“Friends In Low Places” Stock Market (And Sentiment Results)

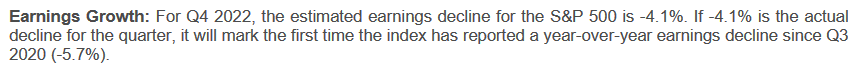

I find it curious that the earnings estimates for Q4 earnings season (of the top 500 US traded public companies) is –4.1%.

Source: Factset

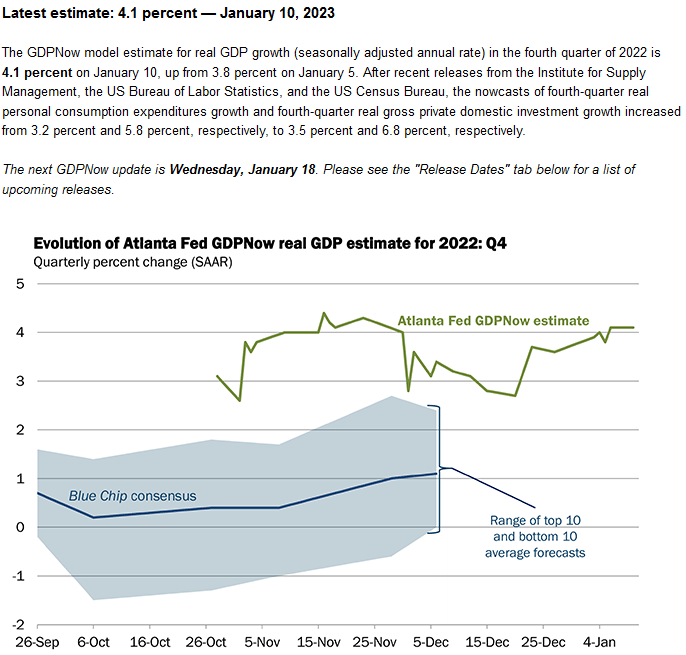

At the same time, Atlanta Fed’s GDP tracking tool GDPNow is saying GDP for Q4 tracked at +4.1%. One of them is going to be materially wrong and my bet is company earnings (are too low). With expectations so low, it sets up for a period of positive surprises moving forward.

Money Supply (tale of two “cities”)

(Click on image to enlarge)

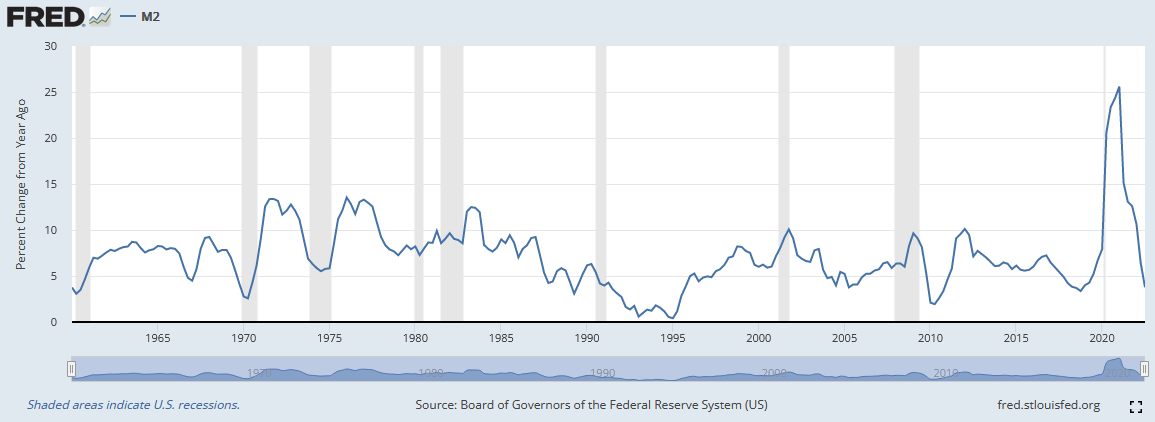

While US M2 money supply (above) is collapsing, China M2 money supply has been growing at double digits for over a half a year. Now that they have finally re-opened the economy, the effect of this easy policy will start to be seen in the economic and company data in coming months (on a lagged basis). Where do you want to place your bets?

