Here Comes Q2 Earnings Season

Second quarter earnings season kicks off this week as Pepsi (PEP) reports before the open tomorrow, while Kraft Heinz (KHC) reports Wednesday, and Delta (DAL) reports on Thursday. The real action, though, will come next week as the major banks and more than 50 other S&P 500 companies will report results. As shown in the chart below, the busiest day of this earnings season will be on 7/25 when 61 S&P 500 companies are scheduled to report, while the busiest week for earnings will be the following week when a total of 160 companies will be reporting. After that things will quickly start to die down in August.

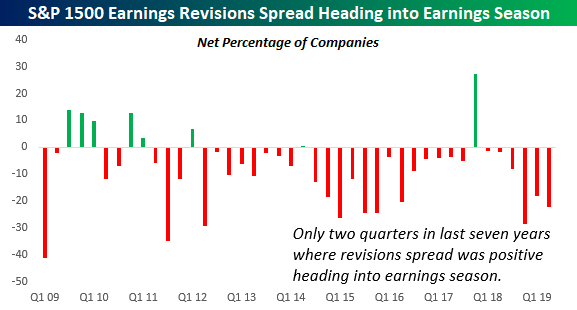

The key trend to watch this earnings season will be how often the term ‘China’ or ‘tariffs’ comes up in quarterly conference calls. With increased uncertainty created by the on-again, off-again escalation of trade disputes between the US and its largest trading partners, we have seen a significant uptick in negative analyst commentary. Over the last four weeks, analysts have raised EPS forecasts for just 278 companies in the S&P 1500 and lowered EPS forecasts for 611. This works out to a net of negative 333 or more than 22% of the stocks in the index. To put this in perspective, there has only been one other quarter in the last three years where the net EPS revisions spread heading into earnings season was more negative than it is now. This doesn’t mean that analysts are normally positive, though. As shown in the chart below, there have only been two quarters in the last seven years where the revisions spread was positive heading into earnings season.

(Click on image to enlarge)

We have just published our quarterly preview of the upcoming earnings season and what to expect in terms of the overall market and sector performance based on trends in analyst revisions. To gain ...

more