GTT Communications: Beaten Down And Primed For A Bounce

Prepared by Stephanie and Tara of BAD BEAT Investing

GTT Communications (GTT) is a telecom company that is on our radar today after some big declines. We believe it is poised for a bounce. Although there have been integration challenges the company’s business model has scaled well over the years. Of course, it doesn't matter what the company has done, it matters what it will do. However, we have to at least acknowledge the returns here.

Source: GTT presentation

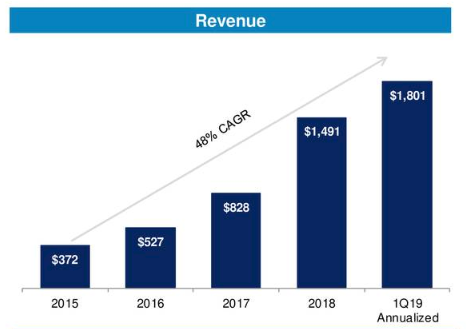

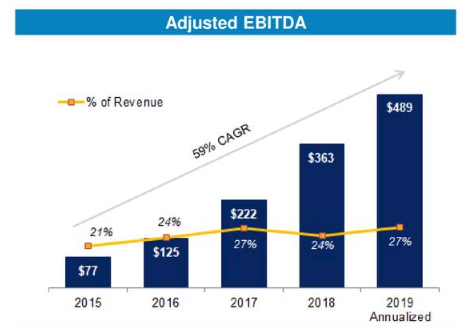

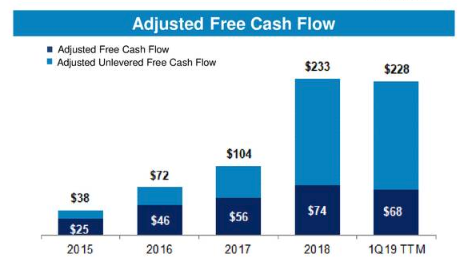

What do we mean? Well, how about EBITDA growth of a stellar 33% CAGR from just over $20 million to a current run-rate nearly half a billion. It is now highly cash generative helping to support its acquisition strategy which it employs. Over the last 5 years (excluding 2019), EBITDA has grown at a solid 70% CAGR and unlevered FCF at nearly a 65% CAGR.

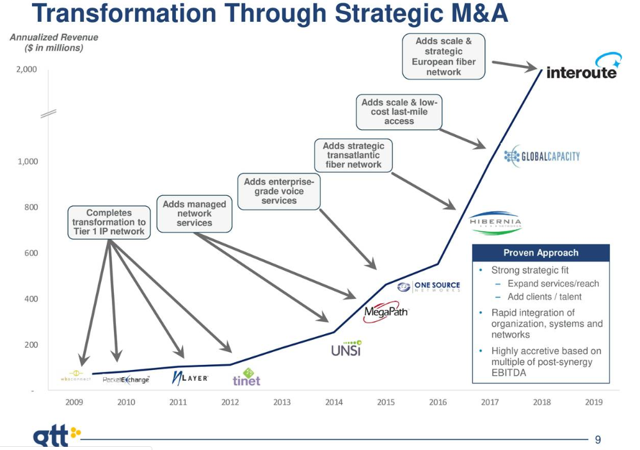

Now here is where it gets murky. One of the reasons the stock is falling is that there are questions surrounding the viability of the business model. Management has excelled at effectively using its capital to acquire complementary companies. It is in the acquisition business and its there goal to grow the customer base and adding the necessary technology to become a dominant player in the space.

Source: GTT presentation

But here is the thing. The rapid integration approach to acquisitions has been one of the cornerstones of its success, helping management achieve a track record of meeting or exceeding its financial targets over the last few years. However, lately performance has been lacking and this has led to investors bailing out on the stock in the last two months for a near 60% decline:

Source: BAD BEAT Investing

Now, this decline was underway, but it has accelerated in the last week. Take a look at the 5-day chart here:

Looking at a longer-term chart, we think we may see some technical support which lends itself to even just a bounce based on the chart. We believe that shares have fallen too far too fast on the same news after the latest quarter, in addition to a recent short report which we will discuss. The play we are looking at calls for trying to scalp a bounce back over $15.

The play

Target entry: $12.70-$13.50

Target exit: $16+

Stop losses: $11.50

Estimated Time frame: ~2-4 Weeks

Further discussion of why we feel confident in another trade here

The big decline started after a miserable quarter which had left the company with sizable debt and minimal cash on hand.

