FTSE China Concerns Continue To Weigh On Export Heavy Blue Chips

London's FTSE 100 index UK export-heavy stock index, started the week on the backfoot experiencing a slight decline due to the underperformance of mining and oil companies' shares. This drop was primarily influenced by mounting concerns regarding China's economic rebound and its property market burdened with debt. The blue-chip FTSE 100 index registered a decrease of 0.39% in value. The apprehension surrounding China's property market escalated when the onshore bonds of Country Garden, a prominent property developer in the country, were suspended. This raised further alarm about the situation. As a result of these concerns, energy stocks also saw a decline of 0.5%. The easing of crude oil prices was driven by worries about China's stumbling economic recovery and a stronger US dollar. Adding to the market's unease, geopolitical tensions were on the rise following an incident where a Russian warship fired warning shots at a cargo ship in the southwestern Black Sea on Sunday.

Entain, the owner of Ladbrokes, finds itself among the prominent losers on the FTSE 100 in the UK, with its shares experiencing a decline of 2.4%. This places Entain in the category of top percentage decliners on London's prestigious blue chip index. A report from the Sunday Times indicates that Entain is exploring the possibility of recovering substantial bonuses that were granted to former board members, including the former CEO Kenny Alexander. In a recent development, Entain made known its decision to set aside £585 million (equivalent to $742.48 million) to address a potential settlement with investigative authorities concerning potential bribery allegations related to its past operations in Turkey. According to the Sunday Times, top executives within the company shared incentives amounting to £82 million during the period between 2011 and 2017, coinciding with GVC's (now Entain) operations in Turkey. Piping Etain to the bottom spot was Ocado shedding 3.8% on the session, several batches of a popular granola brand have been withdrawn from sale in the UK due to concerns that the boxes might contain small stones. Rude Health's Low Sugar Almond and Hazelnut Granola products have been labelled with "do not eat" stickers following the discovery of potential stone fragments. This trendy cereal, favoured by health-conscious consumers, is typically available through the online retailer Ocado.

On the positive side of the ledger Airtel Africa +3.46%, a company listed on both the Nigerian Exchange Limited (NGX) and the London Stock Exchange (LSE) sits top of the table, as the company announced its intention to be listed on the Ugandan stock exchange. This move aims to promote significant local ownership of Airtel Uganda Limited, with a focus on attracting Ugandan investors. This listing is expected to contribute to the growth of Uganda's capital markets.

On the fundamental front , a survey revealed that British employers are anticipating a 5% increase in wages over the upcoming year. This trend is accompanied by a rising practice of offering counter offers to retain employees who are enticed by higher salary offers from rival companies.

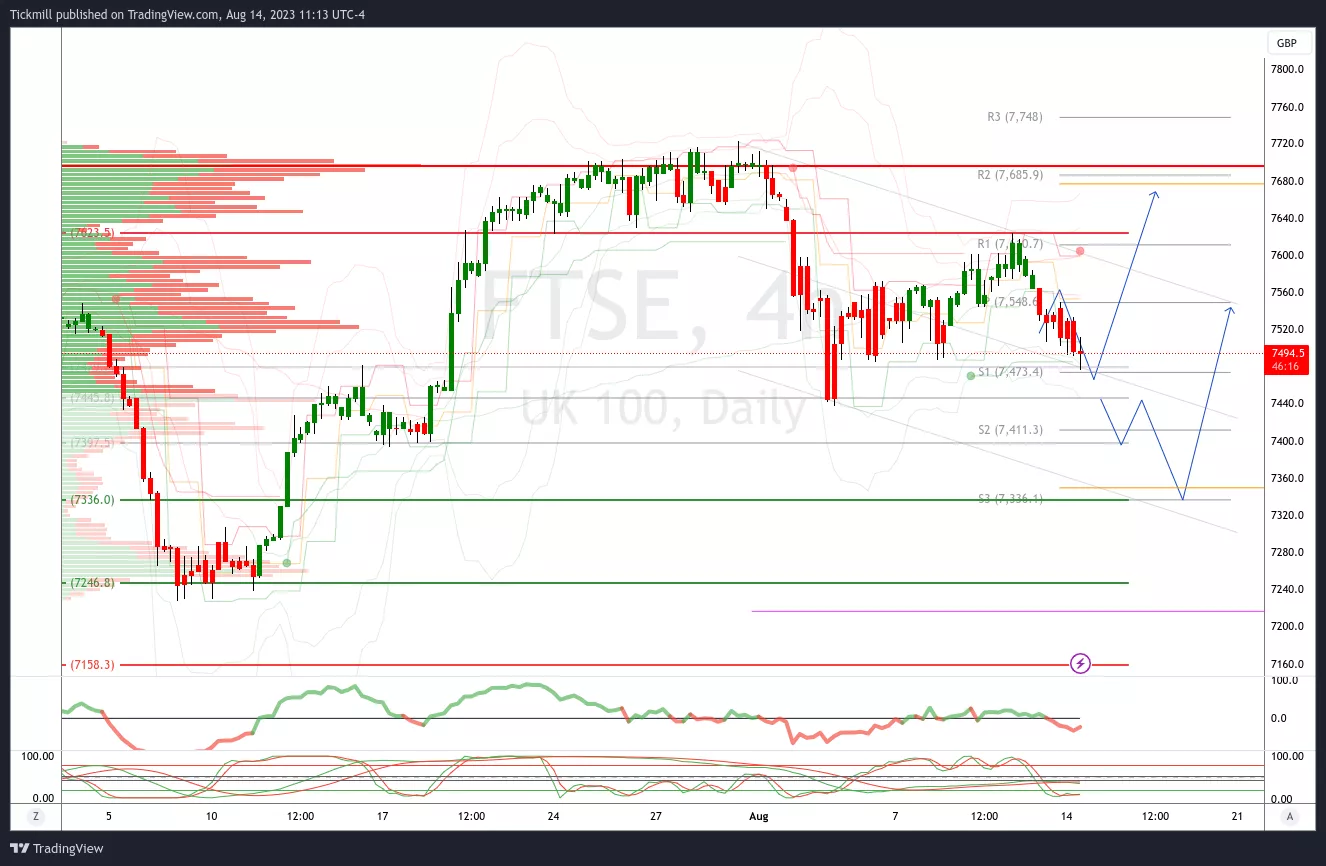

FTSE Intraday Bullish Above Bearish below 77520

-

Below 7400 opens 7400

-

Primary support is 7330

-

Primary objective 7750

-

20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, Aug. 14

FTSE Rolling Over Into The Close, Potential BoE Action Weighs

Daily Market Outlook - Friday, Aug. 11

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more