Goldman Sachs Stands At The Top But May Fall

With President-Elect Trump’s cabinet selections come near an end we can see that he plucked three graduates from Goldman Sachs (GS ). Remember, this is the very same Goldman Sachs that berated on the campaign trail for robbing Americans of jobs and he proclaimed that he was going to battle Wall Street if he was to be elected into The White House. After going as far as saying that Hillary Clinton and Ted Cruz were being manipulated by Goldman Sachs Mr. Trump went out and got himself three Goldman alums for his cabinet. The post of Treasury Secretary went to Mr. Steven Mnuchin, Chief Strategist is Mr. Steve Bannon, and now the National Economic Council Director will be former COO Mr. Gary Cohn.

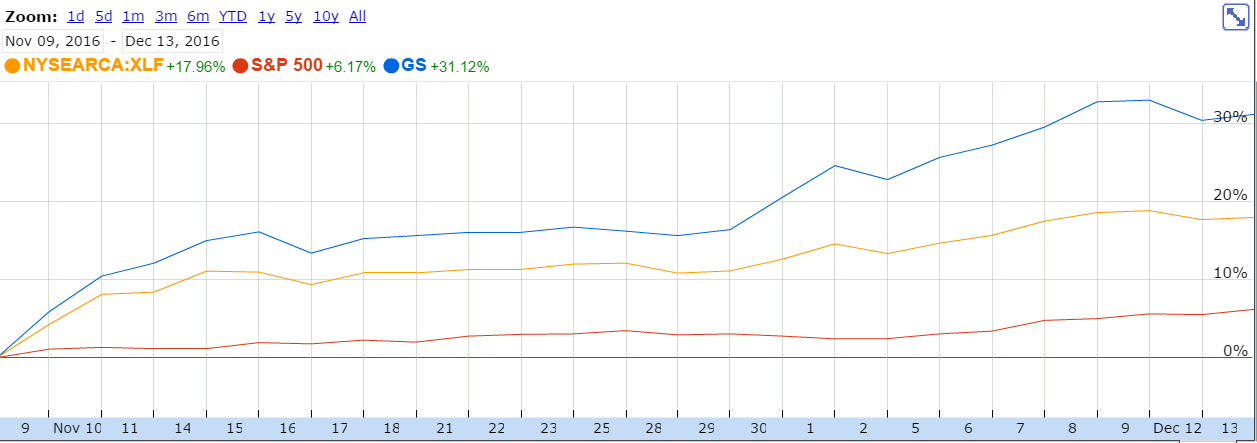

Since the election, Goldman Sachs is up a whopping 31.1% while the Financial ETF (XLF) is up 18% and the S&P 500 is up 6.2% as seen from the chart below. The stock is now trading above the highs experienced in 2007. The question becomes if the economy has indeed improved that much over what it was in 2007 then sure the stock price of Goldman is warranted. We’ve seen the “unemployment” number drop significantly, but how good is it really? There are probably more people now than there were before which just dropped out of the labor market completely, after all, that is what Mr. Trump ran his ticket on this campaign season, getting Americans employed again.

The company currently trades at a trailing 12-month P/E ratio of 19, which is fairly priced, but I mainly like to purchase a stock based on where the company is going in the future as opposed to what it has done in the past. On that note, the 1-year forward-looking P/E ratio of 13.27 is currently inexpensively priced for the future in terms of the right here, right now. Next year's estimated earnings are $17.98 per share and I'd consider the stock inexpensive until about $270 on a P/E valuation only. The 1-year PEG ratio (1.26), which measures the ratio of the price you're currently paying for the trailing 12-month earnings on the stock while dividing it by the earnings growth of the company for a specified amount of time (I like looking at a 1-year horizon), tells me that the company is fairly priced based on a 1-year EPS growth rate of 15.12%. The company has great near-term future earnings growth potential with a projected EPS growth rate of 15.12%. In addition, the company has great long-term future earnings growth potential with a projected EPS growth rate of 19.2%.

Now I’m not saying go out and short the stock right here, but I just believe there isn’t much room to the upside which makes me want to be writing calls right now. I definitely don’t think it can go lower from here but also believe the move to the upside is exacerbated, I just think it will trade sideways from here. So what I did was write the January $240 call and collected $9.07 for it and used those proceeds to purchase the January $250 call for $4.96 as protection in case I was dead wrong about the move.

The one event between now and January that may have any sort of impact on stocks is the Federal Reserve meeting. I think the market is pricing in 100% certainty that the FOMC is going to raise the interest rate this month and it might just be a "buy the rumor, sell the news" event which is great for the trade strategy I just described. This trade will also encompass the January earnings report and President Elect Trump's inauguration which I also believe may be a sell the news type of event. Thank you very much for reading and I look forward to your comments!

Disclaimer: This article is in no way a recommendation to buy or sell any stock mentioned. This article is meant to serve as a journal for myself as to the rationale of why I ...

more

Thanks for sharing

Goldman Sach's in political power has pretty much always benefited Goldman Sacs as it has on the Federal Reserve. I wouldn't worry about the brain drain. Trump's move to embrace what he vilified as being dirty is very much fitting right into the Washington political crowd. Sadly, It is to be expected.

Nice article. You know what they say: the bigger they are.... $GS