Follow-Through Thursday – Big Earnings Test

I told you earnings would be tricky.

It looked as though Sales and Earnings were growing (in absolute terms), but after 73% of S&P 500 companies reported, Sales Growth is now barely positive (0.7%) and earnings growth is at -7.4% and, when we look at the broader US equity market (3,076 companies) Sales Growth is not even positive anymore with earnings also down -7% (almost half of the companies have reported).

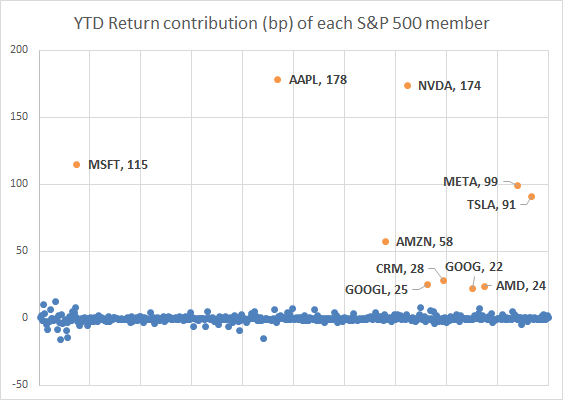

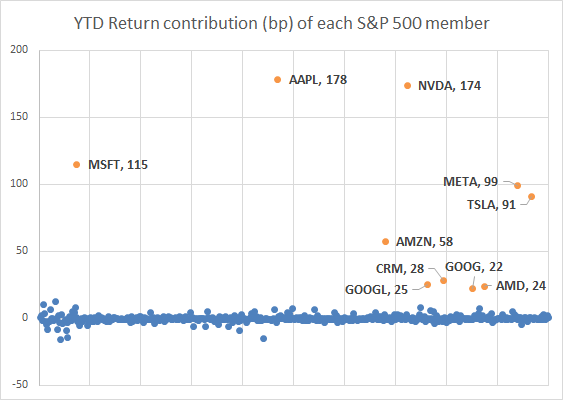

I’m not going to get too into the numbers but StockTwits has a useful mini-chart view of reporting companies (from Benzinga) and you can play with that. Too much red for my taste! And, still very disturbing – just 10 stocks in the whole S&P 500 are actually up more than 15% for the year (and two of them are GOOGL!) and, of course, they are the ones we discussed who SELL the AI, for the other 490 companies – AI is just a new expense they have to account for:

Not TSLA, of course, as with everything he does, Musk just claims he invented AI years ago and he’s already got a better version which will be rolling out next year. CRM is the real exception here as they are simply using AI to improve their product and this company is trading at $220.50, which is a $215Bn market cap for a company that made $200M last year and Q1 + Q2 have been about $100M so far in 2023 (they are 1 quarter early) so unless they somehow made $5Bn in Q3 (8/25 report) this valuation is way ahead of itself.

They started the year at $135 so that’s up 63% so far yet the very AI they are using to get people excited it the same AI that will make their data integration systems pointless in the future. The company laid off 10% of its workforce in January and cut back on office space as well. While you can applaud them for “prudent cost-cutting” – do those sound like the actions of a company whose valuation has grown 63% in 7 months?

More cuts are expected, by the way…

(Click on image to enlarge)

This is the problem with most analysts – they haven’t actually WORKED for real companies and they don’t understand that growing companies don’t lay off employees in a tight labor market – it’s just not worth the time of having to hire and train more people if you think you are going to need them in less than a year. And 10% is not a little – imagine cutting 10% of the people from your workforce. That would certainly NOT make you more productive, would it?

We’ll see how the big-name Earnings Reports go this week and next. Meanwhile, Productivity came in high at 3.7% after being down 2.1% in Q1 so I guess AI is helping a bit. As you would expect with machines replacing people, Unit Labor Costs have dropped to 1.6% from 4.2% last quarter – two nice improvements. Jobless claims were the usual 227,000 and continuing claims the usual 1.7M.

We get Services PMI, Factory Orders, and ISM later this morning.

More By This Author:

TGIF – Bank Earnings Boost MarketsTuesday Already?

Monday Market Mayhem – Trade Wars

Click here to try Phil's Stock World free. Try PSW's ...

more