Franklin Resources: Time To Buy

Franklin Resources (NYSE: BEN) is one of the lesser-known Dividend Aristocrats and is a Dividend Champion. However, investors should keep this stock. It is one of the large publicly traded asset managers in a consolidating industry. Most other large asset managers are privately held, like Vanguard and Fidelity. The firm is a survivor, and it actively returns cash to shareholders and is undervalued. The forward dividend yield is now roughly 4.2% and covered with a conservative payout ratio of ~30%. The dividend is growing and has been raised for 42 consecutive years. The stock price is down about (-17%) year-to-date it is trading at a low valuation of approximately 7.5 times forward consensus earnings. The combination of high dividend yield and low valuation means it is time to buy Franklin Resources.

Overview of Franklin Resources

Franklin Resources was founded in 1947 by Rupert Johnson, Sr. Today, Franklin Resources is a leading asset manager offering equity, fixed income, and international mutual funds to retail investors and institutions. The firm’s top brands are well-known, including Franklin Templeton, Brandywine, Western Asset Management, Clarion, Martin Currie, and Royce.

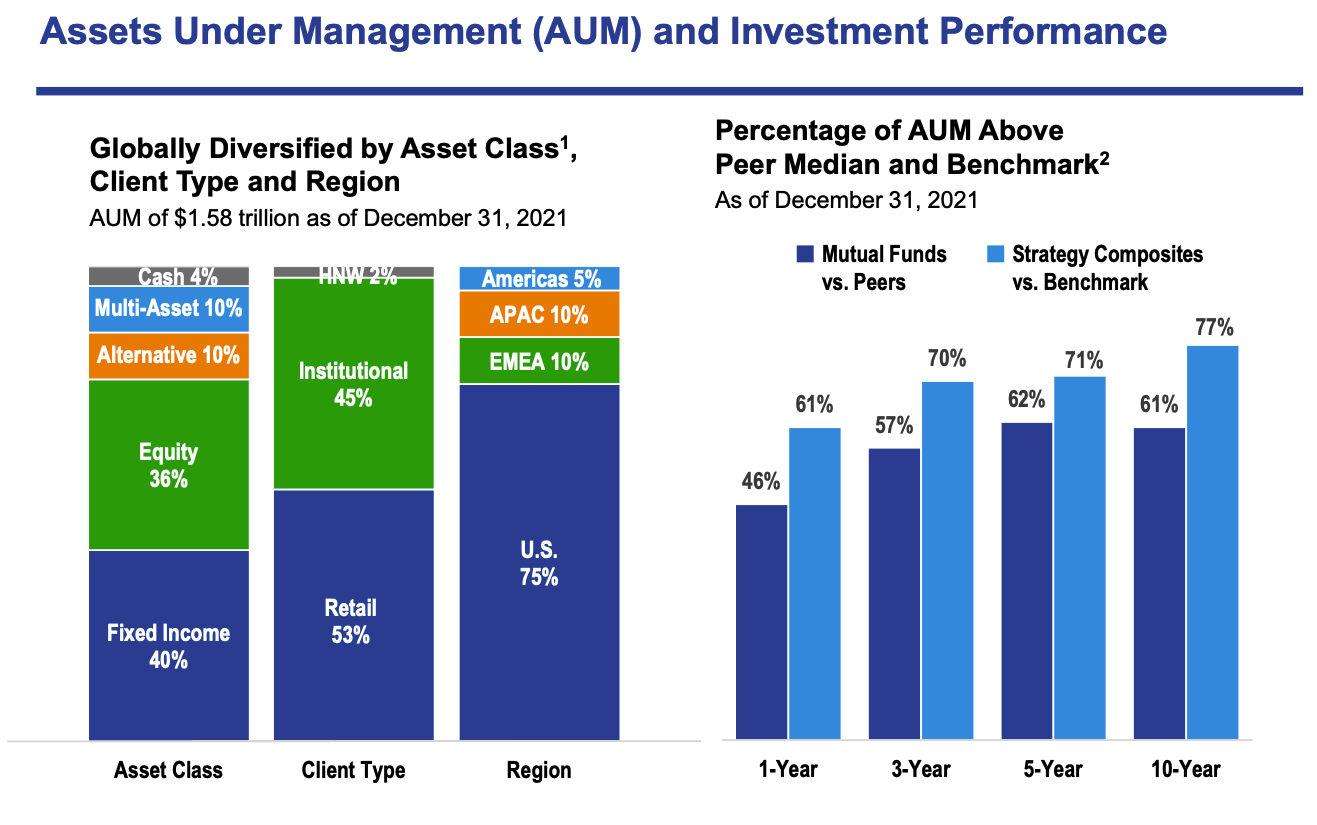

At the end of Q1 FY 2022, it had $1.578 trillion assets under management (AUM). The AUM was divided into 40% fixed income, 36% equity, 10% alternative, 10% multi-asset, and 4% cash. Client type was 53% retail, 45% institutional, and 2% high net worth. Reportedly, the company’s funds outperform most of its peers and benchmarks over longer periods.

(Click on image to enlarge)

The Johnson family still controls the firm, and family members are the Chairman of the Board, Vice-Chairman, and Chief Executive Officer. The family owns about 40% of the stock.

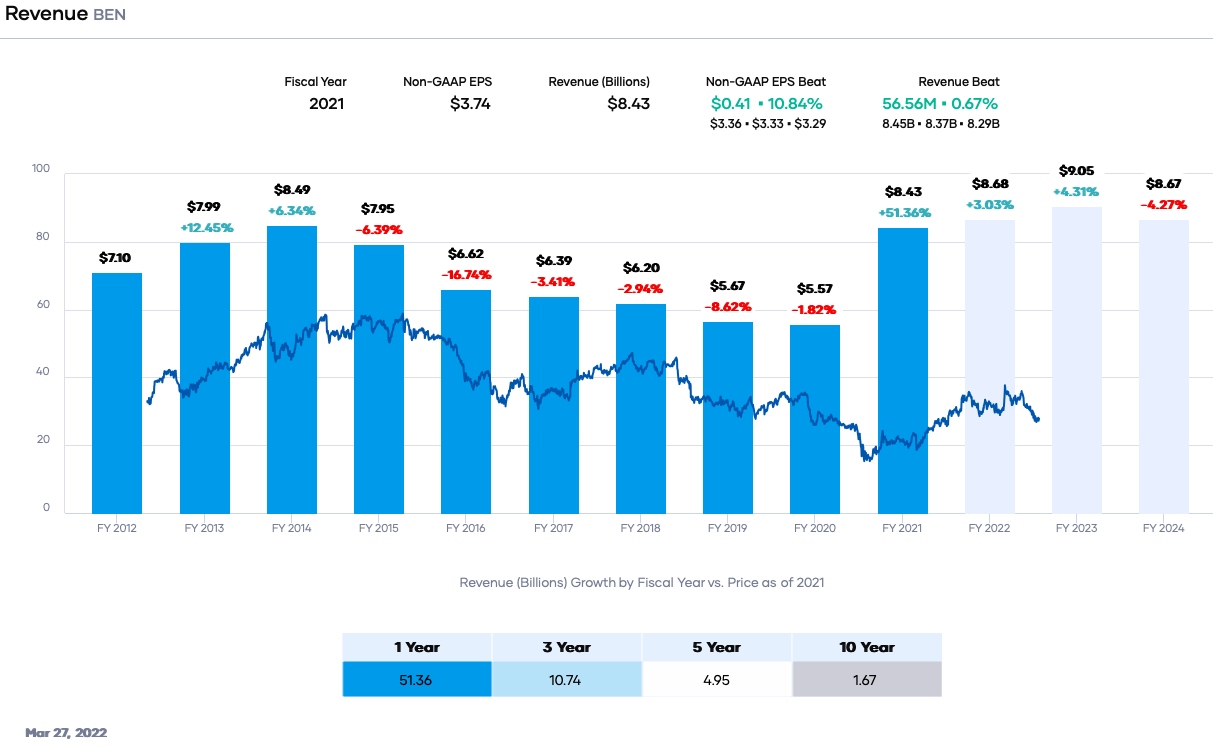

Total revenue was $8,425.5 million in fiscal 2021 (fiscal year ends on September 30th) and $8,654.4 million in the past 12 months.

