Happy Monday So Far, With A Busy Week To Follow

Image Source: Unsplash

It’s Monday morning, and we’re higher. As we noted two weeks ago, that’s become a frequent occurrence. We broke a 15-week streak last week (of course, after we wrote about it), and noted that Mondays have closed higher 80% of the time this year, when 53% has been normal for all days and Mondays prior to this week. But there are a number of potentially market-moving events coming down the pipe this week. Any or all of them can disrupt today’s good mood.

The first key number comes out this afternoon at 3 pm EDT. That is when the US Treasury releases the estimate for its borrowing needs over the coming months. The last report, on July 31st, clocked in at a fairly shocking $1.007 trillion. That spooked bond markets, and the latest leg higher in bond yields (lower bond prices) can be largely attributed to that announcement. The 10-year yield was at 3.96% prior to that announcement. It’s currently 4.89%. That is a staggering move. Also, neither the S&P 500 (SPX) nor NASDAQ 100 (NDX) has closed above its July 31st close since then.

Hence it will be very interesting to see the bond market’s reaction. It is difficult to get a consensus estimate for today’s announcement, though our senior economist, Jose Torres, puts it somewhere in the $1.4-1.5 trillion range, and he is at $1.6 trillion. A few hundred billion here, a few hundred billion there, pretty soon we’re talking about real money, right? There is much more focus on today’s announcement than there was last quarter, but a significant reaction from bond traders could certainly spill over into stocks.

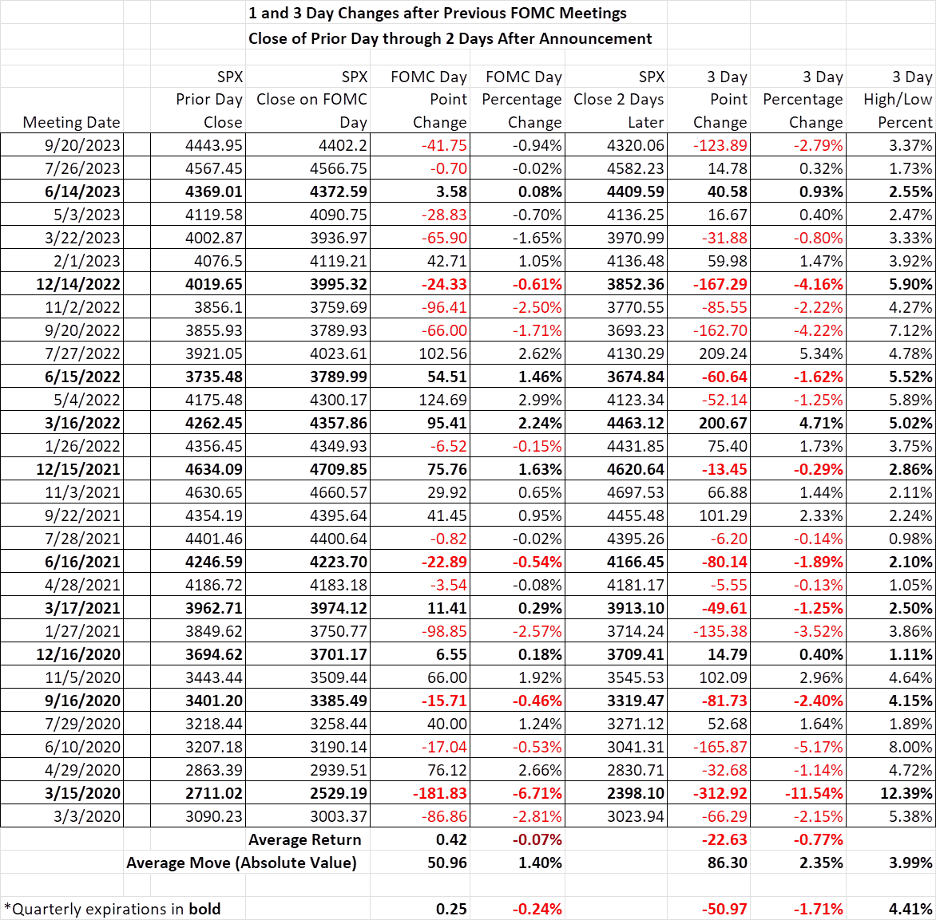

Meanwhile Wednesday of course promises to be noteworthy. We will learn the likely composition of the Treasury’s borrowings that morning at 8:30 am EDT. That could have a significant on the shape of the yield curve, depending upon whether the borrowing will skew short-term or long-term. And the Big Kahunas of market events, the FOMC meeting, and Chairman Powell’s press conference follow at 2:00 pm and 2:30 pm that afternoon. The table at the bottom of today’s piece shows SPX’s post-FOMC reactions after the past several meetings. Volatility is hardly guaranteed, but it often accompanies these events.

Finally, after the close on Thursday and before the open on Friday, we have two highly consequential reports. Thursday afternoon brings Apple (AAPL) earnings. As we have seen recently, a big post-earnings move from a mega-cap tech stock – and this is the most mega of the mega-caps – can drag the broad markets in its wake. Friday morning brings the monthly employment data. The combination of Nonfarm Payrolls, Unemployment Rate, and wage data have often demonstrated their potential to move markets.

When we wrote about the phenomenon of consistently rising Monday markets, we were at a loss for a solid explanation. We guessed:

Maybe there is something about avoiding major trouble over the weekend that makes traders bullish on Mondays.

That explanation seems to be relevant today. Stocks, if not bonds, seem to be having a bit of a relief rally. With the events facing the markets this week, it will be fascinating to see whether this morning’s good feelings can persist.

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Fed’s Inflation Gauge Rises At The Fastest Pace In Five Months

Mr. Market Plays Survivor Plus AMZN Expectations

What If The Mag Seven Becomes The Big Five? + It’s Meta’s Turn

Disclosure: OPTIONS (WITH MULTIPLE LEGS)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more