Four Stocks To Watch This Week - Tuesday, July 16

Image Source: Pexels

While the DIA delivered an expected uptick, the big surprise last week was the IWM which gapped up heavily on Thursday.

And now we have an awkward situation where all four main indices are somewhat overbought while still having upside potential.

We prefer optimal Big Money Footprint setups close to the important Key Levels (50 and 200 dma's).

A quick pullback would be helpful, but with earnings season now upon us and looking reasonably optimistic, the numbers of stocks fitting our criteria will be reduced due to the overbought nature of many of them.

The answer to this conundrum is to keep our shape. By this I mean keep focusing on stocks consolidating near their own Key Levels. Don't get suckered into already overbought positions.

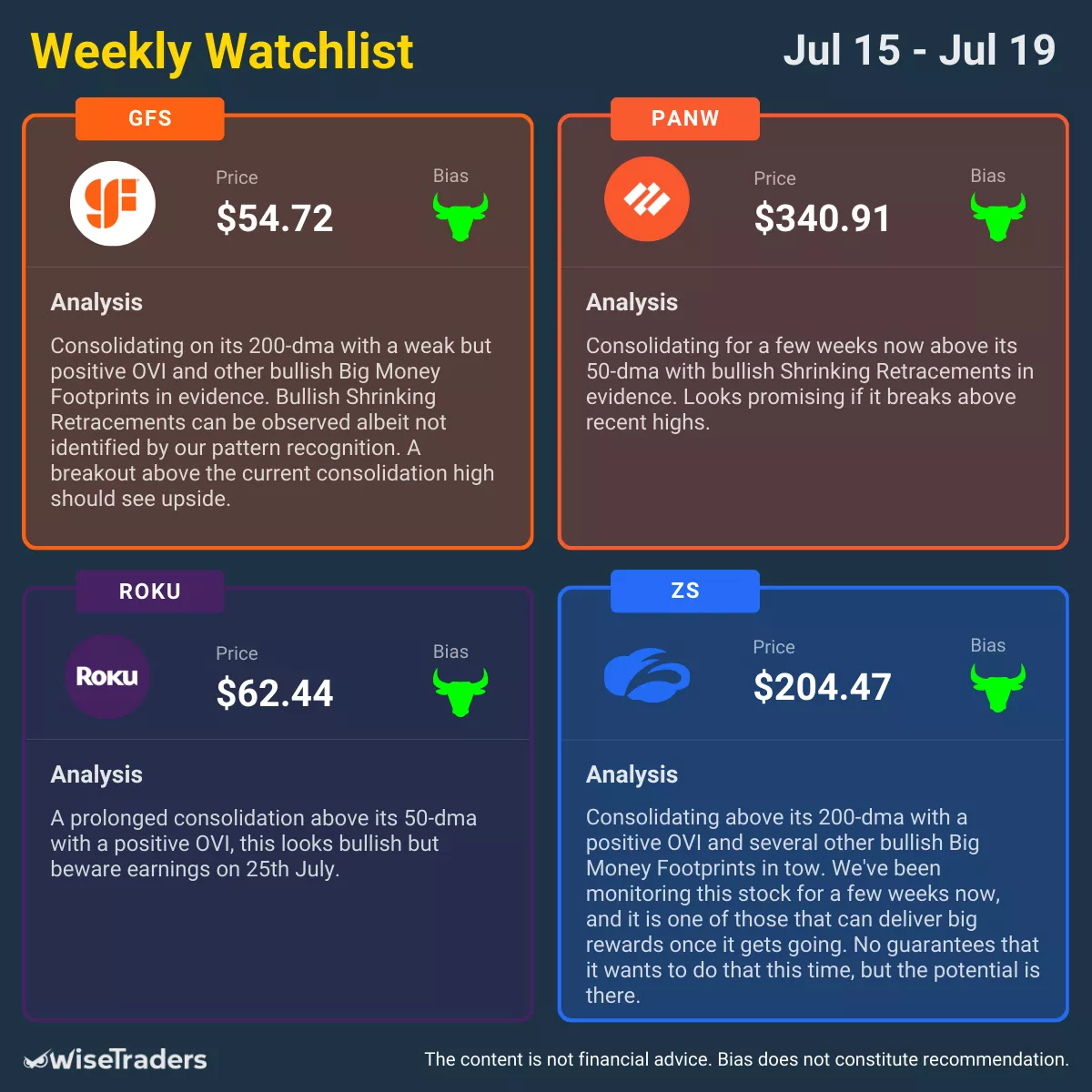

Here are four stocks to keep on your radar this week:

- GFS (bullish) - Consolidating on its 200-dma with a weak but positive OVI and other bullish Big Money Footprints in evidence. Bullish Shrinking Retracements can be observed albeit not identified by our pattern recognition. A breakout above the current consolidation high should see upside.

- PANW (bullish) - Consolidating for a few weeks now above its 50-dma with bullish Shrinking Retracements in evidence. Looks promising if it breaks above recent highs.

- ROKU (bullish) - A prolonged consolidation above its 50-dma with a positive OVI, this looks bullish but beware of earnings on 25th July.

- ZS (bullish) - Consolidating above its 200-dma with a positive OVI and several other bullish Big Money Footprints in tow. We've been monitoring this stock for a few weeks now, and it is one of those that can deliver big rewards once it gets going. No guarantees that it wants to do that this time, but the potential is there.

More By This Author:

Individual Stocks Continue The Good, Bad And The Ugly

Four Stocks To Keep On Your Radar This Week

Holiday Week Action Suggests Optimistic Earnings Ahead

Remember, we only trade confirmed breakouts and always manage our trades with the E.D.G.E trade plan.

This watchlist ...

more