Financial Stocks Are Cheaper Than Usual

Financial Stocks Portfolio

Since the recession of 2008 to 2009, financial stocks, in general, have been trading at significantly lower valuations than normal. This creates several opportunities for the value investor. First of all, there is always the potential turbocharging of your performance if the stocks move back into a more normal and comparable valuation range. However, many of the high-quality dividend growth stocks in the financial sector are cheap today by any standard definition of valuation.

In this video, we cover 5 very high-quality A-rated or better life and health insurers all with long-term debt to capital levels of 25% or lower. Moreover, each of the 5 stocks I cover today offers dividend yields much higher than the yield you can get from the SPY. This combination of quality, low valuation, and high yield make these blue-chip dividend growth stocks worthy of further evaluation by the prudent dividend investor.

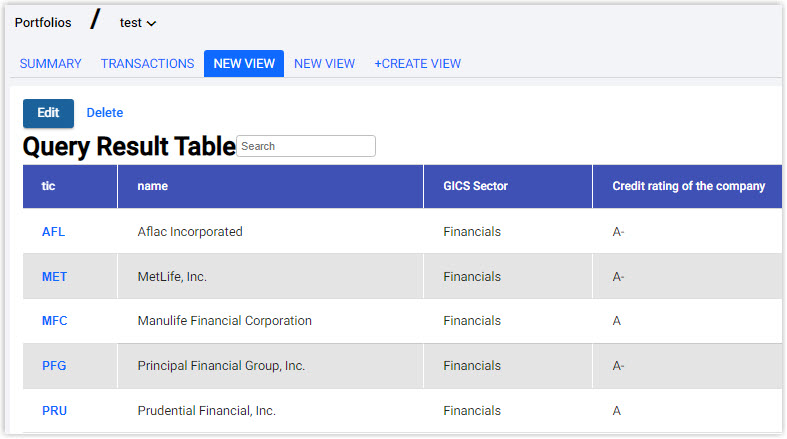

The Stocks I will go over are Aflac (AFL), MetLife (MET), Manulife Financial (MFC), Principal Financial Group (PFG), and Prudential Financial (PRU).

Video Length: 00:18:31

Disclosure: Long AFL, MFC, PFG, PRU at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a ...

more