Franklin Resources’ Revenue and Earnings Growth

Franklin Resources faces challenges in generating revenue and earnings growth in a very competitive industry. In the past decade, revenue peaked in 2014 and started a multi-year decline. Asset managers receive the great majority of their income from declining management fees. In turn, this has caused volatility in earnings.

The main issue is industry-wide fee compression and investor preferences for passive index funds and exchange-traded funds (ETFs). Investors are increasingly aware that high expense ratios detract from mutual fund performance. According to Morningstar, fees have fallen for two decades, led by index funds. This long-term trend means the primary source of revenue for asset managers is declining in the race to zero.

(Click on image to enlarge)

Portfolio Insight

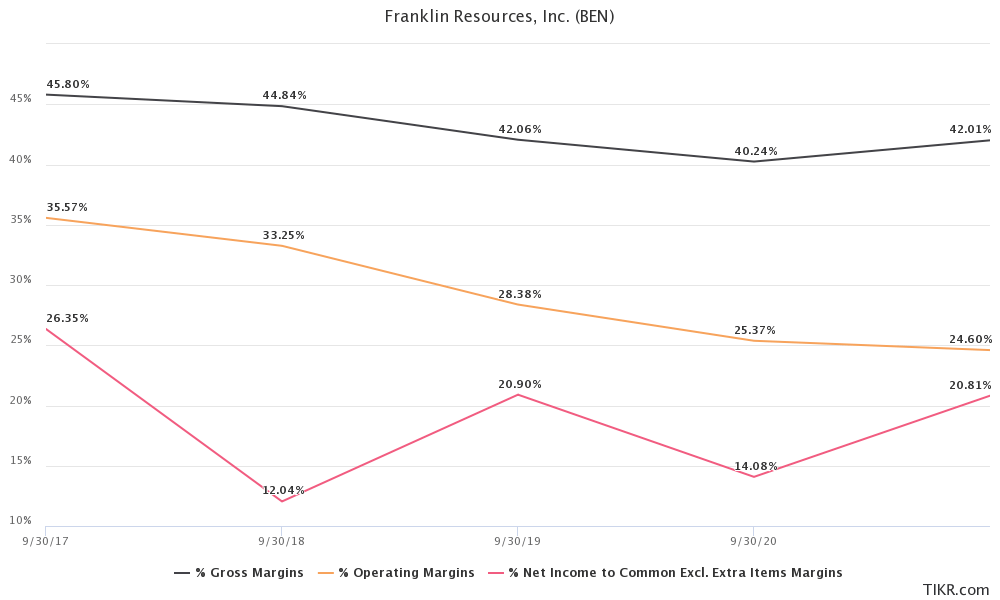

Negative revenue growth and volatile profitability mean the industry must consolidate. Franklin Resources has been active on this front and reversed the long-term revenue decline by acquiring Legg Mason in 2021 for $4.5 billion. Furthermore, the acquisitions may help with declining gross, operating, and profit margins over the past few years. The higher AUM will be spread over lower fixed costs as operational efficiencies take hold.

(Click on image to enlarge)

TIKR

The firm is still active on the acquisition front and acquired O’Shaughnessy Capital Management in 2021 and plans to acquire Lexington Partners. These acquisitions will increase Franklin Templeton’s AUM. The Lexington acquisition alone will add about $35 billion in AUM in alternative markets. As a more prominent player with an excellent financial position and family control, the firm will likely continue to be a consolidator in the industry.

