FedEx Corp.: Fundamentals Support The Price Increase

After reporting better than 4th quarter results on Tuesday, the stock price of FedEx Corp. (FDX) has been on a tear. With this article, I plan to demonstrate that the fundamentals support the current price rise. Moreover, the fundamentals also suggest that it is not too late to take a long-term position in this leading air freight and logistics company.

Yesterday, FedEx reported a surge in quarterly adjusted earnings of $2.53 per share compared to expectations of $1.52 per share. Even though these earnings were almost 50% lower compared to the same period last year due to the coronavirus pandemic, they were obviously well ahead of expectations.

The pandemic really hurt FedEx’s global trade and commercial business-to-business shipments for both express and ground, and additionally weakened the company’s light truckload volumes. These headwinds exasperated the lost Amazon revenue that FedEx intentionally relinquished last year. Nevertheless, the 4th quarter report produced signs of progress and the reestablishment of long-term future growth once the current pandemic is over.

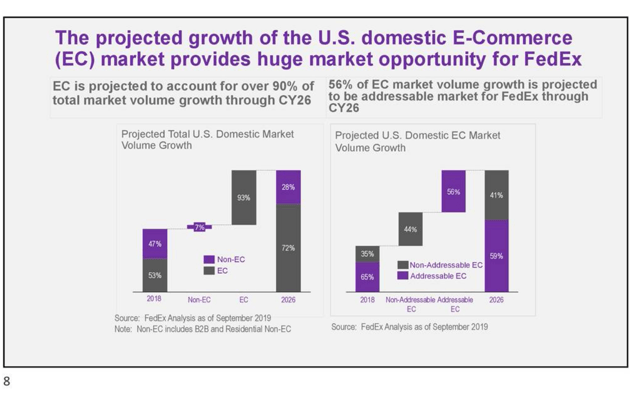

However, as Morningstar pointed out, the pandemic has accelerated the broader shift to e-commerce sales for large retailers, which they suggested materially drove up demand for residential business to consumer package deliveries. As a result, ground saw a staggering 25% jump in average daily packages and residential deliveries ballooned to 75% of US sales for the quarter. This contrasted with 56% of sales a year ago. Morningstar also reported that, and I quote “express’ Asia outbound and Europe outbound volumes strengthened in the quarter, as unusually tight industry capacity (limited commercial-airline belly space) is boosting demand for FedEx’s airlift assets.”

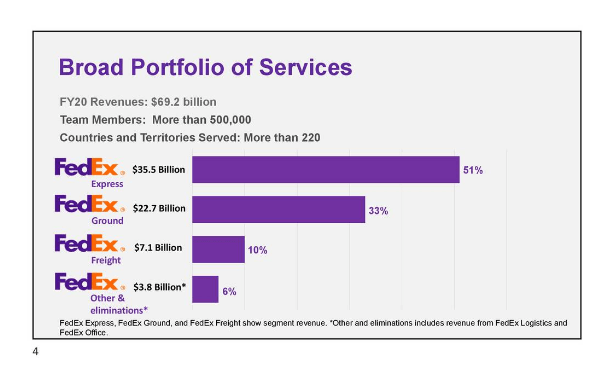

With the following slide from FedEx’s earnings presentation you can clearly see the importance of these improvements by examining the relative contribution of express and ground to FedEx’s overall business:

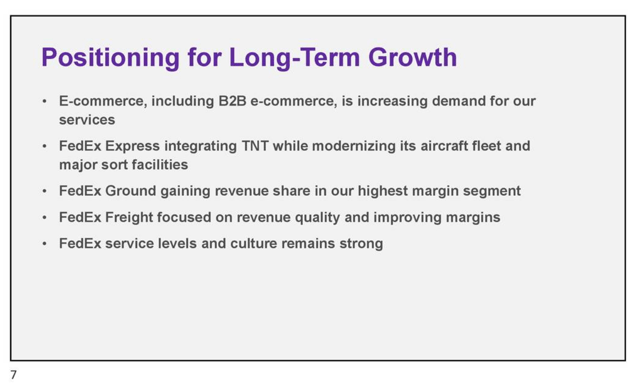

Furthermore, FedEx also presented the following reasons why they believe that they are well-positioned to continue to produce long-term growth:

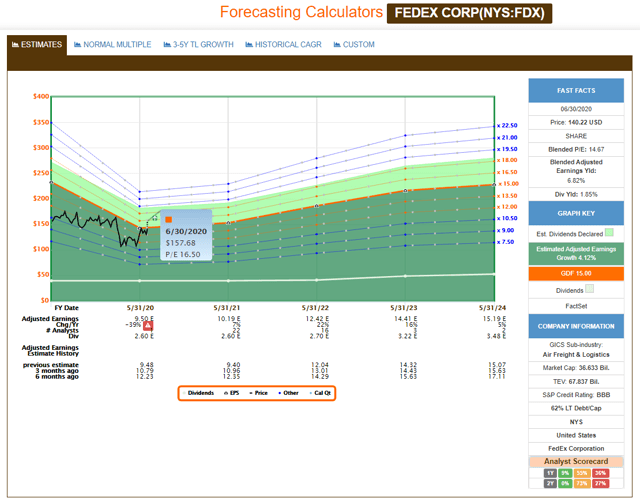

Later, I will illustrate how the leading analysts following the company expect these initiatives and projections will lead to growth of future earnings and cash flows.

