Happy 13-Year Anniversary

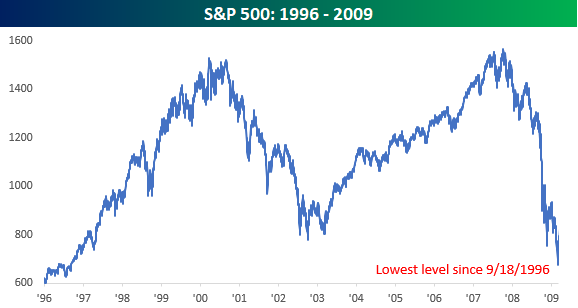

Today marks the 13-year anniversary of the day when things got as bad as they can get for financial markets. After more than a year-long bear market which cut the value of the US stock market by over half, on 3/9/09, the S&P 500 closed at its lowest level since September 1996. A peak to trough haircut of more than 50% is enough, but bear markets are crueler than that, and this one was especially so. A case in point- on its way to zero in 2008, Lehman Brothers saw separate rallies of 24%, 53%, 26%, 70%, 34%, etc. and with each one, investors kept getting sucked back in thinking the worst was over.

Now, replay that scenario with every other stock in the Financials sector and you start to get the picture. On a market-wide basis; in the two weeks after the 2008 Election, the S&P 500 dropped more than 20%. Then, as President-Elect Obama started to announce his cabinet, markets breathed a sigh of relief. The naming of Tim Geithner as Treasury Secretary elicited an especially strong response, and from late November through year-end 2008, stocks recovered and rallied more than 20%. It was a new bull market! But at the start of 2009, any hopes of an enduring rally quickly faded as the S&P 500 resumed its downward slide.

As catastrophic as the stock market declines were, most Americans couldn’t be bothered with it, not because they weren’t busy losing their shirts or retirement saving, but instead because they were too busy wondering if the ATMs would still be working tomorrow or where they would stay when their homes were foreclosed. We hear a lot of market people who consider making it through the COVID Crash as a badge of honor, but for the markets, COVID was just a bad month.

The phrase gets tossed around a lot, but the period spanning the late 1990s through 2009 really was a lost decade for the US equity market and marked the first time since 1941 that the rolling 10-year return for the S&P 500 was negative. In the 1990s, we were all told that stocks only go higher over the long-term, but ten years later we had all just experienced the harsh reality first hand.

If you lived through it, late 2008/early 2009 was as bad or close to as bad as it gets. Financial blood was in the streets and the bodies of failed banks and brokerages were piled up. By March 2009, no one even wanted to hear the word stock, and the mere mention of the stock market was enough to leave you by yourself at a party. As these things often work, March 2009 ended what was a nearly 13-year period of no gains in the stock market and the beginning of a nearly 13-year massive rally. There were bumps along the way, but they were mostly short-lived, and even after this year’s brutal start, the S&P 500 is still up over 500% from those lows.

As much as sentiment has worsened and as painful as the declines from the January highs feel now, they are a blip when viewed in the context of the last 13 years. Just to put things in perspective, on Monday, the S&P 500 fell more than 2.95% for its worst one-day decline since October 2020. From September 2008 through March 2009, though, there were more than 30 one-day declines of 2.95%! For another example, the CBOE Volatility Index (VIX) closed above 30 for the 7th straight day on Tuesday, which is one of just 17 streaks where it has closed over 30 for seven or more days. On 3/9/09, though, the VIX closed at just under 50 in what was the 121st straight day of closes above 30 and ultimately the longest ever streak of closes above 30 (170). In other words, as bad as it feels now, things could get a lot worse.

Conversely, whenever you hear someone say there’s no way out from here for equities, remember March 2009, March 2020 at the COVID lows, and every other bear market or correction low. The way out for the market was never obvious. It never is.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more