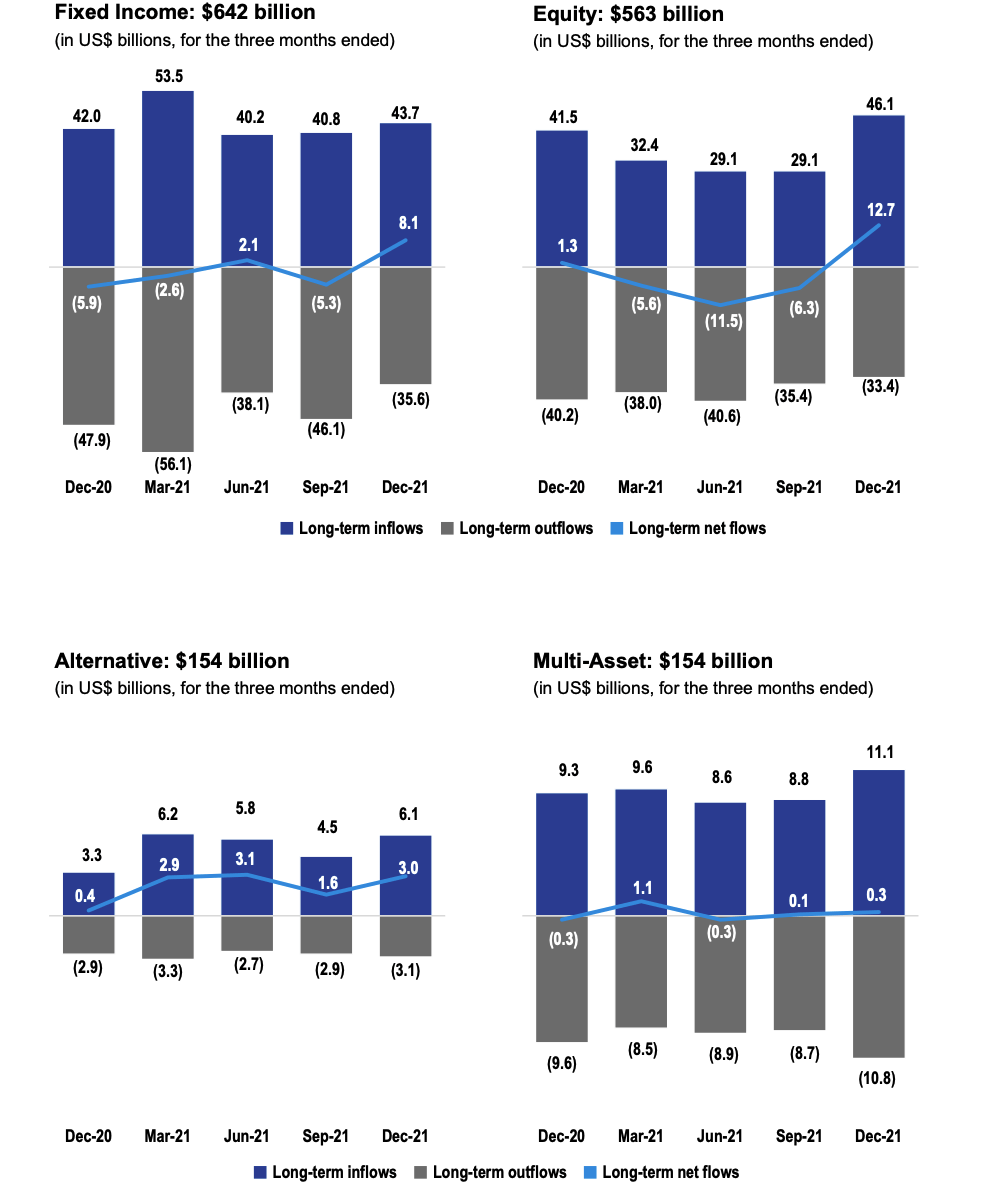

In terms of organic growth, Franklin Templeton has struggled with net outflows in its equity funds and, to a lower extent, in its fixed-income funds. Recently, though, this has reversed. The fund has more success with alternative and multi-asset funds, but these asset classes are smaller.

(Click on image to enlarge)

Franklin Templeton Q1 FY 2022 Earnings Release

Risks to Franklin Templeton

Franklin Templeton's primary risks are regulation, fee compression, and poor fund performance.

The firm operates in a highly regulated industry. This fact leads to high requirements for compliance. Along these lines, data breaches and employee misconduct are also legal and reputational risks.

Fee compression is a secular industry trend that the firm has little control over. Fees continue to drop for the reasons described above. Net outflows will also affect fee revenue because lower AUM means less revenue. Investors moving money between asset classes may also impact fee revenue. Fixed income and cash have lower fees than equity or alternative asset classes. For example, the adjusted effective fee was 0.387% in the most recent quarter. This was comprised of equity (0.31%), alternatives (0.63%), multi-asset/balanced (0.37%), fixed income (0.27%), and cash management (0.13%).