Source: GTT SEC Filings

First-quarter revenue grew 73% year-over-year (resulting from more acquisitions) and decreased 1% sequentially to $450 million. Adjusted EBITDA grew 95% year-over-year and grew 4% sequentially to $122 million. The Interoute acquisition was the driver in question. Exchange rates had an unfavorable impact on reported results, as approximately 52% of revenue was denominated in non-U.S. dollar currencies. On a constant dollar basis, revenue grew 80% year-over-year and decreased 1% sequentially, while adjusted EBITDA grew 106% year-over-year and 5% sequentially.

Source: GTT presentation

The adjusted EBITDA margin of 27% increased by over 300 basis points year-over-year and by 140 basis points sequentially. The company has a financial objective of 30% here by next year. First-quarter net loss was $27 million compared to net loss of $31 million last year and net loss of $53 million last quarter. The net losses in each period were driven mainly by nonrecurring costs, including exit and integration costs as well as the noncash change in fair value related to the exchange rate and interest rate hedges.

First-quarter capital expenditures were $32 million or 7% of revenue compared to $13 million last year and $16 million last quarter. Going forward, CAPEX will be between 6% and 7% of revenue, driven mainly by success-based investments in support of specific revenue opportunities.

Source: GTT presentation

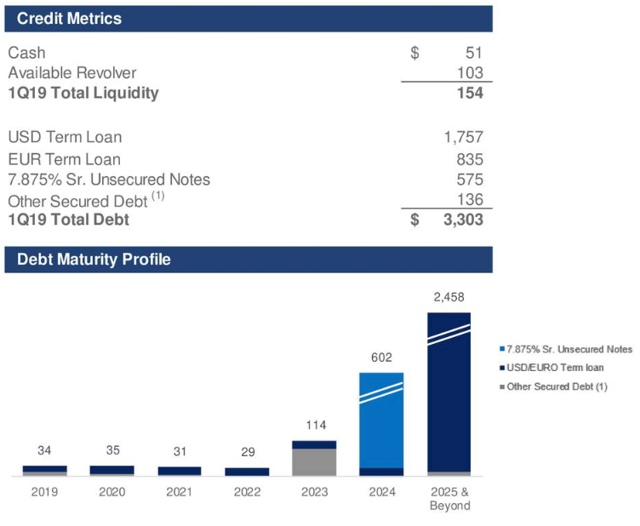

First-quarter ending cash balance was $51 million and net cash provided by operating activities was $16 million, which was negatively impacted by a significant use of working capital related to Interoute accounts receivable. This resulted in some invoice delivery delays and slower payments. This is typical during the integration process, albeit on a larger scale due to the size of Interoute. This will be resolved this quarter, we surmise.

Source: GTT SEC Filings

We expect cash flow to increase throughout the year as GTT sees fully realized cost synergies and it finishes paying out exit and integration costs. The main priority for this cash flow will be to repay drawn revolver and help fund small acquisitions.

Source: GTT presentation

Debt is a major issue. GTT's debt balance was approximately $3.3 billion at the end of the first quarter, including $2.6 billion of senior secured term loans maturing in 2025, of which roughly 1/3 is euro-denominated and $575 million of senior unsecured notes maturing in 2024. During the first quarter, GTT drew $26 million of an additional revolver. The maximum permitted net secured leverage under that covenant as, defined in the credit agreement, is currently 6.5x. They are at approximately 5x. So they have significant room to draw more if needed at this time.

To make matters worse, the issues we highlighted above were the basis of a recent short thesis which slammed shares. Short-seller Wolfpack Research issued a negative report earlier this month. They said the telecom is over-levered and has a "fundamentally broken" business that conceals a lack of organic growth and cash flow using non-GAAP metrics, the report said.

So why the selling recently? It looks like short selling, but it is very possible hedge funds are selling GTT. However, that is unclear at this time.

Final thoughts

So here is the deal. We have a stock down 60% here. The short-seller report came out weeks ago when the stock was at about $23 a share. So it has fallen nearly 50% since then as well. We believe the long-term chart suggests the stock can be bought here, and that the company, while certainly highly leveraged, consistently delivers on these acquisitions; they pay off. We think that you need to be a buyer when others are hating. We would expect GTT to acquire multiple companies each year still, as this is the business model, including in 2019. We probably don't see a large acquisition this year but you will likely see smaller ones. We believe that as Interoute becomes fully integrated the opportunity open back up for real stock growth.