Glencore – Contrarian Industrial Materials Trader And Miner Best For Patient Investors

Swiss-based and London-listed Glencore (GLCNF) is one of the world’s largest industrial miners and commodity traders adversely affected by the current decline in commodity pricing. Glencore is one of the ten biggest companies within the London FTSE 100 Index. The firm’s industrial and marketing activities are supported by a global network of more than 90 offices located in over 50 countries.

For patient and contrarian investors looking for a pick-up in Chinese industrial demand and a stable/declining US Dollar, Glencore could a top choice. However, over the past few years as commodity prices fell, GLNCF has greatly underperformed the S&P. It should be noted GLNCF has outperformed its peers with a -7.6% one-year decline vs the industry at -27.1% and an average -6.6% annual 3-yr decline vs its peers at -10.6%.

Glencore has significantly expanded its production base and marketing capabilities following the acquisitions of Xstrata and Canadian-based agricultural trading firm Viterra.

GLCNF has one of the most appealing commodity exposures. Among the diversified miners, Glencore has the highest exposure to base industrial metals and especially copper, zinc, and nickel which many believe have a positive medium- to long-term outlook. In addition, Glencore has limited exposure to recently downgraded iron ore. GLCNF generates 55% of EBITDA from mining activities, 40% from commodities trading, and 5% from oil and agricultural.

Glencore has the potential for strong free cash flow generation and modest debt levels. Given the lack of iron ore exposure, the more resilient marketing business, as well as the pullback in capex, GLCNF should remain free cash flow positive from 2015 onwards even at current spot commodity prices. Below is a table outlining 2014 to 2017 proposed capital expenditures, separated between funds needed to sustain current production and anticipated growth initiatives, along with 2014 trailing current twelve month operating cash flow, in billions.

As shown, even with the current depressed commodities market, management believes in its ability to grow the underlying business.

Concerning growth plans, Chief Executive Ivan Glasenberg recently said, "Our focus is on expansion that can generate profit, on a tidy, neat balance sheet and any excess cash we will give back to shareholders." The firm has been keeping its promise of returning excess cash to shareholders. The recent semi-annual dividend was increased 11%, long-term debt is being reduced, and the company has embarked on a $1 billion share buyback program.

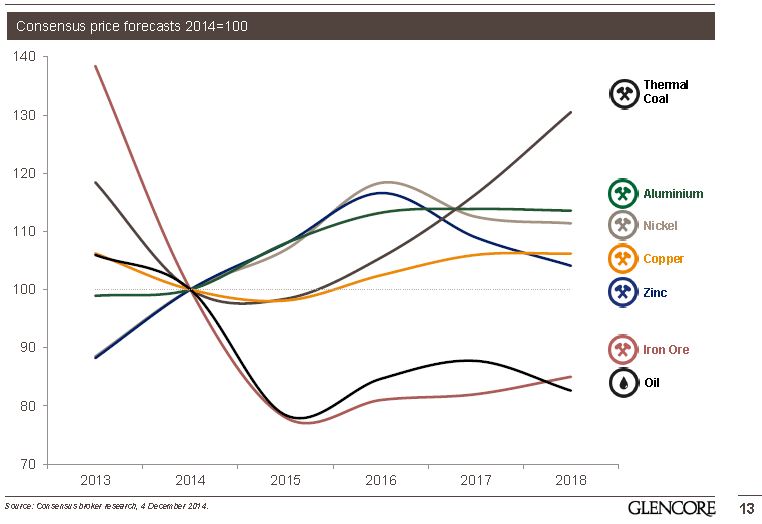

In its most recent Investor’s day presentation, management offers its forecast for commodity pricing going out to 2018. As shown in the graphic below, all commodities, except oil and iron ore are expected to be higher in 2018 than 2014. A rebound as indicated below should greatly improve shareholder returns.

The presentation can be found here (PDF).

Commodity prices have fallen back to their lows of 2009, which of course was at the height of the financial crisis. While global economic growth will be muted in 2015, the decline in commodity prices to panic levels of 2009 seems overdone. Any rebound will greatly enhance Glencore’s operating cash flow and shareholder returns.

Morningstar offers its insightful research with this recap:

Bulls say: Glencore's globe-spanning network of traders and logistics assets generates significant economies of scope. Full access to Xstrata's mine production allows the combined enterprise to extract greater value from those volumes. Glencore is more diversified than other large mining companies are.

Bears say: Glencore's mining portfolio is decidedly "overweight" higher-risk countries with relatively underdeveloped institutions and limited legal safeguards for foreign investors. Despite disclosures afforded by the initial public offering and subsequent filings, the marketing business remains incredibly opaque to outsiders. While marketing activities are less sensitive to the general direction of commodity prices than its industrial activities, the best-laid plans of traders can go awry when prices rise or fall faster than anticipated or historical correlations break down.

Investors should appreciate the market in 2015 markets will favor companies with higher revenue exposure to the US. In addition, a strong US Dollar hurts Glencore earnings by negatively influencing commodity prices. By the conversion of earnings to USD, GLCNF could be a candidate for contrarian thinking for patient investors.

Current yield is 3.8% with a strong likelihood of a dividend increase with the May payment. EPS in 2015 are expected to be $0.43 and in 2016 $0.54 per share.

CEO Glassenburg is actively seeking to expands its mining interest and made an offer to purchase Rio Tinto (RIO), which was rebuffed. By British securities law, GLCNF cannot make another offer for Rio Tinto for 6 months but Glassenburg is still on the hunt for bolt-on acquisitions. With low oil prices, it would seem natural for Glassenburg to pick up some longer-term energy assets on the cheap.

While it may take a while for shareholders to reap the benefits of an anticipated commodity price turnaround, new purchases or position additions at the current depressed market prices should amply reward long-term investors.

Author's Note: This article was first published in the Jan 2015 issue of My Investment Navigator Newlsetter

Disclosure: Long GLCNF

Great write up. I've added it to my portfolio.

Mike,

Thanks for reading and posting your comments. Glad you found the article useful.