The other main risk is poor mutual fund performance. In the asset management industry, money often flows to funds performing well. Poor short-term or long-term performance will cause investors to pull cash from Franklin Templeton's funds. Although the firm does a reasonably good job with fund performance, this risk is omnipresent.

Franklin Resources' Dividend Growth and Safety

Franklin Resources is a Dividend Champion and Dividend Aristocrat with 42 years of dividend increases. The last dividend increase was 4.0%, with a quarterly dividend rate of $0.29 per share. The forward dividend yield is now approximately 4.17%. This value is more than the average dividend yield of ~1.3% for the S&P 500 Index and the trailing 5-year average of ~1.6%.

The company has paid a dividend since 1981. The dividend has grown at a double-digit rate for the past decade. The trailing 10-year dividend growth rate is 12.76% CAGR, the 5-year dividend growth rate is 8.84% CAGR, and the 3-year dividend growth rate is 5.95% CAGR.

(Click on image to enlarge)

Portfolio Insight

The dividend safety is excellent based on earnings, free cash flow, and conservative debt. Forward fiscal 2022 guidance for adjusted earnings per share is $3.72, and the forward annual dividend rate is $1.16 per share. These numbers give a payout ratio of about 31.2%. This value is conservative and below my criterion of 65%. The low payout ratio also supports long-term future dividend growth and safety.

In addition, the free cash flow more than covers the dividend and meets my target value. In fiscal 2021, free cash flow (FCF) per share was $2.38. The dividend-to-FCF ratio was about 49%. This percentage is below my target value of 70% and is conservative for dividend safety.

Franklin Resources has a net cash position adding to the dividend safety. At the end of Q1 FY 2022, the company had $4,178.8 million in cash and cash equivalents. There was no short-term debt, and long-term debt was $3,393.7 million. In addition, the firm owned about $1,663.2 million in long-term investments. Furthermore, the rating agencies give Franklin Resources an A / A2 upper-medium investment-grade credit rating. As a result, there is little risk to the dividend from debt.

Valuation for Franklin Resources

We use the forward consensus guidance of $3.72 per share to determine a fair value estimate for Franklin Resources. We will use 10X as a reasonable value for the price-to-earnings (P/E) ratio, which is in the range in the past 5-years. We use a slightly lower multiple to account for fee compression and other risks. Our fair value estimate is $37.20. The current stock price is ~$27.83, indicating the stock is undervalued based on forward earnings estimates.

Applying a sensitivity analysis using P/E ratios between 9.0 and 11.0, I obtain a fair value range from $33.48 to $40.92. Thus, the current stock price is ~68% to ~83% of our reasonable, fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

9.0 |

10.0 |

11.0 |

|

|

Estimated Value |

$33.48 |

$37.20 |

$40.92 |

|

% of Estimated Value at Current Stock Price |

83% |

75% |

68% |

Source: dividendpower.org Calculations

How does this compare to other valuation models? An EV / EBITDA analysis from finbox results in a fair value estimate of $35.81. The calculation assumes a 6.9X last twelve months EBITDA and a 6.4X forward EBITDA multiples.

The Gordon Growth Model gives an estimated fair value of $29.00, assuming an 8% desired rate of return and a 4.0% dividend growth rate. The dividend growth rate is conservative and near the value over the past few years.