Now onto the shorter term view for the General Market:

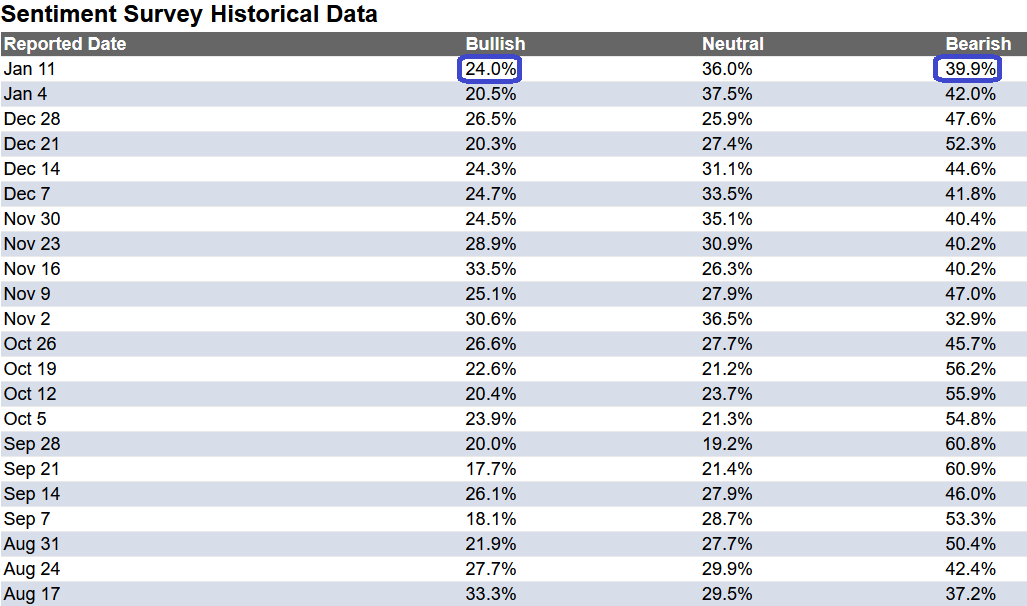

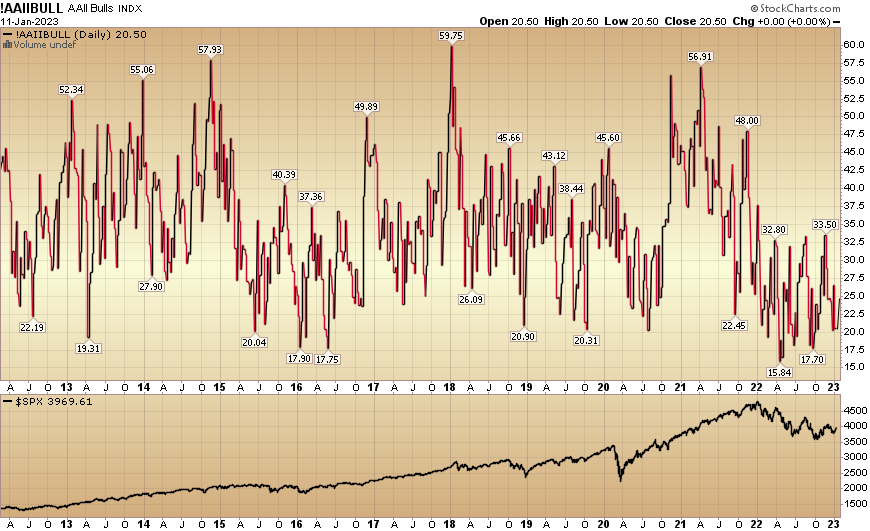

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose modestly to 24% from 20.5% the previous week. Bearish Percent ticked down to 39.9% from 42%. Sentiment is still fearful for retail traders/investors.

(Click on image to enlarge)

