless of the fact that it will take time for the economy itself to restart and bounce back.

Election uncertainty ahead

Even once we get past the Coronavirus pandemic, volatility is unlikely to disappear for the rest of the year, given that it is an election year.

It is looking increasingly likely that Joe Biden will be the Democratic nominee to face President Trump in November 2020. While Biden is certainly better than a Sanders administration, a Democratic government will surely not be as business-friendly as the Republican government has been. Hence if polls indicate a Biden win over Trump as we near the election, markets could get increasingly volatile, given that the Democrats are keen to overturn the lax business regulations and tax cuts that the Trump administration has enacted.

Joe Biden has been open about his plans to raise the corporate tax rate to 28% (up from the current 21%) if he gets elected. Hence if a Biden victory looks increasingly likely, the market will begin pricing in higher corporate tax rates, undermining equity market performance. Nevertheless, if we end up witnessing a prolonged recession/ economic weakness in the aftermath of the COVID-19 pandemic, it could make it difficult for a potential Biden administration to raise the corporate tax rate in such an environment, which could help support stocks.

Stock buybacks, a factor that has played an important role in propelling equity prices higher over the past decade, could also be under threat under a Democratic government, especially following the multi-billion dollar Coronavirus bailouts. Biden has already urged American CEOs to refrain from stock buybacks for a year, amid the lofty bailouts for Corporate America. Hence, if he were to be officially sworn into office, corporations can surely expect more headwinds in terms of their stock buyback plans over the coming years. Therefore, the absence of stock buybacks would certainly undermine equity returns going forward.

In fact, not only Democrats but also President Trump has expressed willingness to ban stock buybacks for companies that are bailed out amid the Coronavirus outbreak. Hence, in terms of stock buybacks, investors will be indifferent to who wins the election this year, as this financial engineering technique will inevitably face hindrance ahead. Thus, even once this pandemic scare passes, investors should beware of the aftermath repercussions for corporations and financial markets going forward.

Bottom Line

The Coronavirus has already wiped out trillions in wealth, while freezing economic activity. Given the uncertainty over how long this pandemic will last, investors are still wary of buying into this market rout. Astrological analysis, which had correctly identified both the occurrence and timing of this black swan event, conveys that this pandemic will not last beyond April/May 2020. Therefore investors looking to make timely investments should keep this timeframe in mind, in terms of expecting improving conditions, whether in the form of declining number of cases/deaths, or a cure discovery.

Nevertheless, even once this pandemic passes, investors should not fall into the trap of believing that volatility will be absent for the rest of the year. The upcoming Presidential election will surely stir increased volatility this year, especially if polls indicate a Democratic win. Furthermore, share buybacks are certain to come under scrutiny (from both sides of the political spectrum) following bailouts of American corporations using taxpayer money, also undermining equity market performance over the coming years. Therefore, while there are certainly attractive buying opportunities present in financial markets, investors should keep in mind that volatility will still be present this year even once this pandemic scare passes.

If China is any indication, the Pandemic will end in 4 months...

I can't see Trump waiting that long. But he needs to show patience. Thanks.

Unfortunately, Trump has no patience. He is already pushing to reopen America. That means he won't lose millions from his hotel and other businesses, but as a trade-off, millions will die.

Biden would likely be open to helping small business. Republicans frittered tax cuts, opened trade wars, allowed obsessive stock buybacks that are wasted. That isn't business friendly. That is the casino WallStreet friendly which does not filter to real business. It is pretend business.

Wasn't it the democrats who blocked the aid bill in the Senate?

Yes, over the big biz slush fund. They need to split the cash to mainstreet from the other issues.

I really don't understand how they can't put politics aside at a time like this. A lot of people live paycheck to paycheck and literally can't buy food or medicine right now.

Wall Street wants to start up small biz. There is a problem with this virus. First, healthy people are spreading it. Second, healthy people are not being tested!