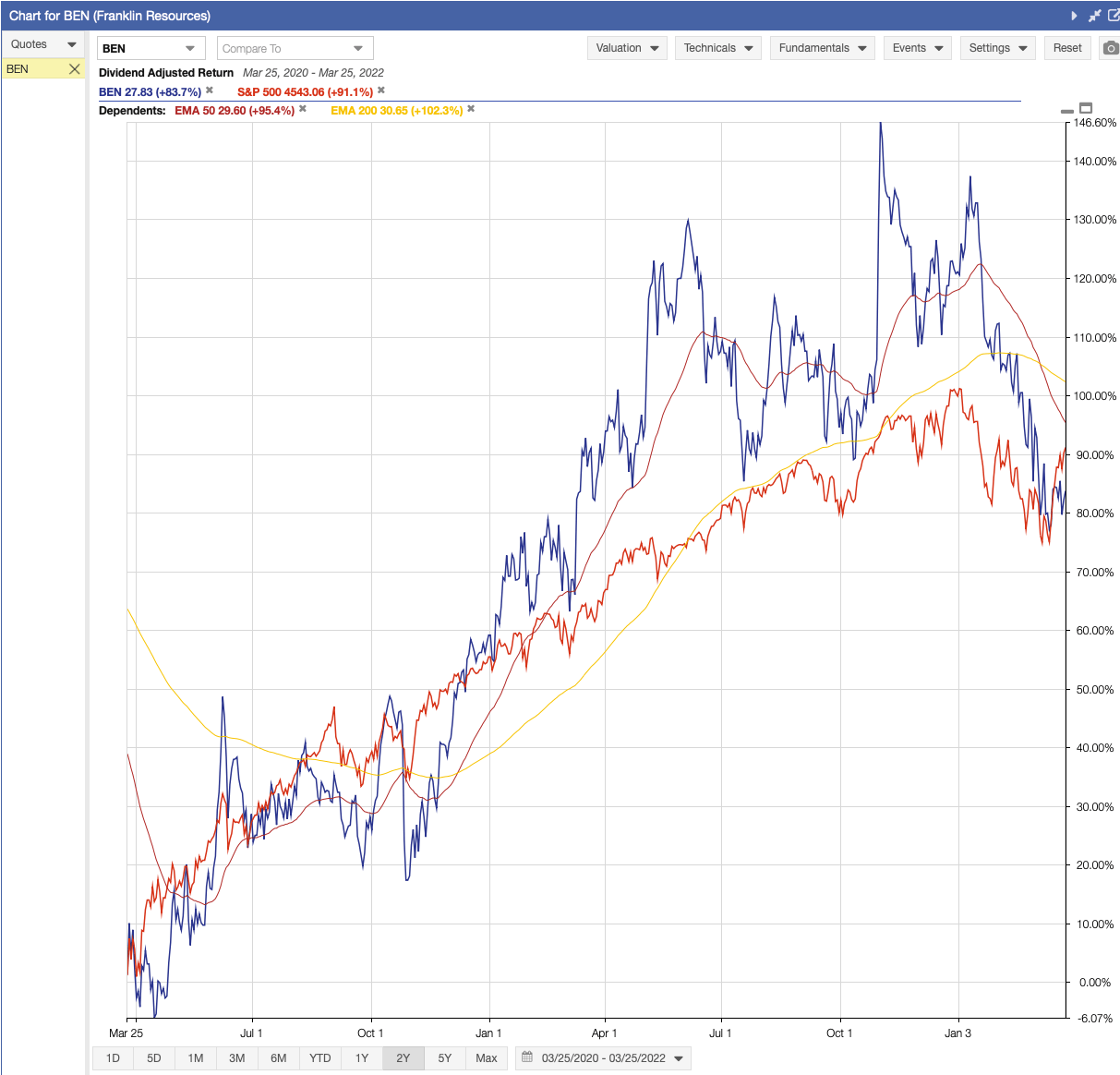

The average of these three models is approximately $34.00, suggesting Franklin Resources is undervalued at the current price. Furthermore, the stock is trading below its 50-day and 200-day exponential moving averages (EMA).

(Click on image to enlarge)

StockRover

Final Thoughts on Franklin Resources

Franklin Resources has struggled over the past several years due to industry-wide headwinds. Fees have come down, and competition from index mutual funds and ETFs has increased. However, the firm is actively growing through acquisitions adding scale and operational efficiencies. This growth should help with revenue and earnings growth, and margins.

In the meantime, Franklin Resources is a Dividend Aristocrat, and the dividend yield is near the all-time high. The dividend is supported by excellent dividend safety metrics and a net cash position on the balance sheet. The stock is undervalued and trading below its 50-day and 200-day EMA. Investors seeking income or to live off dividends should consider the stock. I view Franklin Resources as a long-term buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 ...

more