S&P Global Reports Declining Employment

Markets are mixed in today’s shortened trading session against the backdrop of a light economic calendar. Today’s post-Thanksgiving flash U.S. Purchasing Managers’ Index from S&P Global depicted continued economic expansion even though employers reduced their staffing for the first time in three and a half years. While America celebrated the holiday, the European Union’s data was far more gloomy, pointing to another quarter of economic contraction.

U.S. Hiring Turns South

Manufactures trimming headcounts isn’t a new development, in fact, they reduced staffing levels last month as well. The surprise in this morning’s report was that employment weakness has now spread to servicers, with overall employment turning negative for the first time since July 2020.

Economic Growth Remains Positive

This morning’s Purchasing Managers’ Index (PMI) for services depicted slow economic growth even as employers cut staffing. This month’s 50.8 index figure narrowly beat expectations of 50.4 while slightly improving from October’s 50.6. Demand conditions improved slightly even as firms raised their selling prices, which together helped offset the negative impact of declining employment and reduced backlogs. Servicers appear to be focusing on margins, as they raise prices for consumers at a disproportionate rate relative to their input costs. Input costs by the way, benefitted from reduced staffing, softer wage pressures, and declining commodity prices, especially oil. Still, service sector confidence dipped to the lowest level since July as consumer spending uncertainty heightens.

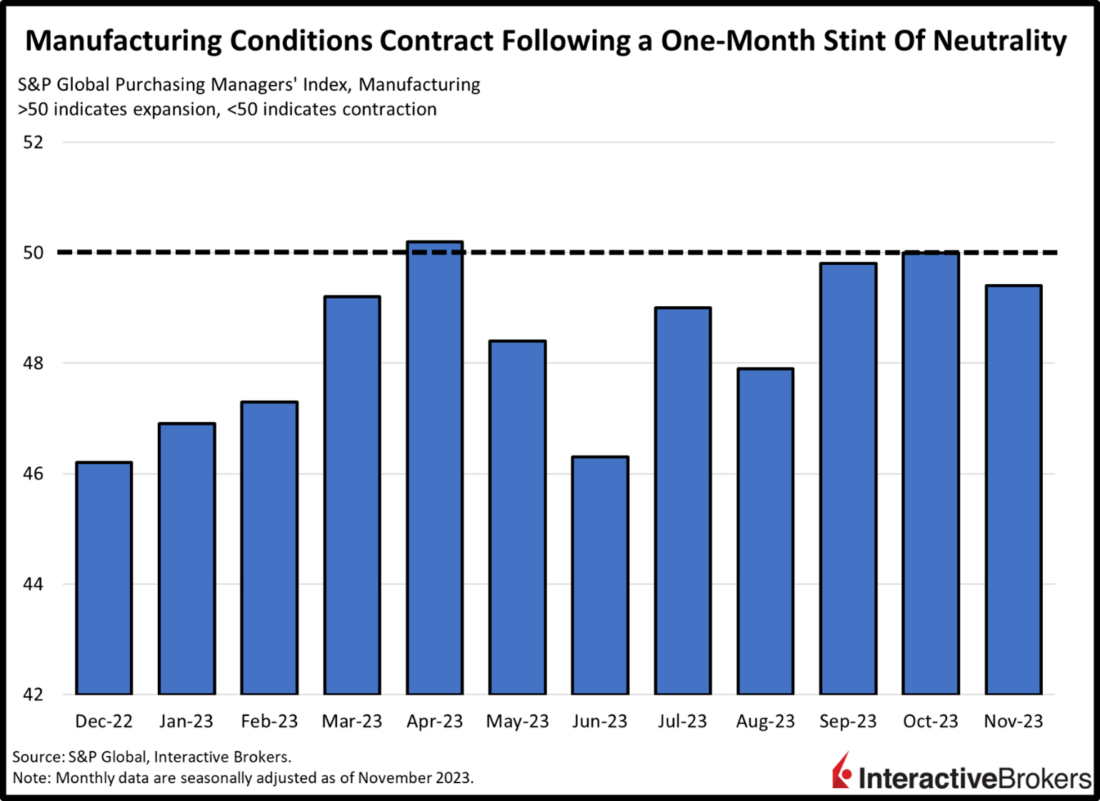

Manufacturing Turns Negative, Again

The Manufacturing PMI turned negative after a one-month stint exactly at the expansion-contraction threshold of 50. This morning’s 49.4 result, furthermore, missed projections of 49.8. New orders were flat, which drove a decline in headcounts, but manufacturers nevertheless reported stronger output driven by efficiency improvements in production processes. Weakness in overall demand alongside increased efficiencies caused backlogs to decline. On the other hand, foreign demand increased, a result of a weaker dollar and lower interest rates. Rising productivity amidst growing international demand led to a slight uptick in manufacturer confidence. Still, manufacturers will need much stronger orders in the medium term to maintain scale, since they can’t work on backlogs forever.

(Click on image to enlarge)

Euro Area Remains Sluggish

Turning to the EU, yesterday’s PMI’s were much worse as consumers turn increasingly cautious, leading them to spend less. The services PMI came in at 48.2 for November, roughly in-line with the consensus estimate of 48.1 but slightly higher than last month’s 47.8. The manufacturing figure arrived at 43.8, slightly better than the 43.4 anticipated and October’s 43.1. Strong cost inflation driven by wage pressures contributed to further weakness in new orders as prospective customers tightened their purse strings. Lethargic this month and last points to another quarter of negative GDP growth, which can be interpreted as a “technical recession”.

Cyclicals & Defensives Higher, Tech and Bonds Lower

Stock indices are mixed while bond prices decline on a light-volume day. For stocks, the cyclical Russell 2000 and Dow Jones Industrial indices are leading as their prices rise 0.8% and 0.3%. The Nasdaq Composite and S&P 500 indices aren’t enjoying the same fortunes, meanwhile, with the former down 0.3% while the latter is lower by 0.1%. Sectoral breadth is impressively positive, with energy and materials leading with gains of 0.9% and 0.5%. Technology and communication services are the only two sectors lower. Both have dropped 0.5%. Bond yields are trading higher, with the 2- and 10-year Treasury maturities trading at 4.95% and 4.49%, as yields rise 5 and 7 basis points (bps) across the instruments. The dollar is weaker though, with the greenback losing value versus the euro, pound sterling, franc, yen and Aussie and Canadian dollars while it gains against the yuan. The Dollar Index is down 31 bps to 103.43. Crude oil is recovering, as market players dial up expectations of OPEC + production cuts at this Thursday’s meeting. WTI crude is up 0.6% or $0.42 to $76.74 per barrel.

The Cost of Lower Inflation

With today’s data reflecting reduced headcounts across the U.S. economy, some market watchers are questioning if the traditional correlations regarding employment and inflation still hold, at least to a degree. Next week’s data covering new home sales, consumer confidence, personal Income & outlays and ISM-manufacturing are likely to provide further color on the situation. As we remain in a strong seasonal period for stocks, another important question is whether the “Santa Rally” was has already occurred, with the S&P 500 Index up 18.3% year-to-date at a time when employment growth went negative, according to S&P Global. Do we cheer incoming rate cuts, or do we mourn the loss of jobs?

More By This Author:

Score One For The Options Traders On Nvidia (So Far)Options Market Expectations For Nvidia Earnings

Hey ChatGPT, What’s A Soap Opera?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more