General Electric: The Re-Constituted And Re-Invigorated Dividend Play

Image Source: Pixabay

General Electric (GE) was the quintessential dividend growth stock in the 1990s. It made many millionaires through price appreciation and a rising payout. Eventually, the company ran into problems during the subprime mortgage crisis and the Great Recession. But today, the “new” GE Aerospace is an attractive company focusing on commercial and defense markets, explains Prakash Kolli, editor of Dividend Power.

We discuss General Electric because the company has returned from its travails. It recently split into three corporations: GE Aerospace, GE HealthCare Technologies Inc. (GEHC), and GE Vernova Inc. (GEV). GE HealthCare is a medical device firm, while GE Vernova holds most of the old electrical and power businesses.

GE Aerospace (GE)

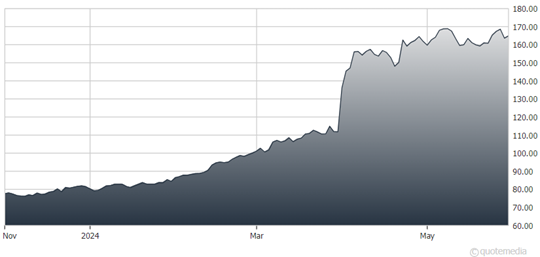

The legacy firm is GE Aerospace, which became the General Electric Company. The stock price has been the highest since 2016, with good results and optimism about the aviation business. However, it is still short of its all-time high share price and market capitalization.

The firm produces solid results with higher revenue, profit, and free cash flow. Debt and leverage are down, too, and the company has a BBB+/Baa1 lower-medium investment-grade credit rating.

Notably, General Electric has changed its capital allocation strategy to invest organically in growth, return cash to shareholders via buybacks and dividends, and perform M&A. As a result, we view General Electric as a dividend growth stock again.

Two of the three spun-off companies pay dividends, while GE Vernova does not yet. General Electric’s dividend was notably boosted 250% to $0.26 per quarter from $0.08.

It will be many years before General Electric returns to its former dividend growth glory and Dividend Aristocrat status, but it has a path to get there now.

My recommended action would be to consider buying shares of General Electric.

About the Author

Prakash Kolli is the founder and author of the Dividend Power investment blog. He writes about dividend growth stocks for the long-term small investor seeking to invest in dividend stocks for income and growth. His focus is on undervalued stocks with sustainable dividend growth and capital appreciation potential. His work has appeared on Seeking Alpha, Sure Dividend, ValueWalk, and other financial sites.

More By This Author:

SLV And SIL: Two Ways To Play Boom In Silver Prices

On Holding AG: An Up-And-Coming Athletic Shoe Company With Attractive Growth

Nvidia: What The Tech Giant Said After Blowing Away Estimates

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more