Fundamental Vs. Technical Analysis: What’s The Difference?

Image Source: Pexels

Key Takeaway

As “Mr. Valuation,” I have spent decades helping investors understand the practical distinctions in the debate of fundamental analysis vs technical analysis. Although both approaches have their advocates, I remain firmly convinced that fundamental analysis—the process of evaluating the business behind the stock—is the most reliable method for achieving long-term investment success. Technical tools can assist with market timing, but they do not replace the essential discipline of understanding intrinsic value.

Fundamental vs. Technical Analysis: An Overview

When I first began my investment journey, it became clear that the stock market eventually acts as a weighing machine rather than a voting machine. Over time, stock prices reflect the underlying strength and profitability of the business—not short-term market noise or speculative enthusiasm. This distinction lies at the heart of the ongoing comparison of fundamental analysis vs technical analysis.

Fundamental analysis concentrates on the company—its financial health, growth prospects, competitive advantages, and intrinsic value. Technical analysis, by contrast, focuses on price movements, chart patterns, and market trends. Each method offers its own perspective, but throughout my career—and through the development of FAST Graphs—I have consistently found that fundamentals offer the most dependable foundation for prudent, long-term investing.

Technical analysis can help investors interpret momentum or identify better entry points, but it is the fundamental vs technical investing distinction that matters most. Fundamentals drive long-term returns because earnings ultimately determine market price. Technical factors influence short-term fluctuations, but those movements are often emotional, speculative, and detached from economic reality.

What Is Fundamental Analysis?

Fundamental analysis is the discipline of evaluating a company’s financial strength, business performance, and intrinsic value. In the broader discussion of fundamental analysis vs technical, this approach focuses entirely on the business itself—its earnings power, balance sheet quality, and long-term prospects—rather than on short-term price movements.

In practice, I rely heavily on FAST Graphs because it enables me to visually correlate a company’s earnings, dividends, and stock price over time. This is where technical analysis versus fundamental analysis becomes remarkably clear: the market may temporarily price a stock irrationally, but over long periods, price follows earnings.

The core tools of fundamental analysis include:

- Financial Statements: Income statements, balance sheets, and cash flow statements provide insight into profitability, debt levels, cash generation, and the sustainability of dividends.

- Economic Indicators: Macroeconomic data—GDP growth, inflation, consumer sentiment—helps investors understand the environment in which the business operates.

- Interest Rates: Shifts in interest rates influence borrowing costs, discount rates, and ultimately corporate earnings.

- News and Events: Corporate actions, regulatory changes, and industry developments can materially affect the outlook for a business.

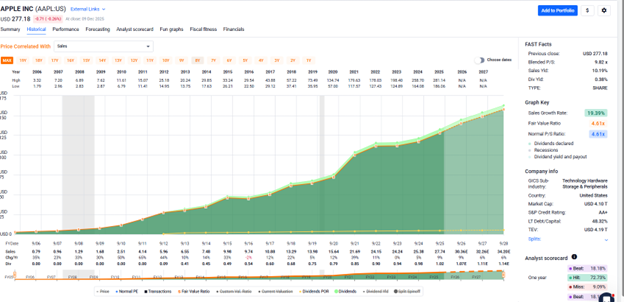

Apple Inc.: Fundamental Analysis

Apple is an excellent example of how fundamental analysis reveals the true strength of a business, and why I place far greater weight on fundamentals in the ongoing debate of fundamental analysis vs technical.

- Sales (Revenue): Apple’s revenue history demonstrates steady, dependable growth across multiple product cycles—a hallmark of companies whose stock prices ultimately follow earnings.

(Click on image to enlarge)

- Operating Margin and Net Margins: Strong margins speak directly to competitive strength. Apple’s consistent profitability illustrates why technical analysis versus fundamental analysis cannot replace understanding the business.

(Click on image to enlarge)

- Price Follows Fundamentals: Over time, as Apple’s earnings and cash flows increased, its price followed. This confirms the principle of fundamental vs technical investing: fundamentals tell you what to buy; technicals may help with timing, but they do not define value.

(Click on image to enlarge)

What Is Technical Analysis?

Technical analysis is the study of price movements and trading volume to forecast future price behavior. In the fundamental analysis vs technical debate, technical analysis focuses almost entirely on market action rather than business performance.

Key tools include:

- Technical Indicators: Moving averages, RSI, MACD for trend and momentum signals.

- Volume Analysis: Confirms moves and signals potential reversals.

- Relative Strength: Compares performance to sector or market.

- Chart and Candlestick Patterns: Identify potential bullish or bearish trends.

- Support and Resistance Levels: Show where stocks may reverse direction.

- Trend Analysis: Determines prevailing price direction.

