Finally A Down Day – Sentiment Back To Greedy

The stock market finally had a down day, albeit a small one where the damage was seen in the mid and small caps. The media can stop with the nonsense about how many up days in a row the S&P 500 has seen. The bottom line is that momentum has been strong and some thrusts off of the mini-crash low on August 5th have been triggered. While that’s relatively unimportant for the short-term, it does typically insulate the stock market from more serious damage over the coming 6-12 months.

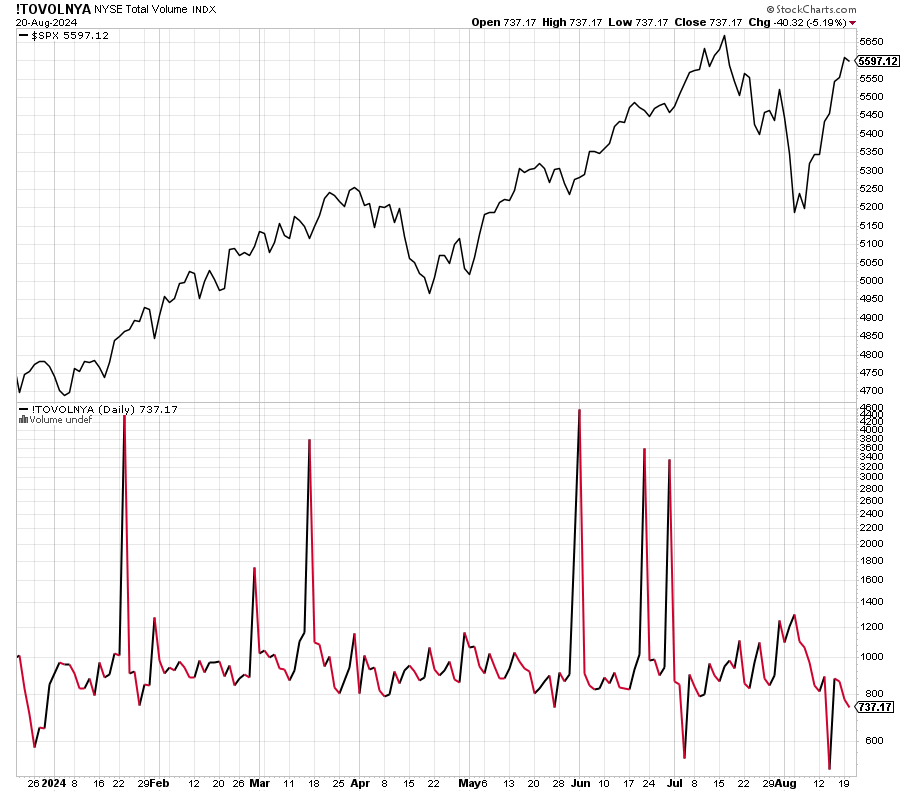

Let’s check in on total volume on the NYSE. The upper chart is the S&P 500 while the lower one is volume. On the far right of the lower chart you can see that volume has been very light during the whole rally, even taking into account that “everyone” is frolicking in The Hamptons. I would have thought that number would have increased by now, volume that is, not the frolickers.

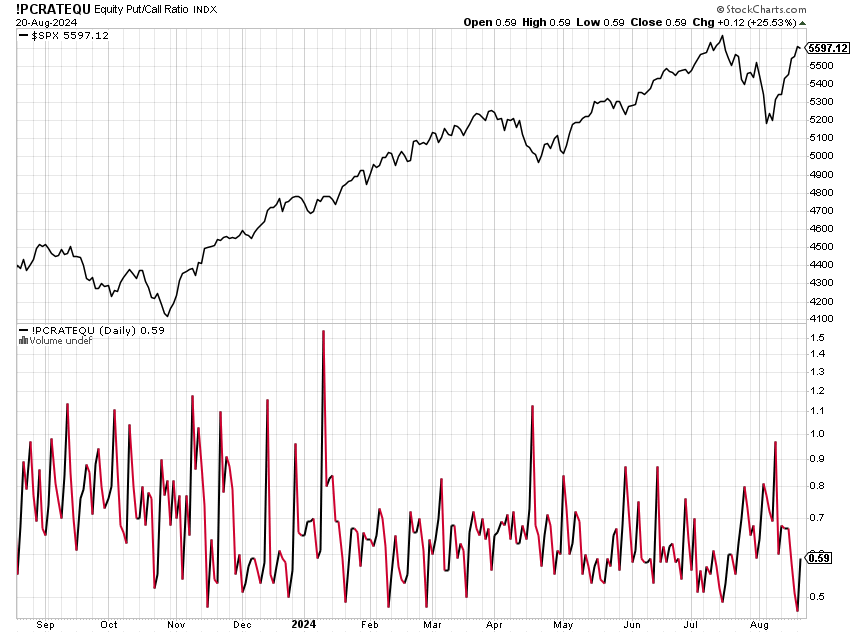

Sentiment has also done a complete 180 since the rogue wave on August 5th. No matter which options metric I use, we can clearly see that traders went from fearful to greedy in just a few weeks. Below are the daily put/call readings for equity option traders. Without getting too wonky, daily readings under .60 show people taking the bullish side. On Monday it was below .50. On August 5th it was almost 1.0. These readings are volatile so smoothing them out with a moving average can be helpful.

Stocks have run hard and fast so some pause to digest or minor pullback is to be expected. However, because the recovery has been so powerful, it needs to continue without much damage or that light volume on the way up is going to invite selling in a few weeks.

On Monday we bought DRN, more RYVIX, more RYFIX, more RYZAX and more levered NDX. We sold levered inverse NDX. On Tuesday we bought levered inverse NDX. We sold levered inverse S&P and some levered NDX.

More By This Author:

Earthquake Or Rogue Wave – A Look At 1997 And 1998 For CluesEarly Or Wrong?

Big Run Up – Sell A Higher Open

Please see HC's full disclosure here.