FTSE Rolling Over Into The Close, Potential BoE Action Weighs

Image Source: Pixabay

London's FTSE 100 index, which is heavily reliant on exports, started the day with a decline on Friday. The pressure on the index was due to the strength of the pound, which gained ground following surprising economic data revealing higher-than-anticipated growth for the UK in the second quarter. The unexpected growth in the second quarter was a result of a strong performance in June. The growth was measured at 0.2%, which contrasted with the flat reading that economists had predicted in a Reuters poll. As a response to the data, the FTSE 100 index experienced a 0.6% drop. Simultaneously, the British pound halted its three-day losing streak. Additionally, energy stocks experienced a decrease of 1.1% due to a decline in crude oil prices.

In other news, the UK's competition regulator provided preliminary clearance for UnitedHealth Group's acquisition of healthcare technology company EMIS, valued at £1.24 billion ($1.58 billion). Following this announcement, shares of EMIS surged by nearly 25%, reaching a ten-month high.

On the positive side of the ledger, shares of the British insurer Beazley Plc saw an increase of nearly 2%, which positioned the company the top percentage gainers on the FTSE 100 index. The company has confirmed that its guidance regarding growth and the combined ratio, along with its positive outlook for the business, will remain unchanged. In addition to this announcement, Beazley revealed that its Chief Financial Officer (CFO), Sally Lake, is set to step down from her position in 2024. Despite these developments, the company's shares have experienced a year-to-date decrease of approximately 22% as of the last market close.

On the negative side of the ledger British gambling company Entain after disclosing Thursday that it has allocated £585 million (approximately $744.5 million) for a potential settlement with British authorities saw further investor concern leaving the firm bottom of the index down over 4% on the session.

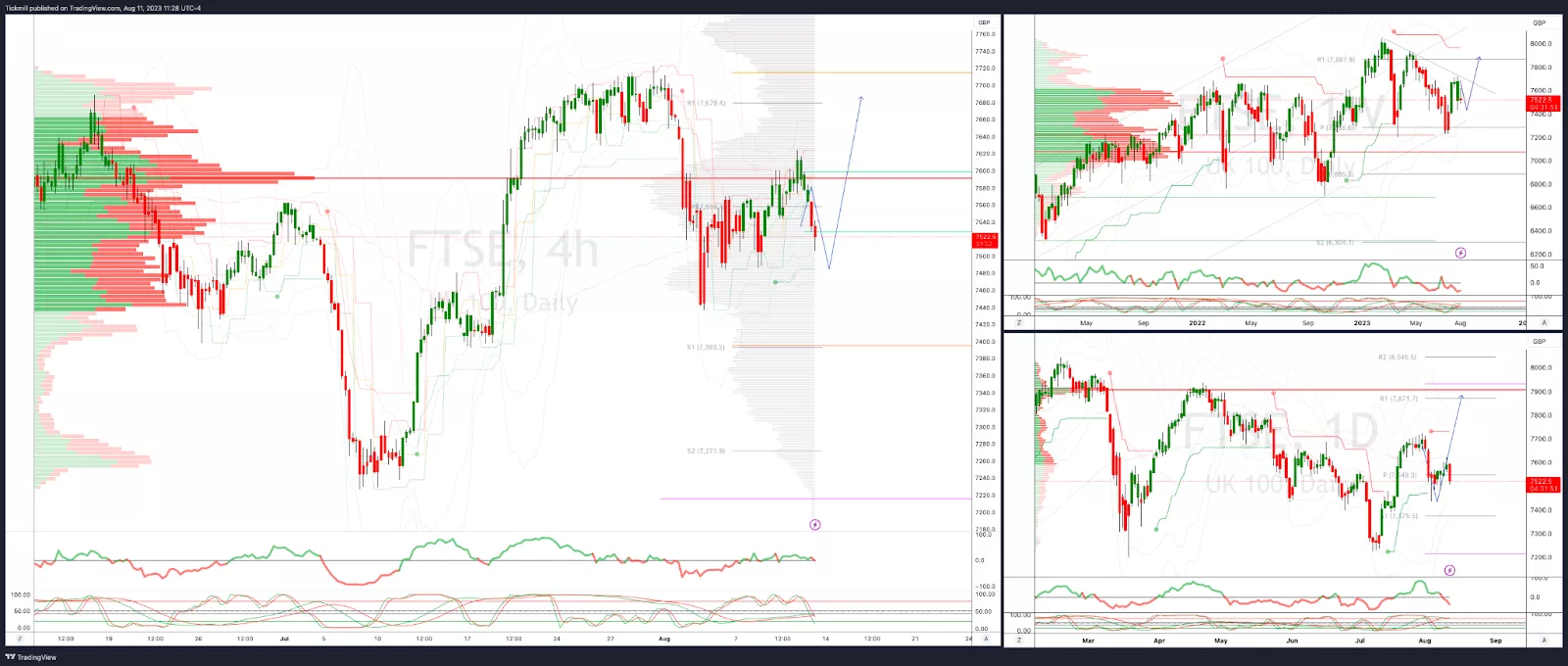

FTSE Intraday Bullish Above Bearish below 7650

- Below 7550 opens 7400

- Primary support is 7400

- Primary objective 7750

- 20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Aug. 11

FTSE Heading For Biggest Gain In Three Weeks

Daily Market Outlook - Thursday, Aug. 10

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to ...

more