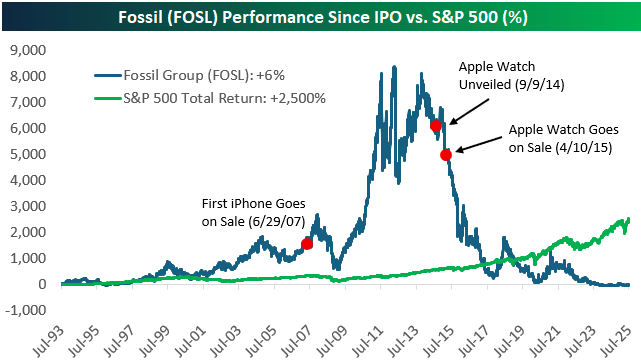

Fossil: From 8,000% To 6%

Fossil Group (FOSL) was one of the biggest post-financial crisis winners in the market, with its stock surging to a post-IPO gain of more than 8,000% at its highs in the mid-2010s. The company had built a dominant brand in watches, and investors rewarded it with a meteoric run that outpaced just about everything else at the time. But as the chart below shows, that entire move ultimately proved fleeting. Today, FOSL is up just 6% since its IPO in 1993, while the S&P 500 is up more than 2,500%. So what happened?

The turning point came in September 2014 when Apple unveiled the Apple Watch. At the time, the product hadn’t launched yet and there was still plenty of debate over whether consumers would embrace wearable tech. But investors didn’t wait to find out. FOSL’s stock started dropping almost immediately and has never recovered. As Apple’s ecosystem expanded, Fossil’s relevance shrank, and the stock followed.

Fossil wasn’t a company in obvious decline when the Apple Watch was announced. In fact, its fundamentals were still strong. But the market is forward-looking, and it doesn’t wait for earnings reports to adjust. Just the idea of a better product from a bigger competitor was enough to spark a mass exodus. While consumers were still deciding if they needed a smartwatch, Wall Street had already moved on.

That’s why this chart matters for today’s winners. Any of the stocks leading the market higher right now could be like Fossil in 2014. Massive runs, strong fundamentals, and dominant positions in a booming narrative. But disruption rarely announces itself in advance, and today’s leaders don’t have to stumble on their own to fall out of favor. All it takes is a shift in the landscape, whether it's a better chip, a new platform, or a change in demand.

No one’s saying today's market leaders are doomed, but Fossil’s chart is a reminder of how quickly things can turn, and how the market often sees it before the headlines do. Even an 8,000% gain can vanish if the narrative flips. It’s a good reason to stay humble and diversified and always think about what’s coming around the corner.

More By This Author:

Profit Taking And Discount ShoppingSmall Business Foibles

Beating The Odds

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more