FOMO Is Back, Baby

Image Source: Unsplash

FOMO is Back, Baby!

Traders have decided that even though it’s still earning nearly 5%, cash is trash compared to quick profits in a wide variety of risk assets.

Remember, market movements hinge on the equilibrium between fear and greed. While the “F” in “FOMO” is fear, FOMO is actually a manifestation of greed. Nervousness about losing money is fear. If you’re concerned about not making enough money, that’s greed. Right now, you have portfolio managers in both equity and fixed income chasing performance into year-end. While individuals are often perceived as being more susceptible to FOMO, it actually hits professionals more directly. No portfolio manager wants to underperform his benchmark and peers, so they need to be afraid of missing out. Momentum has a way of becoming self-fulfilling.

The root of the “everything rally” is the expectation that rates will be coming down, and that is indeed a solid reason for a rise in risk assets. Thanks to the combination of a positive read of yesterday’s Fed-speak and positive comments about bonds from famed investor Bill Ackman, we now see Fed Funds futures pricing in a rate cut in May instead of June. From a theoretical standpoint, almost every pricing model utilizes risk-free rates as a discounting mechanism. For bonds, it’s obvious – if short-term rates come down, that needs to be reflected throughout the yield curve. In the case of stocks, if rates are declining, the present value of a company’s future cash flows increases, and thus so should its stock price. In the case of gold, I prefer to think of it as an “anti-dollar” than an inflation hedge. Remember, the rate cuts are predicated on tame inflation, but since lower US rates reduce the appeal of the dollar, the falling dollar boosts gold. A lower dollar also benefits multinational stocks.

But the more immediate situation is that investors have become addicted to liquidity and thus get very excited about the possibility of a fresh dose. The prospect of easy money allows Bitcoin to zoom on anticipation of ETF listings based upon the inherent assumption that the public is waiting around to put their money into those funds. It’s certainly more likely if folks are in a speculative mood. And we have a rally in GameStop (GME) today…

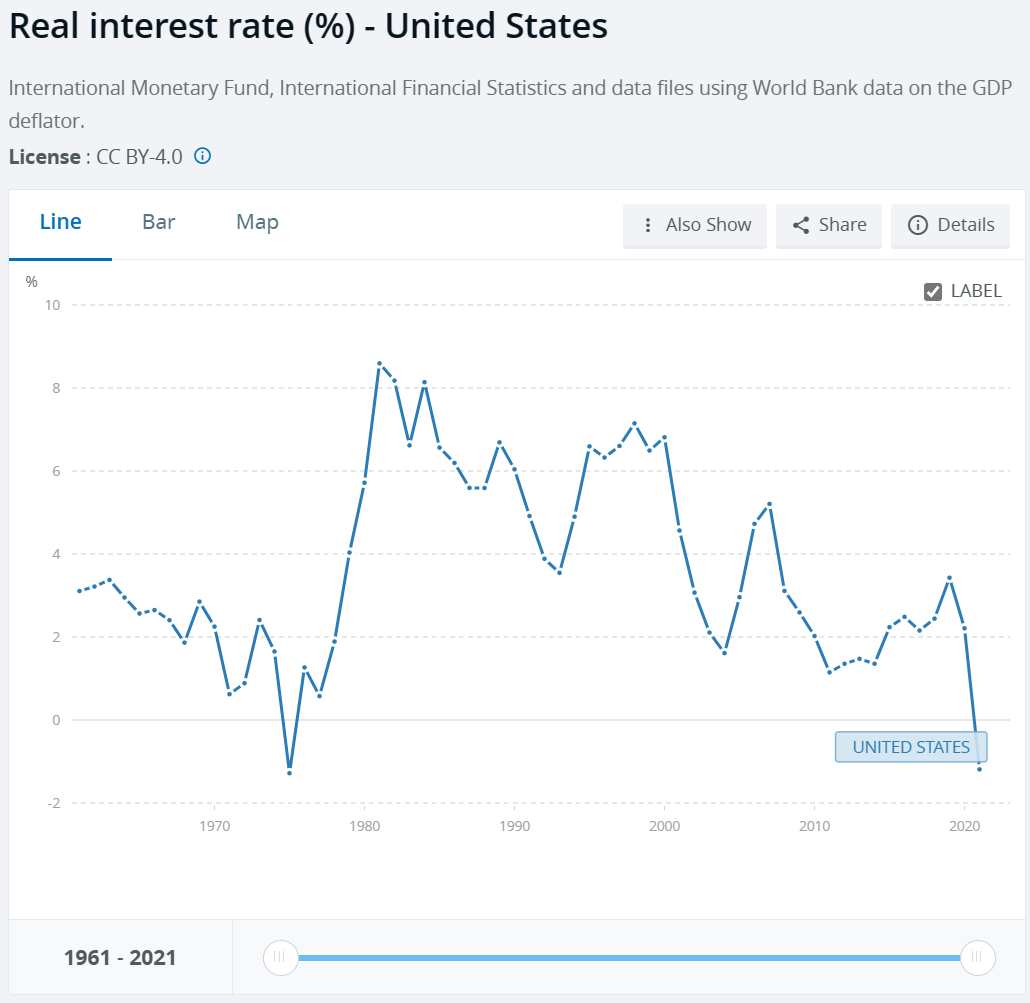

My concern is that stock traders have become more enamored about the prospect of cuts without fully considering the “why.” If we do get a soft landing, why would the Fed be willing to cut as early as May? They would need to see sustained 2% inflation. Considering we’re not there yet, that seems premature. And it’s also not clear that the Fed will see the need to lower real interest rates pre-emptively if the economy is chugging along modestly. Remember, it’s the last few years that have been abnormal in that regard. The current rate is a bit high on a historical basis, but not out of line with what prevailed prior to the Global Financial Crisis. (see graph at bottom)

Finally, consider also that next year is an election year. The Fed is historically loath to change rates ahead of an election to avoid perceptions that they are picking sides. As we saw in 2020, it is unlikely that the Fed would refrain from activity if circumstances dictate. But it would also mean that any pre-emptive or discretionary changes would likely need to occur earlier in the year. Futures are currently pricing in at least one rate cut between July and November.

As noted above, I have no reason to doubt that the Fed would be quick to cut rates or back off QT if economic circumstances dictate. But those circumstances are not what is priced into the market right now. Be careful what you wish for.

(Click on image to enlarge)

More By This Author:

Selective Listening Among Dueling Fed Speak

Has Volatility Been Permanently Subdued?

S&P Global Reports Declining Employment

Disclosure: FUTURES TRADING

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC ...

more