Greenbrier: Did Railcar Orders Really Fall 70%?

Greenbrier's (GBX) FQ2 results were, at least to my mind, a disaster. The company missed on all fronts. Revenue of $669 million was $60 million shy of the $730 million analysts were expecting. Earnings per share of $1.141 missed by $0.15. I assumed the company would meet revenue expectations due to deliveries from its backlog. However, results were worse than I could have imagined.

Below is my take on the quarter:

Manufacturing Was A Disaster

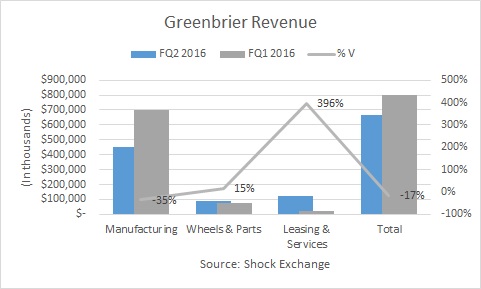

Usually a stalwart, the Manufacturing segment was a complete disaster this quarter. This segment produces railcars, tank cars, intermodal cars, etc. and has traditionally been over 85% of total revenue; this quarter it fell to 68%.

Manufacturing revenue was down 35% sequentially as deliveries fell from 6,900 units last quarter to 4,500 this quarter. Total revenue was off 17% Q/Q, but FQ1 appears to have been a high water mark at $802 million in revenue.

The free fall in deliveries was a complete surprise. Management divulged that its 36,000 unit backlog (into the quarter) represented firm orders. Railroads are hurting financially due to declining rail traffic and a stagnant global economy. I surmised that instead of canceling orders Greenbrier's clients could delay deliveries. This helps stem cash burn for clients, but potentially pushes revenue for Greenbrier into the future. FQ2 results only emboldens my thesis. Management still estimates it will deliver 20,000 to 22,000 units this fiscal year. However, I will believe it when I see it.

New Railcar Orders Were Worse

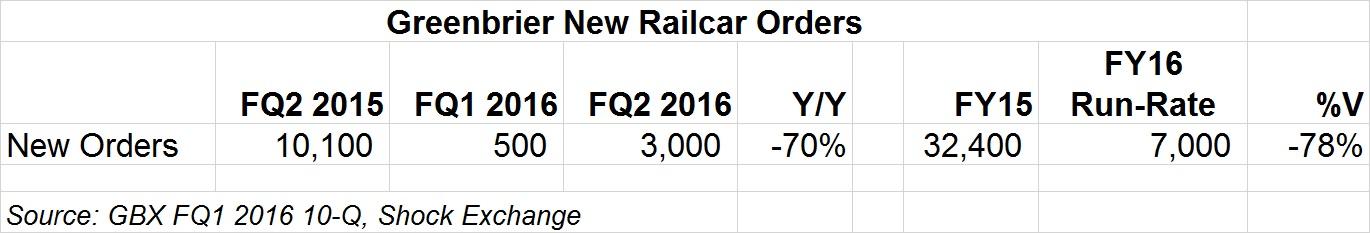

Railcar orders were 3,000, of which 2,100 came in the month of December. Orders were down 70% versus the 10,100 garnered last year. It proves that the 500 generated in FQ1 was no fluke; it also portends the outlook for the economy and Greenbrier's forward earnings could be rather dismal.

The company's run-rate orders (through first half FY16) are 7,000 or 78% off the 32,400 generated last year. Previous orders were likely energy-driven. How that impacts its backlog and market share going forward remains to be seen. The backlog fell from 36,000 units last quarter to 34,100 in FQ2. Management believes Greenbrier's share of industry deliveries is about 30%. However, it is not garnering 30% of industry orders. Industry orders (based on calendar quarters) for Q3 and Q4 2015 totaled about 16,500; over the past two fiscal quarters Greenbrier has garnered 3,500 -- equating to 21% share. The analysis isn't quite apples-to-apples but it gives an indication that [i] orders are likely less than 30% of the industry's and [ii] the decline in tank cars and other energy-related orders could be taking a toll.

Longs point to FY16E earnings and the company's low p/e ratio. However, current revenue and earnings were created by orders in prior quarters when the shale energy boom was still going strong; current deliveries may not reflect future performance. Management's goal is 30% share of normalized industry deliveries of 50,000 -- about 15,000 annually. That implies Greenbrier's run-rate revenue and earnings are less than what is expected this fiscal year. GBX is down over 50% over past year. I believe the stock remains overvalued, but longs apparently feel otherwise. The stock was up nearly 5% on terrible results. I will look to close my short position on any dips.

I am short NOV and GBX

You really like to bash this company don't you. Oh, you're a short! I get it now....but I don't buy it.

The Shock Exchange is bearish on the economy. Revenue and earnings for cyclical names like GBX will continue to fall.

I agree.