Healthcare Stocks Hit New Highs But Small Caps Lag

Healthcare Stocks Hit New Highs

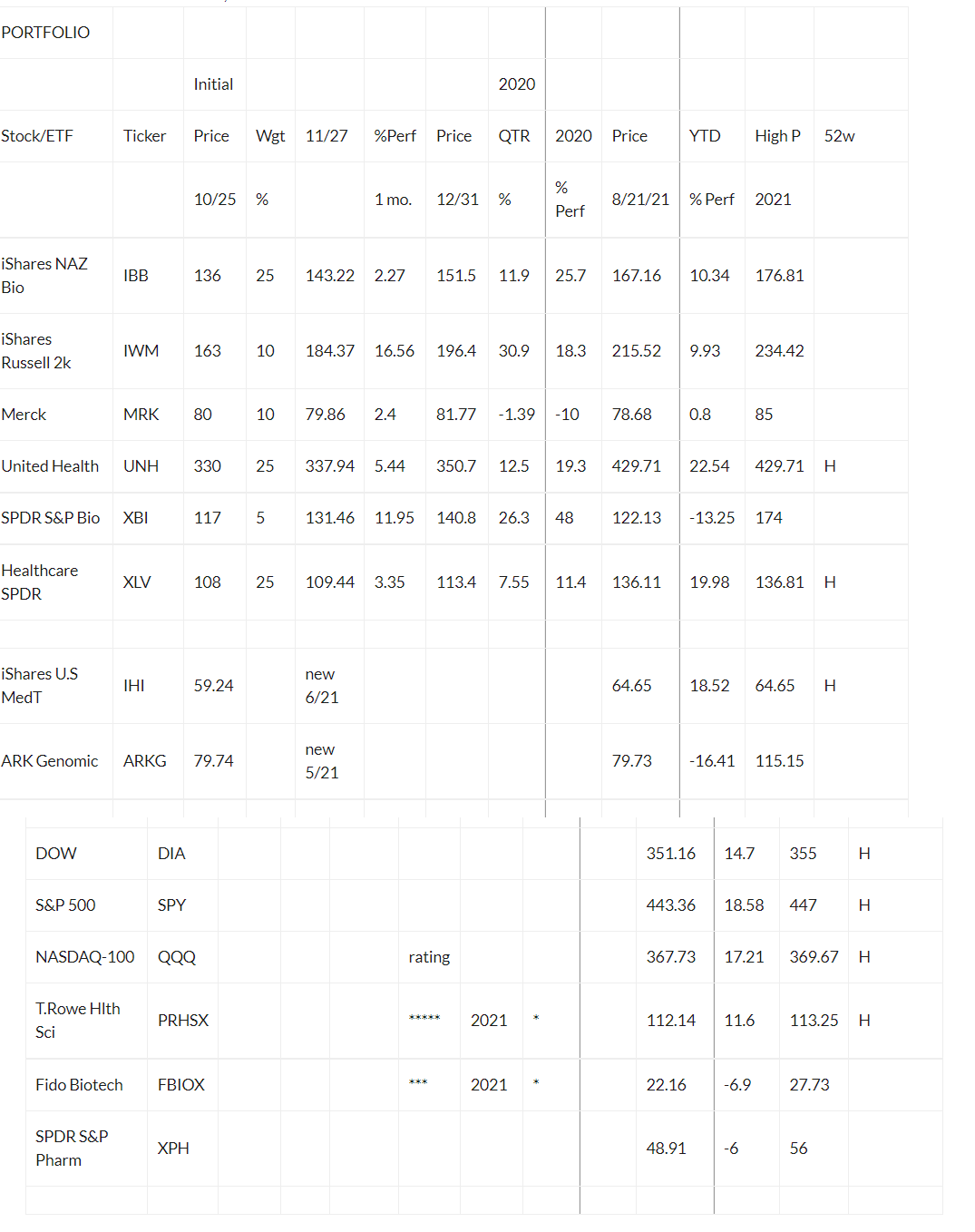

- Small cap life science stocks lag: ARKG, XBI.

- Winners in Portfolio UNH, XLV.

- Pfizer PFE vaccine FDA approval sparks rally in biotechs

We have favored healthcare stocks for non-traders since October 2020. Over the past week, many stocks by sector were mainly down as the surge in the delta COVID variant raised concerns about the economy and hospitalization rates in certain Southeastern States. Many of the “re-opening plays were down the past week- energy, materials, and industrials. But today saw another reversal in a broad rally. Although vaccination rates have been picking up public health experts are leaning toward a view that the virus may be with us for some time to come. Travel outside the US is not recovering and consumer sentiment and retail sales were down recently.

Vaccine Stocks Continue to Run

Pfizer was up almost 3% on full FDA approval of their vaccine in partnership with BioNTech (BNTX) up 9.2% even though FDA approval was expected. Today vaccine stocks are rallying again on funding for booster shots and a longer-term outlook for vaccine mandates. But expect some pushback and revisions on the booster plan. Moreover, full FDA approval may encourage more vaccinations. On Friday BNTX was up 5.08%, MRNA up 1.98 %, NVAX up 6.17%. In the coming months we’ll see if the vaccine manufacturers reformulate to better protect against the delta and other variants, Coronavirus testing stocks lagged today despite the expectation that more venues and companies will require vaccination and COVID tests: ABT flat at $126, QDEL flat at $119,

Small Cap Speculative Stocks Perk Up Today

As you can see from the IWM and the more speculative biotech ETFs most of the rally YTD has been in the higher quality biopharma dividend names plus United Health (UNH). Today all of our new small-cap focus stocks are up for the second day: CRSP, CYRX, and VCYT.

Many smaller cap biotech stocks trade on news and milestones and have no earnings so require more expertise in the field.

Surprisingly the debacle of the Kabul evacuation is not being reflected in the economic outlook nor the market. The Fed outlook will be in the headlines later this week.

Disclosure: None.