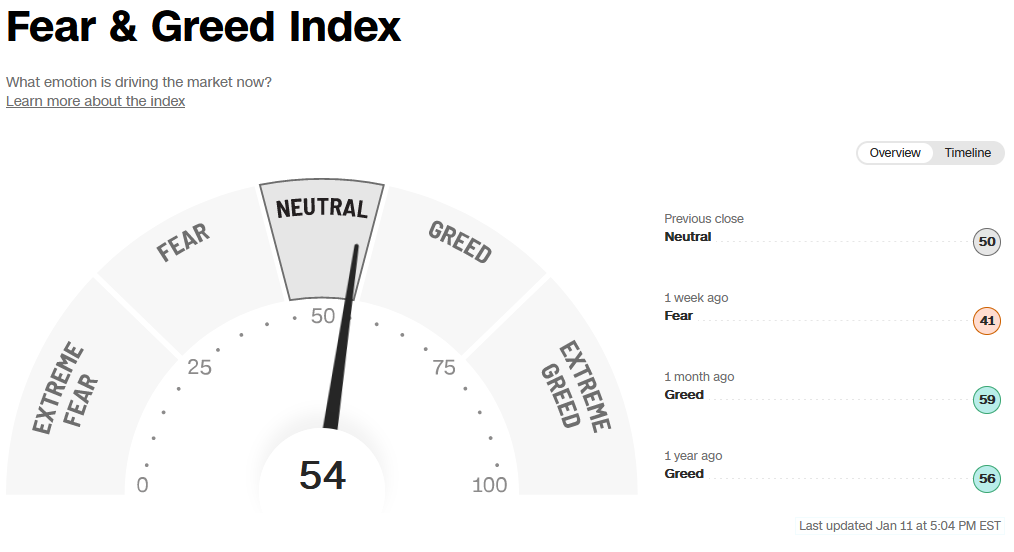

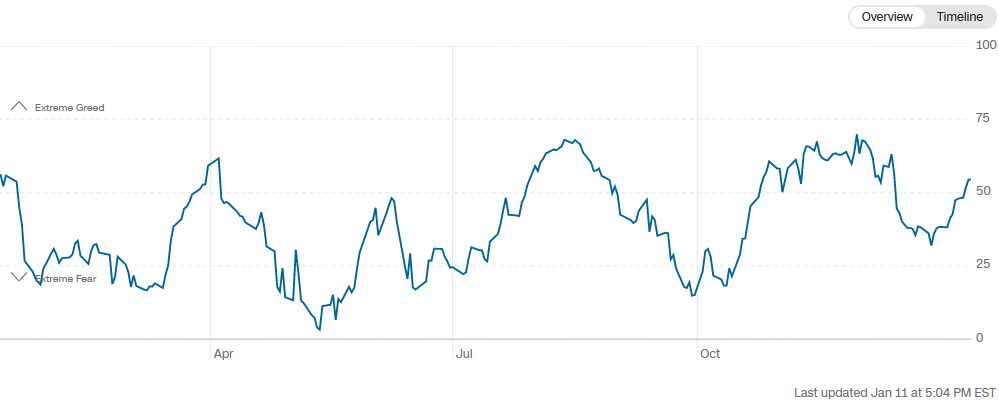

The CNN “Fear and Greed” rose from 40 last week to 54 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

(Click on image to enlarge)

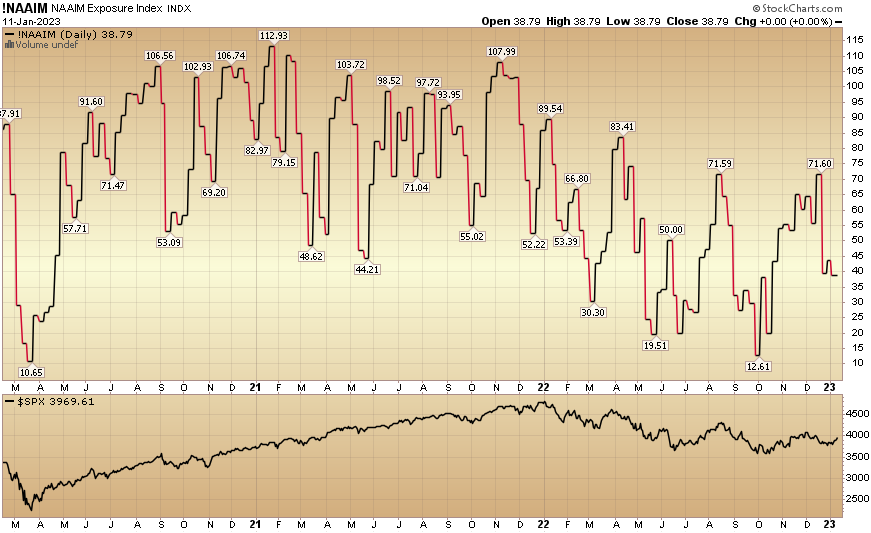

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 38.79% this week from 43.48% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Damn Strait” Stock Market (And Sentiment Results)

The “3 Magic Words” Stock Market (And Sentiment Results)

“Take A Brea(d)th” Stock Market (And Sentiment Results)…

Disclosure: Not investment advice. Visit Terms at HedgeFundTips.com