Technical analysis can be useful for timing trades, but it is secondary to fundamental analysis when assessing long-term investment value.

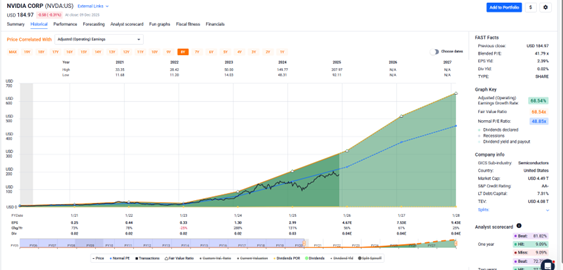

Nvidia Corp.: Technical Analysis Example

Nvidia illustrates how technical signals can diverge from strong fundamentals. Its earnings, growth trajectory, and market position remain robust, yet short-term technical indicators recently suggested caution.

This divergence highlights the limitations of relying solely on technical analysis versus fundamental analysis. In fundamental vs technical investing, the key lesson is that technical tools inform timing, but the underlying business determines long-term returns.

(Click on image to enlarge)

When to Use Fundamental Analysis and Technical Analysis

Fundamental analysis is essential for long-term investors seeking wealth creation. By understanding intrinsic value, investors identify high-quality businesses trading below true worth.

Technical analysis is best for short-term trading or timing decisions. Short-term price movements are often emotion-driven, not reflective of fundamentals. As I say: in the short run, emotions determine market price; in the long run, earnings determine market price.

The most successful investors use fundamentals to choose what to buy and technicals to refine when to buy or sell.

Advantages and Disadvantages of Fundamental and Technical Analysis

|

Approach |

Advantages |

Disadvantages |

|---|---|---|

|

Fundamental Analysis |

• Provides intrinsic value |

• Time-intensive |

|

• Identifies undervalued assets |

• Requires reliable data |

|

|

• Supports long-term wealth creation |

• Less effective for short-term trading |

|

|

• Reduces emotional decisions |

||

|

Technical Analysis |

• Useful for short-term trading |

• Ignores business fundamentals |

|

• Offers real-time signals |

• Prone to false signals |

|

|

• Simple visual cues |

• Less reliable for long-term investing |

Key Finding

Fundamental analysis provides a more reliable foundation for long-term investing than technical analysis alone. Technical indicators can assist timing decisions, but fundamental vs technical investing shows that true value is built on business results, not short-term price movements.

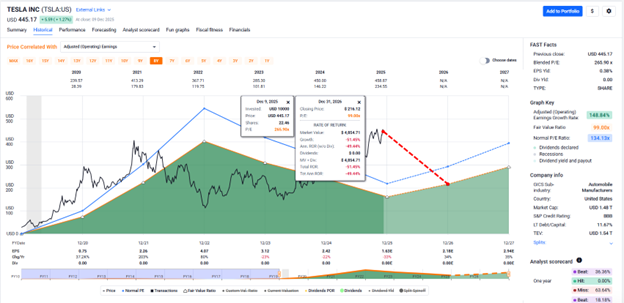

For instance, Tesla’s fundamentals recently raised concerns about overvaluation, even as technical indicators showed mixed signals. Relying solely on technicals could have led to risky decisions, while a fundamental approach would have prompted caution.

Tesla overvalued

(Click on image to enlarge)

Blending Fundamental and Technical Analyses

Over the years, I’ve found that blending both approaches can enhance your investment process. I use fundamental analysis to identify high-quality, undervalued companies—my “what to buy.” Then, I may consult technical analysis to optimize my timing—the “when to buy.” This hybrid approach is increasingly popular among professionals, especially with the advent of advanced tools and platforms.

For example, with FAST Graphs, I can quickly screen for fundamentally sound stocks and then review their technical charts for optimal entry points. This combination helps me avoid overpaying and reduces the risk of buying into short-term market weakness. However, I am only applying technical analysis once the decision to buy, or sell, has been made from a fundamental perspective. The key is to let fundamentals drive your decisions, using technicals as a secondary check—not the other way around

Conclusion

While both methods have merit, fundamental analysis vs technical clearly favors fundamentals for long-term success, I believe that a disciplined focus on fundamentals is the most reliable way to achieve long-term investment success. Tools like FAST Graphs allow investors to focus on intrinsic value, while technicals can refine timing. Remember: in the end, it’s the business that matters, and long-term wealth is built by owning strong companies at attractive valuations.

More By This Author:

Retirement Income Blueprint: 5% Yield And Dividend Growth Without Selling SharesIntrinsic Value Definition, Formula & Calculator: A Rational Investor’s Guide To True Worth

A High-Yield Dividend Growth Portfolio Objective FIRE (Financial Independence Retire Early) - Part II

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more