For Dividend Growth HPQ Versus HPE Or Both?

Dividend Growth HP Inc versus Hewlett Packard Enterprise

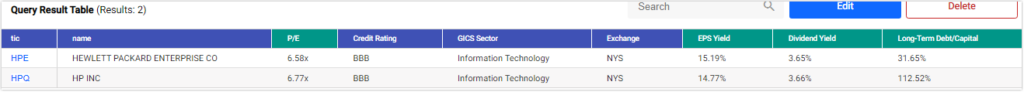

Value investing is all about finding bargains that meet your investment goals and provide a margin of safety long-term. HP Inc (HPQ) and Hewlett-Packard Enterprises (HPE) represent two dividend growth stocks with uncanny similarities regarding valuation and yield. In November 2015 Hewlett-Packard spun off Hewlett-Packard Enterprises into a separate business. Hewlett-Packard a.k.a. HP Inc. kept the iconic HPQ stock symbol and the historical stock price data. When viewed separately it seems that the spinoff unlocked shareholder value for both companies.

(Click on image to enlarge)

HPE versus HPQ

In this video, we compare the two that currently offer almost identical dividend yields and historically low valuations. The viewer can then decide for themselves whether they buy either company or both. Regardless, we believe both entities represent good value over the long run with an adequate margin of safety. Of course, as value stocks both seem currently out of favor and could go lower. Remember: “they do not ring a bell at the top or bottom of the market.”

Video Length: 00:20:14

More By This Author:

The Normal P/E Ratio (The Blue Line) – What It Is And How It Works

3M: Is The Potential Reward Worth The Risk?

What Is The P/E Ratio And How It Is Used For Investing

Disclosure: Long HPE at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more