Halfway Through September

After a strong week, markets are getting off to a positive start this week ahead of this week’s Fed meeting. The S&P 500 is indicated to open with a gain of 0.25%. Overnight, Asia was mixed, but Europe has been higher across the board. The economic calendar is light to kick off the week, as the Empire Manufacturing report came in weaker than expected. Later on this week, things will pick up with Retail Sales highlighting Tuesday’s schedule and Housing Starts and Building Permits coming on Wednesday, along with the Fed.

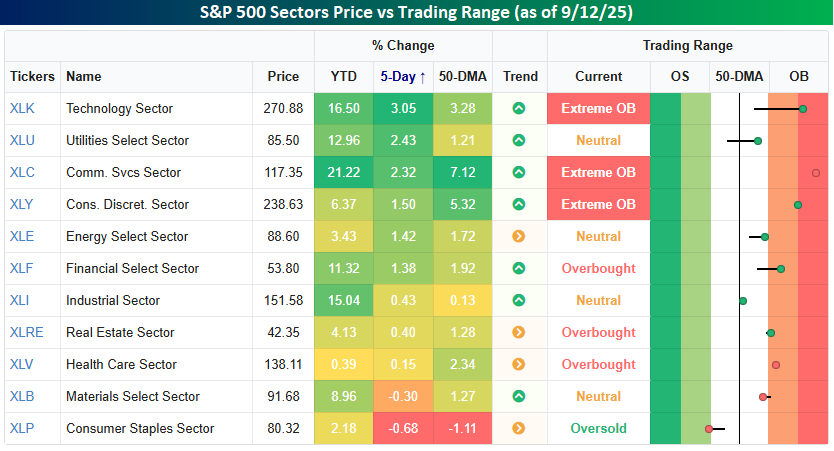

Markets are always forward-looking, and last week they looked forward to this week’s FOMC meeting, where Powell & Co will announce a cut of at least 25 basis points (bps) on Wednesday. Last week, six sectors rallied by at least 1%, including Technology, Utilities, and Communication Services, which rallied more than 2% each. We’ve grown accustomed to seeing Tech and Communication Services rally in unison. However, it’s still hard to get used to seeing the traditionally defensive-oriented Utilities sector rallying alongside those two sectors, but markets are always evolving. On the downside, the only sectors to finish lower last week were Consumer Staples and Materials. They’re also the only two sectors to finish last week below their 50-day moving averages. Consumer Staples is even oversold as well!

Six sectors finished last week at short-term overbought levels heading into this week’s Fed meeting, including three at ‘extreme’ overbought levels. While there is nothing prohibiting overbought sectors from becoming more overbought in the short term, it also sets up the possibility of a sell-the-news reaction to this week’s rate cuts. Just something to be on the lookout for.

More By This Author:

Another Strong Week For StocksHighs Keep Adding Up

Back To Reality

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more