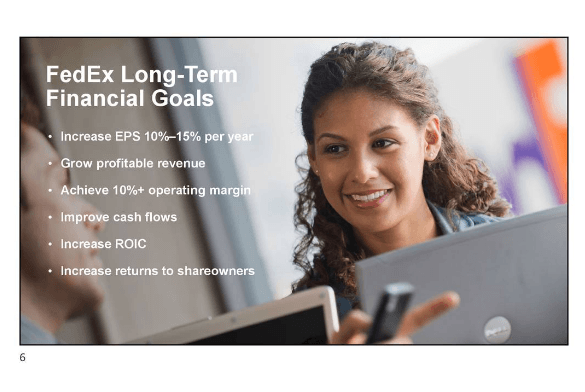

Furthermore, as is often the case, analyst expectations are guided by the company’s expectations. The following slide presents FedEx’s long-term financial goals presented by management. Personally, I believe that the most important goal is for the company to improve their cash flows, specifically free cash flow going forward. As I will also illustrate later, negative free cash flow since fiscal year 2017 does represent a negative in my humble opinion:

FedEx Corp.: FAST Graph Analyze out Loud Video

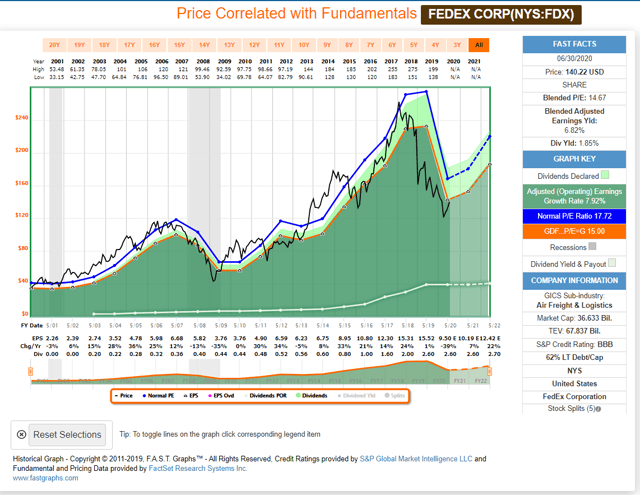

With the following video, I intend to illustrate several important fundamental considerations regarding FedEx. First and foremost, the company is a poster child representing how stock price follows fundamentals in the long run. The following screenshot clearly shows how price goes where earnings go, up or down in the long run.

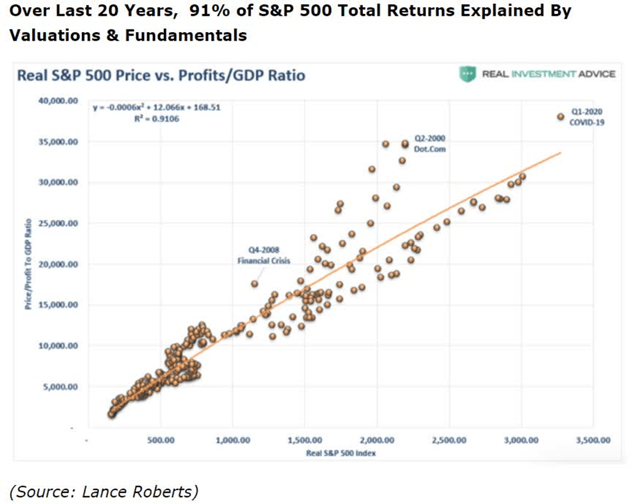

This is extremely important as my associate Dividend Sensei of the Dividend Kings pointed out as follows:

According to research from J.P. Morgan, BankAmerica, and Princeton, only 9% of 12-month returns are explained by valuation/fundamentals. However, the number increases to 45% over 5-year time frames and most importantly valuation/fundamentals account for 90% of 10-year returns.

In the case of FedEx, as I showed above, and as I will demonstrate in the video, valuation is currently aligned with fundamentals, and as previously stated, fundamental growth is expected to return in the future. Therefore, I consider FedEx an interesting long-term total return candidate based on those attributes. However, in the video, I also point out some negatives that investors considering FedEx should contemplate.

Video Length: 00:12:00

Summary and Conclusions

As of the time I am writing this article, FedEx’s stock price is trading at approximately $157 a share. The forecasting graph below shows that to only be slightly above yesterday’s closing stock price when you look at it graphically. The change is approximately 12%, nevertheless, the graphic below shows that there is still plenty of opportunity left in FedEx over the next couple of years. The bottom line, I believe investors looking for total return with a dividend kicker might want to take a closer look at FedEx as a long-term investment.

Disclosure: Long FDX.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more